On April 2, Vietcap Securities Joint Stock Company (code VCI) is scheduled to hold its annual general meeting in 2024. The meeting documents have been announced.

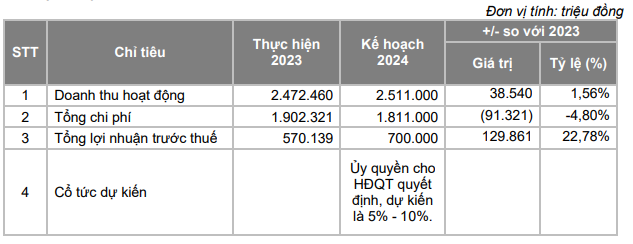

Entering 2024, Vietcap plans to achieve revenue of VND 2,511 billion and pre-tax profit of VND 700 billion, increasing by 2% and 23% respectively compared to the previous year. The plan is based on the VN-Index fluctuating around 1,300 points by the end of 2024.

The dividend rate will be delegated to the Board of Directors and is expected to be between 5% – 10%.

According to Vietcap, the stock market in 2024 is expected to be vibrant and optimistic thanks to the recovery of businesses, combined with low interest rates and attractive valuations in the long term.

The company will continue to focus on developing retail brokerage services for individual investors, with customers as the focus and focusing on developing quality services to serve customers more than the strategy of lowering fees. The company will continue to invest in technology by expanding the number of personnel in product development, innovation, investing in technology infrastructure to continue improving features in the trading software, and creating more products. In addition to technology, the company will increase training for brokerage staff, customer service staff, and increase distribution channels.

Notably, Vietcap will propose to shareholders three capital increase options to meet the trend of continued growth in the scale of the securities market. If completed 100%, the charter capital of this securities company will increase from VND 4,375 billion to nearly VND 7,200 billion.

Specifically, the first option is to issue 4.4 million preferential shares to employees (ESOP). Selling price is VND 12,000/share, equivalent to raising VND 53 billion. Newly issued ESOP shares will be restricted from transfer for 1 year. The estimated proceeds will be used to supplement working capital and reduce debt.

The second option is to issue nearly 133 million bonus shares to existing shareholders from share capital at a rate of 30%, equivalent to each shareholder who owns 10 shares will receive 3 new shares. The issuance will take place after the completion of the ESOP share issuance. The issued shares will not be restricted from transfer.

The third option is private placement of nearly 144 million shares to domestic and foreign investors with financial capacity, professional securities investors. The issuance is expected to take place in 2024, after completing the ESOP and bonus share issuance programs. The entire private placement shares will be restricted from transfer for at least 1 year from the completion of the offering.

The offering price will not be lower than the book value at December 31, 2023, which is VND 16,849/share. Accordingly, Vietcap plans to raise at least VND 2,420 billion to supplement capital for margin lending and proprietary trading.

In addition, the general meeting will also consider dismissing Mr. Nguyen Hoang Bao – a member of the Board of Directors. Mr. Bao submitted his resignation on March 6. It is known that Mr. Bao is the husband of Ms. Nguyen Thanh Phuong, Chairwoman of Vietcap’s Board of Directors.

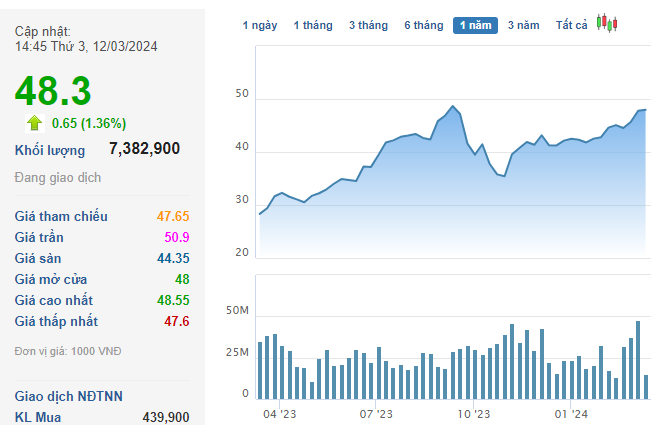

In the market, VCI shares closed the session on March 12 at VND 48,300/share.