Image: FPT

|

FPT is expected to present the above plans at its annual general meeting in 2024, which will be held on April 10, 2024 in Hanoi, both online and in person.

Breaking revenue and profit records

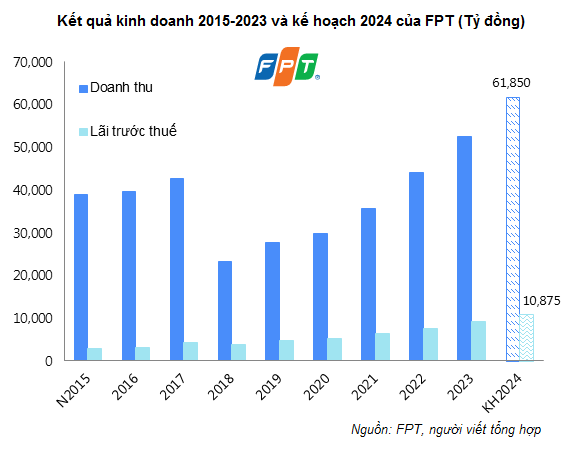

In 2024, FPT aims to achieve a revenue growth of 17.5% and a pre-tax profit growth of 18.2% compared to 2023, reaching a total of VND 61,850 billion (~2.5 billion USD) and VND 10,875 billion respectively. If the targets are met, the corporation will continue to break its previous records and achieve positive growth for the 6th consecutive year.

Looking at the performance of each business segment, the Technology segment will continue to play a leading role with an expected revenue contribution of VND 31,449 billion (a 21% increase compared to the same period) and pre-tax profit of VND 5,195 billion (+25%). Next is the Telecommunication segment, which is expected to achieve a revenue of VND 17,600 billion (+11%) and pre-tax profit of VND 3,508 billion (+15%). The Education and Other Investment segment is projected to generate a revenue of VND 6,100 billion (+14%) and a pre-tax profit of VND 2,172 billion (+9%).

In 2024, FPT plans to allocate VND 6,500 billion for investment purposes, of which VND 2,200 billion will be invested in the Technology segment, including investment in office complexes in major cities such as Hanoi, Danang, Ho Chi Minh City, Quy Nhon, as well as investment in technology infrastructure.

In the Telecommunication segment, FPT plans to allocate VND 2,300 billion to invest in main cables, submarine cables, upgrading domestic telecommunication infrastructure and the Data Center system. The remaining VND 2,000 billion will be invested in the Education segment to expand university campuses in Hanoi, Ho Chi Minh City and Danang, as well as establish new training facilities in other provinces and cities.

Proposal of a 20% cash dividend and a 15% stock bonus

With the achievement of record-breaking revenue and profit in 2023, the Board of Directors proposes a cash dividend for 2023 at a ratio of 20% (for every 1 share owned, shareholders will receive a dividend of VND 2,000 per share). FPT has already made a provisional dividend payment of 10% in July 2023, and the remaining dividend is expected to be paid in the second quarter of 2024.

The corporation also plans to issue bonus shares to increase its equity capital from retained earnings (bonus shares). FPT plans to issue a maximum of 190.5 million bonus shares at a ratio of 20:3 (equivalent to 15%), which means shareholders will receive an additional 3 new shares for every 20 shares owned. The purpose is to improve liquidity for FPT shares and create value for shareholders.

The source of funds for the issuance will be taken from undistributed post-tax profits belonging to shareholder equity on the most recent audited financial statements of the parent company. The implementation is expected to take place after the approval of the AGM, no later than the third quarter of 2024, upon the approval of the State Securities Commission.

The last time, FPT paid a cash dividend of 20% for the year 2022 and a bonus stock dividend of 15% to shareholders.

In 2024, the corporation plans to continue to distribute a cash dividend of 20%.

Issuance of more than 9 million ESOP shares at a preferential price of VND 10,000 per share

To implement the resolution passed at the 2023 AGM, FPT has approved the issuance of over 6.3 million shares under the Employee Stock Ownership Plan (ESOP), equivalent to 0.5% of the outstanding shares. The eligible participants are employees at level 4 or above and some employees with outstanding achievements and significant contributions to the company’s development in 2023. These shares will be restricted from transfer for 3 years from the end of the offering period.

The corporation also approved the issuance of nearly 2.9 million shares under the share option plan for senior executives in 2024, equivalent to 0.227% of the outstanding shares – according to the plan approved at the 2020 AGM. The eligible participants are young high-level managers approved by the Board of Directors, who have made significant contributions and have the potential to build the company in the future. These shares will be restricted from transfer for 10 years from the end of the offering period.

Therefore, the corporation will issue over 9.2 million ESOP shares at a preferential price of VND 10,000 per share. The implementation will take place in 2024, after the audited financial statements are approved by the State Securities Commission. The proceeds are expected to supplement the working capital.

On the stock market, FPT shares are currently trading at a historical high of VND 117,000 per share, a 120% increase from the market’s low point in mid-November 2022. This breakthrough has pushed the corporation’s market capitalization to nearly VND 149,000 billion (~6 billion USD), an increase of VND 27,000 billion since the beginning of 2024.

| FPT Stock Price since 2021 |