During the 4 consecutive sessions from March 11th to March 14th, 2024, the State Bank of Vietnam has reissued bonds after a 4-month hiatus with a total volume of 60,000 trillion dong, a term of 28 days, and an interest rate of 1.4%.

In the updated report, BIDV Securities Company (BSC) has compiled a record of money withdrawal transactions through Bonds in the period 2018 – 2023 and evaluated the bond issuance activity as a normal, fundamental operation of the State Bank, mainly targeting exchange rate stabilization.

In Vietnam, during the period 2018 – 2023, the State Bank has consistently carried out this operation many times, with an average withdrawal of about 9.4 times per year, and an average net withdrawal value per cycle of 47.647 trillion dong.

According to BSC, the State Bank mainly withdraws with a total net withdrawal volume per cycle below 50,000 trillion dong. When the net withdrawal value ranges from 50,000 trillion to less than 100,000 trillion dong, there is a 33.33% probability that the VN-Index will decrease during the withdrawal cycle, which implies a higher probability of increase. When the net withdrawal value exceeds 100,000 trillion, the probability of the VN-Index decreasing during the withdrawal cycle is 66.67%, significantly higher.

Most recently in the period of October 2023, the State Bank reissued bonds from September 21st to November 8th, 2023, and net withdrawal was 194.650 trillion dong. As a consequence, the exchange rate decreased and continued to maintain a downward trend until the end of November. Conversely, overnight interbank interest rates increased sharply in response to the withdrawal activity, but quickly decreased again.

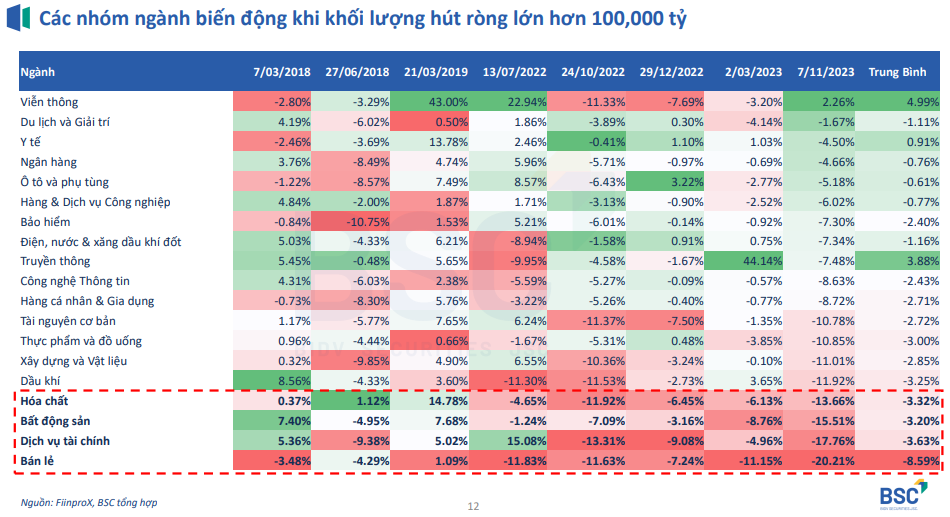

During this period, the VN-Index decreased by more than 15%, with the most volatile sectors being retail, financial services (securities), real estate, and chemicals…

In conclusion, BSC believes that when the net withdrawal is low, the fluctuations of the stock market are not clear, showing that this information does not have a significant impact. The bond net withdrawal activity is a normal business operation, a regulatory tool, and does not imply a policy reversal.

BSC recommends investors not to be overly concerned, to monitor and objectively evaluate the market information in order to have suitable investment strategies. Important indicators to consider in the current context include exchange rates (free exchange rates), DXY; net withdrawal scale – issuance interest rates along with overnight interbank interest rates; and the impact of past volatile sectors on the stock market.

Previously, a report from Dragon Capital also emphasized that bond issuance is a necessary administrative measure to cool down the exchange rate and does not imply changes in monetary policy.

Also discussing this issue, according to the opinion of Mr. Huynh Minh Tuan, Chairman of the Board of Directors of FIDT Corporation, the State Bank’s action may somewhat tighten liquidity in the interbank market/securities market if net withdrawal actions continue to occur.

“Recently, stock market liquidity has maintained a level of over 23.000 trillion dong per session thanks to partly the surplus liquidity in the financial system and record low interest rates flowing into the economy.”

However, Mr. Tuan expects that the bond issuance by the State Bank will not have any impact on the deposit – lending interest rate structure of the banking system in the second quarter, in the context of credit growth still not showing significant signs of recovery.