The rise of the US dollar in Vietnam in the first two months of 2024- one of the reasons is that this currency is continuously increasing globally. |

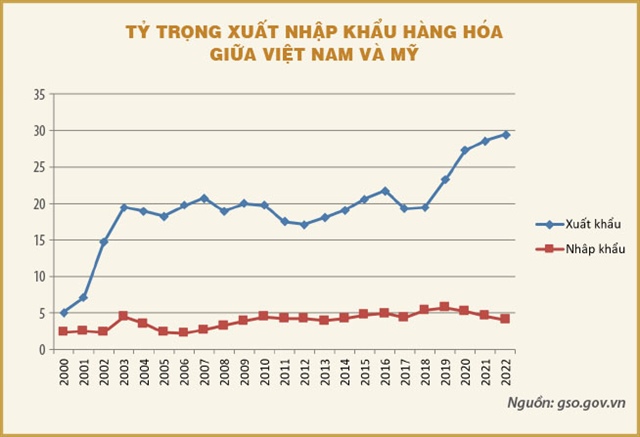

From 2000-2022, the proportion of exports from Vietnam to the US in the total export turnover of goods increased from 5.1% to approximately 30%. Meanwhile, the proportion of Vietnamese imports from the US in the total import turnover of goods did not increase significantly, from 2.3% to 4.03%.

However, for the Vietnamese economy, the depreciation of the dong is not entirely beneficial for exports, as the products Vietnam exports to the US are basically products manufactured by the area with foreign direct investment (FDI); the amount received by Vietnam is very small (according to calculations from the inter-sector balance sheet, the share of Vietnam benefiting from exports is only about 14-18%).

In 2023, imports from the US accounted for only about 4% of the total import turnover. However, the US dollar is still the dominant foreign currency for payment due to:

– The US dollar is the most chosen currency for international transactions, not only in Vietnam but also worldwide.

|

– A currency chosen for payment must meet basic criteria such as being a strong, stable currency that is not subject to risks such as payment ability loss, devaluation, or sudden large price increases, (allowed) easy conversion and payment anywhere, and the currency of a country with a large proportion in global trade…

– For these reasons, usually only the currency of developed countries with the top 5 economies in the world such as the US, Japan, Germany, the UK, France, and more recently the EU, is used; among them, the most popular is the US dollar because the US is the country with the largest share of global trade.

– If compared to the US dollar and the aforementioned strong currencies, of course, other currencies are riskier and less common, more difficult to circulate. Therefore, from the exporter’s perspective, it is natural not to want to pay in any “minor” currency such as the dong, ringgit (Malaysia), peso (Philippines), or rupiah (Indonesia)…even if they export to those countries, especially when these currencies have experienced significant fluctuations.

– On the other hand, importers want to shift this exchange rate risk to the exporter by wanting to pay in their own base currency. This is not to mention that many of these “minor” currencies do not have international conversion capabilities, meaning they cannot freely buy and sell in the domestic and foreign exchange markets, so even if they want to use them for payment, they are also not allowed.

The rise of the US dollar in Vietnam in the first two months of 2024– one of the reasons is that this currency is continuously increasing globally. If at the beginning of 2024, the USD-Index was at 101.38 points, it is now above 104 points. Although the US Federal Reserve (Fed) has signaled the possibility of lowering interest rates this year, it is still unclear when the reduction will begin. The interest rate in the US is still at a high level when the inflation rate in January 2024 is 3.1%, lower than the 3.4% of December 2023 but still far from the target of reducing to 2% set by the Fed. This partly puts pressure on the exchange rates of many countries around the world, including Vietnam.

While traditional investment channels such as stocks and real estate are unstable and bank deposit interest rates continue to decrease, domestic funds are seeking refuge in gold and foreign currencies (such as the US dollar), causing their prices to rise.

In addition, statistical data shows that the total import turnover of goods in the first two months of 2024 is estimated at 54.62 billion US dollars, an increase of 18% compared to the same period last year; of which, the domestic economic area reached 19.67 billion US dollars, an increase of 27.4%, and the FDI area reached 34.95 billion US dollars, an increase of 13.3%, the highest level since July 2022. Regarding exports, in the first two months of 2024, the total export turnover of goods reached 59.34 billion US dollars, an increase of 19.2% compared to the same period last year; of which, the domestic economic area reached 16.14 billion US dollars, an increase of 33.3%, accounting for 27.2% of the total export turnover; the FDI area (including crude oil) reached 43.2 billion US dollars, an increase of 14.7%, accounting for 72.8% of the total export turnover.

Therefore, export businesses have increased orders, so the import of raw materials for production has also increased, leading to an increase in the demand for buying foreign currency for payment, thereby increasing the exchange rate.

The increase in imports is good news for the economy, but in the short term, it also contributes to the pressure on the exchange rate. In addition, speculative factors cannot be ruled out. When speculators see that the exchange rate tends to rise, they will find ways to buy foreign currency and thereby push up the US dollar price on the free market higher than that of banks. However, from import-export data and the high amount of remittances in 2023, it can be seen that exchange rate fluctuations will only occur in the short term and will not be as tense as in the past. In the short term, the exchange rate may increase by more than 3%, even up to 4%, but then it will gradually decrease and oscillate around 3% throughout the year. This is because it is highly likely that the country will continue to maintain a trade surplus, a favorable trade balance. Along with the positive signals in FDI, exchange rate tension will only occur in the short term. Moreover, under necessary conditions, if there is pressure on the exchange rate, the State Bank of Vietnam (SBV) still has room to slightly increase interest rates to ensure exchange rate stability.

On the other hand, statistical data shows that the Consumer Price Index (CPI) in 2023 was at a relatively safe level of 3.25% – lower than other countries in the region and lower than the approved target of the National Assembly at the beginning of the year (below 4.5%). Entering 2024, Vietnam’s inflation target is 4-4.5% and is also considered one of the factors to stabilize the macro economy, maintain confidence in domestic and international investors. Therefore, according to many economic experts, the management agencies have more room to reduce exchange rate pressure, and there will be no major fluctuations.

However, the SBV is still maintaining an accommodative monetary policy, accepting the exchange rate to increase to a reasonable level because domestic inflation is still under control, while the economy needs to continue to be supported for recovery. Furthermore, as global monetary policies begin to loosen, the US dollar tends to depreciate broadly and will reduce pressure on domestic exchange rates.

Bui Trinh