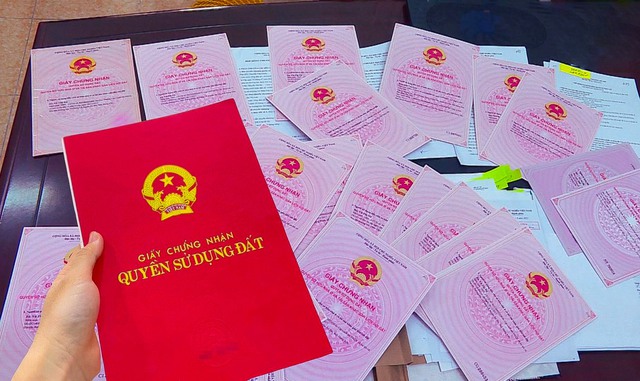

Deadline for transferring the Red Book

Based on Article 4, Section 95 of the 2013 Land Law, for land plots that already have a Certificate of Land Use Right and Assets Attached to Land (referred to as transfer of real estate), it is necessary to register the change (transfer of ownership).

Section 6, Article 95 of the 2013 Land Law states:

“Cases of registering changes specified in points a, b, h, i, k, and l of this Article 4, must be completed within a period of not more than 30 days from the date of change, the land user must carry out the registration procedures…”

Therefore, when transferring real estate, it is necessary to register the change within a period of not more than 30 days from the effective date of the transfer agreement; if the transfer is made but not registered, a fine will be imposed.

According to Section 2, Article 17 of Decree 91/2019/ND-CP on administrative penalties in the field of land, in cases of transfer, inheritance, or gifting of land use rights without registering the change, the following administrative penalties shall apply:

– In rural areas:

+ A fine of 1-3 million VND if the registration is not carried out within 24 months from the deadline.

+ A fine of 2-5 million VND if the registration is not carried out even after 24 months from the deadline.

– In urban areas: The fine is 2 times the corresponding fine in rural areas (up to a maximum of 10 million VND per violation).

Note:

– Urban areas include the inner city, suburbs of cities, towns, and townships.

– Rural areas refer to the remaining areas.

– The above penalties apply to households and individuals.

– The penalties specified in Decree 91/2019/ND-CP apply from January 5, 2020.

In addition to the above fines, violators will also be subject to remedial measures, meaning they must carry out land registration procedures as prescribed.

Deadline for declaring and paying Personal Income Tax, and Registration Fee

Personal Income Tax

– Deadline for submitting tax declaration documents

Based on Section 5, Article 21 of Circular 92/2015/TT-BTC, the deadline for submitting personal income tax declaration documents for the transfer of real estate is as follows:

+ If the transfer agreement does not specify that the buyer is the taxpayer on behalf of the seller, the latest deadline for tax declaration is the 10th day from the effective date of the transfer agreement.

+ If the transfer agreement specifies that the buyer is the taxpayer on behalf of the seller, the latest deadline for tax declaration is the moment when the transfer registration procedures are carried out.

– Deadline for tax payment: The deadline stated in the Tax Payment Notice issued by the tax authorities

Deadline for declaring and paying Registration Fee

– The deadline for submitting the fee declaration documents is at the time of carrying out the transfer registration procedures.

– The maximum deadline for paying the registration fee is 30 days from the date of signing the registration fee payment notice issued by the tax authorities.

Time for carrying out the Red Book transfer procedures

Based on Section 40, Article 2 of Decree 01/2017/ND-CP, the interval for land registration authorities to carry out the transfer procedures for transfers or gifts of real estate is as follows:

– Not more than 10 days, from the date of receiving a valid dossier, in other cases.

– Not more than 20 days, in the case of mountainous, island, remote areas, areas with difficult economic and social conditions, areas with particularly difficult economic and social conditions.

Time for carrying out the Red Book transfer procedures

Note: The above-mentioned time does not include holidays according to legal regulations; the time for receiving dossiers in communes, the time for fulfilling financial obligations by land users; the time for examining and handling cases of land use violations, the time for appraisal consultation.