Source: SBV

|

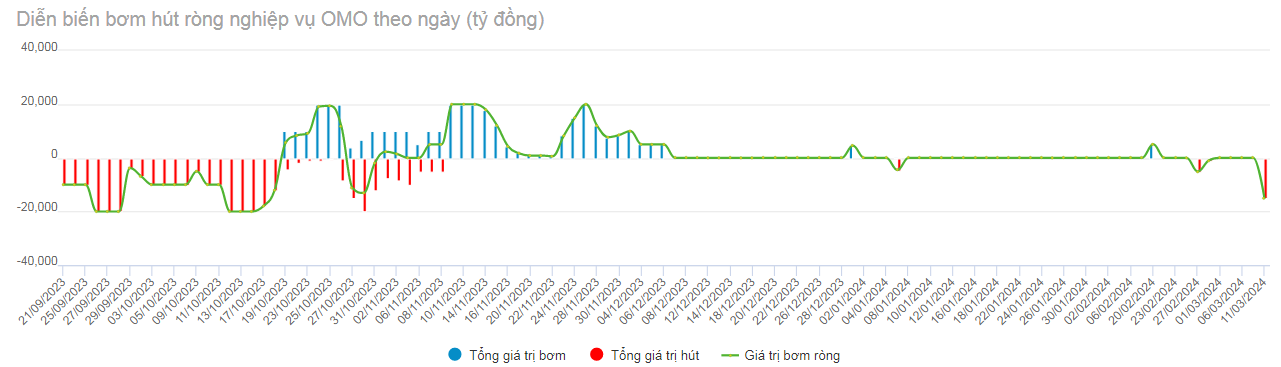

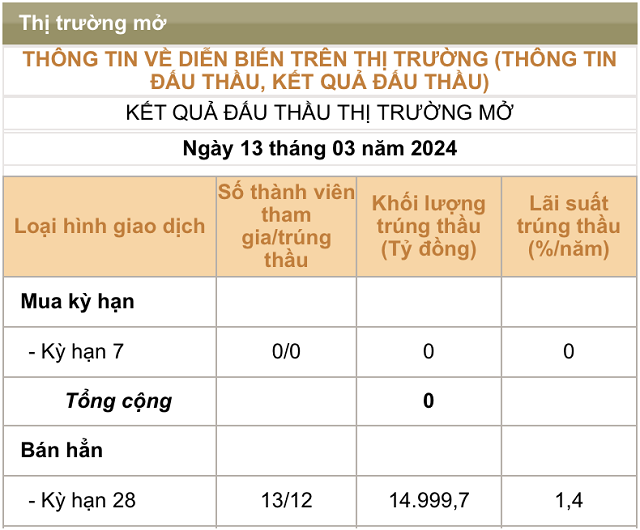

During the trading session on March 13, the State Bank of Vietnam (SBV) continued to use bond issuance as a tool to withdraw liquidity from the system. Specifically, the central bank successfully auctioned 15,000 billion VND of 28-day bonds at an interest rate of 1.4% per annum.

Prior to that, on March 11, the SBV unexpectedly reopened the bond auction channel, withdrawing nearly 15,000 billion VND from the system. This is the first movement in the bond channel in 2024 and the first withdrawal after more than 4 months without any transactions. On March 12, the SBV continued to withdraw an additional 15 trillion VND from the system.

Along with the reopening of the liquidity withdrawal channel, the SBV also suspended the open market operation (OMO) purchase of treasury bills. Since the beginning of the year, the SBV has only used OMO purchases with a 7-day term to support liquidity for banks, with a scale of over 6 trillion VND (during the 2-day period of February 20-21).

With the strong push for liquidity withdrawal through bond issuance and the limitation of support through the OMO operation, from the beginning of the year until now, the SBV has withdrawn 45 trillion VND (over the 3 consecutive sessions of March 11-13) through the bond channel and over 6 trillion VND through the OMO channel upon maturity (February 27-28).

The bond issuance action by the central bank has similarities to September last year when the USD/VND exchange rate also faced pressures in the context of abundant system liquidity with low credit growth.

It is worth remembering that on September 21, 2023, the SBV surprised the market by restarting bond issuance on the open market (OMO) after more than 6 months of suspension (since March 2023).

|

Net open market operation (OMO) trends by day. Unit: Billion VND

Source: VietstockFinance

|

From September 21 to November 8, the SBV issued a total of 360,345 billion VND of 28-day bonds. The SBV stopped issuing bonds from the session on November 9, 2023 when the exchange rate started to cool down.

The trend of net withdrawal by the SBV is happening in the context of prolonged negative VND-USD interest rate spreads, and the USD/VND exchange rate has strongly increased since the end of February.

According to the latest announcement from the SBV, as of March 8, the overnight interbank VND interest rate traded around 0.80% per annum. Meanwhile, the overnight interbank USD interest rate closed at 5.2% per annum. Therefore, currently, the interbank VND interest rate overnight is much lower than the USD interest rate in the same market (0.8% per annum compared to 5.2% per annum).

After the SBV withdrew liquidity from the market, the USD/VND exchange rate at commercial banks also started to cool down. Currently, the USD price at Vietcombank is being bought and sold at 24,450 – 24,820 VND/USD, a decrease of 20 dong compared to the previous week.