Assets Rallying

In recent days, the price of SJC gold has been continuously increasing and surpassing 82 million VND/tael, while gold rings are priced at over 71 million VND/tael, the highest ever. Despite the skyrocketing gold prices, many people are still flocking to jewelry stores. Gold rings are so in demand that some stores have to issue appointment cards for customers to receive their rings after a month. Those who buy gold rings with quantities over 4 taels have to wait nearly a month to receive them. The continuous inflow of investment money has been poured into gold with the expectation that prices will continue to reach new highs in the near future.

Stocks are attracting investment capital, with regular billion-dollar sessions. Photo: Nhu Y.

Alongside the soaring gold prices, on March 11, Bitcoin officially surpassed the $71,000 milestone, setting a new all-time high. Ethereum (ETH) is also nearing the $4,000 mark. According to the New York Times, the major difference between the current surge compared to the explosion in 2021 is the participation of large financial institutions, with the list of “sharks” including BlackRock and Fidelity – two of the world’s largest asset managers. Following the rise of Bitcoin, meme coins, often used for entertainment or speculation (inspired by humorous elements), have also seen a surge in prices. “Doge” coins in the cryptocurrency market such as Dogecoin (DOGE), Shiba Inu (SHIB), and “green frog” Pepecoin (PEPE) have all jumped in value. Within 30 days, PEPE has increased by 784%, SHIB by 266%, and DOGE by 115%. Currently, DOGE and SHIB are among the top 10 cryptocurrencies in terms of market capitalization.

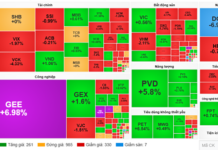

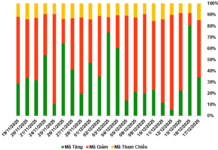

As for the stock market, the VN-Index closed at 1,235 points on March 11, up more than 9.3% since the beginning of the year. The liquidity of all three exchanges is maintaining a steady level of billions of USD (25,000 billion VND). If we exclude the two recent correction sessions, the VN-Index has seen an increase of up to 12%, equivalent to the achievement of the entire year 2023. Investors have gained some profits, leading to a lively trading atmosphere. Large-cap stocks, especially in the banking sector, have brought considerable returns to investors. The continuous hot market stories like the KRX system, upgrades, solutions, and strong government directives have maintained attractiveness, opening up long-term expectations for the domestic stock market.

Beware of FOMO

Mr. Huynh Hoang Phuong, Director of Research and Analysis Division at FIDT Investment and Asset Management Joint Stock Company, believes that among the mentioned assets, cryptocurrencies are currently the riskiest, and investors should not FOMO if they missed the recent surge. According to Mr. Phuong, the turning point for cryptocurrencies began when the US allowed the launch of Bitcoin exchange-traded funds (ETFs) listed in the US. After the legal issues were resolved, a large amount of capital flowed into this investment channel, driving the FOMO capital flow and pushing Bitcoin prices to new highs. Alongside the potential for profits, there are also high risks, and investors should not pour their money into this asset class.

Gold prices continuously break records. Photo: Nhu Y.

In Mr. Phuong’s opinion, investors with large asset values (NAV) are still focusing on stocks, followed by gold. Stocks have recently experienced a strong rally, and any subsequent corrections may present opportunities for “outsider” investors to enter the market. “Stocks have risen due to expectations of recovery, and the upward momentum is supported by looking at this year’s economy and the prospects for businesses. Investors may be interested in sectors that have not yet experienced a surge, as there are still many opportunities in the market. As for gold, after the recent sharp increase, the allocation ratio of new investors at this time should only be 10% of total assets, considering it as a risk mitigation asset,” Mr. Phuong commented.

In terms of savings, according to experts, low savings interest rates, below 5% per year, are also a factor driving money seeking higher return channels. While bonds have low liquidity and there are concerns about lurking risks, many companies are struggling to pay interest to investors, which makes stocks more attractive. Mr. Minh advised investors to be cautious in using margin in the current period. “Leverage should only be used when the market is accelerating and maintaining high liquidity,” Mr. Minh said.

Mr. Hoang Tung, a financial expert from Singapore, believes that with Bitcoin surpassing its previous peak, the cryptocurrency market is very dynamic. However, this is the riskiest market in the world, as the amplitude of fluctuations is larger than any other asset class. Both trading and long-term holding of cryptocurrencies are difficult. In trading, investors must have superior advantages and abilities in predicting price fluctuations; otherwise, there is a high probability of burning their accounts, and maintaining achievements is not easy.

“Apart from some major digital currencies like BTC and ETH, all other ‘junk’ coins have market manipulators, manipulated groups behind them. They operate individually but can also cooperate with each other, sailing together with the founders to create those coins and create liquidity. After each “boom” season, 99% of these ‘junk’ coins permanently disappear. Another common issue is fraud, ghost projects, or scams,” Mr. Tung analyzed and advised investors to be cautious with those “junk” coins. Many lessons have been learned from Lota, Luna, EOS, NFT, where prices soared and then fell off a cliff.