Specifically, SGP plans to achieve a production volume of 9.25 million tons in 2024, an increase of 7% compared to 2023, with container output reaching 190 thousand TEUs, a decrease of 18%.

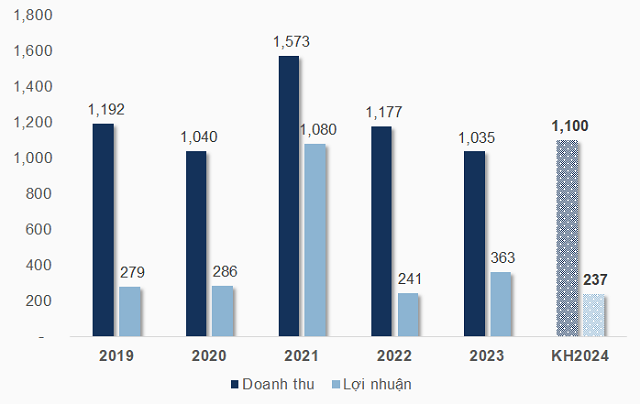

The revenue (total net revenue, financial revenue, and other revenue) is expected to reach 1.1 quadrillion VND, a 6% increase. However, after deducting expenses, the pre-tax profit is projected to be 237.3 billion VND, a 35% decrease, partly due to exceptionally high profit in the same period last year. The profit forecast for the parent company alone is 238 billion VND, higher than the consolidated profit.

Regarding dividends, SGP will propose to the General Meeting of Shareholders to consider them based on the business performance in 2024.

According to SGP, 2024 will be affected by various external factors, including the activities of joint ventures, policy changes, and the construction of Thu Thiem 4 Bridge, which will start in 2025 and impact the customer sentiment in 2024. There will also be a reduction in the exploitation area at Tan Thuan Port and a decrease in the ship reception capacity.

The company stated that it will make efforts to find new customers and focus on developing in remaining areas such as Hiep Phuoc, Tan Thuan 2, Ba Ria-Vung Tau, and expand value-added services to compensate for the decline caused by the aforementioned factors.

|

Business results of previous years and the plan for 2024 of SGP

Unit: Billion VND

Source: VietstockFinance

|

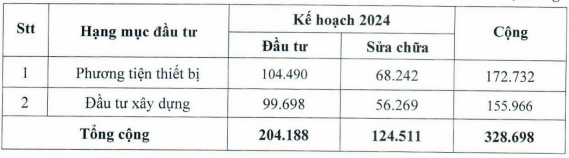

Regarding the new investment plan in 2024, SGP plans to allocate over 104 billion VND for vehicles and equipment such as long-arm excavators, business vehicles, canoes, etc. and nearly 100 billion VND for construction projects, including opening a road to Tan Thuan Tay Container Yard, extending a 60m port bridge, expanding approach bridges, installing new weighing bridges at Tan Thuan 2, developing a 3,000m2 warehouse at the branch in Ba Ria-Vung Tau, and the feasibility study for Can Gio International Transshipment Port. SGP has also listed repair and maintenance expenses, with over 68 billion VND for equipment and over 56 billion VND for construction. The total amount is nearly 329 billion VND, all from SGP’s own supplemental capital.

|

Investment plan for 2024 of SGP

Unit: Billion VND

Source: SGP

|

Saigon Port Corporation (SGP) is a joint-stock company established from the Saigon Port Company Limited, which was wholly owned by Vietnam Maritime Corporation. The company officially operated under the joint-stock company model from October 1, 2015. On April 25, 2016, SGP shares were officially traded on the UPCoM market.

SGP’s ports are strategically located near industrial parks, export-processing zones, and important transportation routes. The company’s main business activities include cargo handling services at seaports, port warehouse operations, and leasing port infrastructure. The primary business areas are in Ho Chi Minh City (District 4, District 7) and Ba Ria-Vung Tau (Cai Mep-Thi Vai).

In 2023, SGP achieved a revenue of over 1 quadrillion VND, a decrease of 12% compared to 2022, mainly due to a decrease in production volume affecting related services such as warehouse storage. Despite the increase in container volume, domestic container revenue remained low, insufficient to compensate for the decline in steel and iron revenue.

However, SGP’s net profit increased by 48% to 296 billion VND, thanks to the successful restructuring of SSIT’s loans and the recovery of land debt. However, the company’s profit fell short of the plan by 28% due to the general impact of the market situation, the declining business results of associated companies, and the increase in land payment compared to the plan.

Huy Khai