Exchange rate pressure is not too worrisome

In a recent report, TPS Securities stated that foreign investors continue to put pressure on the market as they continue to withdraw. It is likely that we will have to wait until Q2/2024 for the US Federal Reserve (FED) to begin the interest rate reduction roadmap, so the story of the interest rate differential between Vietnam and the US is expected to continue and the selling pressure from foreign investors will continue in the future.

In terms of the exchange rate trend, the TPS analysis team believes that the exchange rate is increasing due to several reasons such as: (1) Increased import demand due to export recovery and import of consumer goods during Tet, (2) Affected by concerns that the Fed will extend the duration of interest rate cuts leading to the phenomenon of holding USD affecting the exchange rate on the free market, (3) Interest rate differential between the US and Vietnam from mid-2022 until now has always put pressure on the exchange rate. (4) The sharp increase in domestic gold prices due to increased demand leading to private gold shops increasing gold imports, thereby putting pressure on the exchange rate.

In the opinion of TPS, the exchange rate will not be too tense as before because it is supported by Vietnam’s current abundant foreign currency reserves, Vietnam’s credit growth in the early months of the year is quite low, and Vietnam still maintains a positive trade balance.

VN-Index will consolidate before surpassing 1,300 points

Assessing the market trend, TPS believes that the upward momentum of the VN-Index will slow down after 4 months of consecutive increase, and there is a high possibility of more consolidation sessions before aiming for the resistance level of 1,290 – 1,310 points.

The information that will support the market in the coming time mainly comes from: Shareholder meetings with business plans, capital increase,…; Information related to estimated Q1/2024 business results gradually revealed; Interest rate policy decisions of central banks around the world; The trial operation of the KRX system can strengthen market confidence if positive results are achieved.

In terms of investment strategy, TPS believes that banking and securities are two promising sectors in the market.

Among them, the banking group is being supported by the extension of Circular 02/2023, which helps banks have more room to reduce deposit interest rates to support credit growth. Besides, legal obstacles in real estate are gradually being cleared, creating conditions for credit recovery, the CASA ratio is recovering, which can improve NIM in 2024 and is another factor supporting this group.

The securities group is also expected to improve thanks to factors such as (1) the continuously decreasing deposit interest rates recently will support the flow of capital to the securities investment channel (where the return on investment is higher), thereby supporting liquidity in the market, (2) Economic recovery will help improve the profits of businesses in the market, (3) Operation of the KRX system reinforces the possibility of upgrading the market.

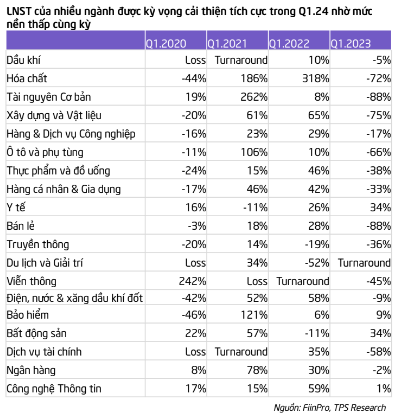

With a slightly higher risk appetite, industries related to import-export activities and manufacturing can be chosen with the expectation that business production and business activities will improve and business results will recover in Q1/2024 thanks to the low base of the same period last year.