Illustrative image

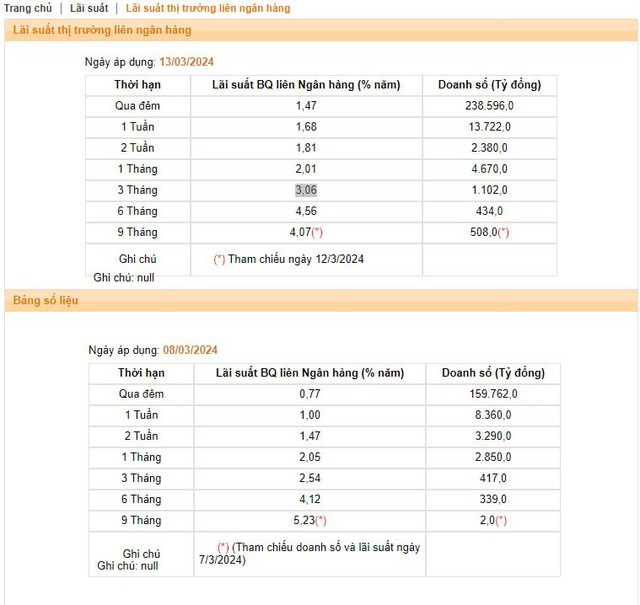

According to the latest figures released by the State Bank of Vietnam (SBV), the average interbank VND interest rate overnight (which accounts for about 90% of the transaction value) has increased to 1.47% in the sessions of March 13th and March 12th from the level of 0.76% recorded in the session of March 11th and 0.77% at the end of the previous week.

Most other key term interest rates have also increased compared to the end of the previous week, such as: 1-week term increased from 1.00% to 1.68%; 2-week term increased from 1.47% to 1.81%; 3-month term increased from 2.54% to 3.06%; 6-month term increased from 4.12% to 4.56%.

Source: SBV

Interbank interest rates have increased sharply after SBV had 3 net withdrawal sessions through the bills channel. Specifically, continuously, in the 3 sessions from March 11th to March 13th, the Operator has successfully issued nearly 45,000 billion dong of 28-day bills and no transaction occurred in the open market, thereby withdrawing an equivalent amount of money from the banking system.

As we have reported earlier, SBV offered to sell bills again from the session of March 11th after more than 4 months of suspension. The resumption of bills offering activity shows the orientation of reducing the system’s liquidity by the Operator and tends to increase the VND interest rate in the interbank market. This will contribute to restraining the increase of the USD/VND exchange rate – which is currently under pressure and getting close to its historical peak level.

The winning volume is nearly 15,000 billion dong per session and the winning interest rate is 1.4% (relatively high compared to the previous period), which shows that SBV is relatively “resolute” in the liquidity withdrawal activities of the Operator.

In today’s session (March 14th), SBV continues to offer 28-day bills through interest rate bidding mechanism. The result is that 10 out of 11 members participated in the bidding with a total volume of 15,000 billion dong continuing to be maintained, with an interest rate of 1.4% per year.

In the collateralized paper channel, there continue to be no new transactions occurred and the circulation volume remains at the level of 0. In total, SBV has withdrawn nearly 15,000 billion dong from the banking system in the trading session of March 14th.

Thus, in the 4 most recent trading sessions, SBV has net withdrawn nearly 60,000 billion dong out of the banking system through the bill channel.

The reopening of the bidding for bills by SBV is similar to the mid-September 2023 when the USD/VND exchange rate was under pressure and the system liquidity was abundant due to low credit growth.

Analysts believe that the bill-issuing move by SBV aims to adjust liquidity in the system in the short term, and from there it is expected to push up the VND interbank interest rate, helping to reduce the interest rate gap between USD and VND, thereby indirectly supporting the exchange rate.

Statistics from September 21st to November 8th show that SBV has issued a total of 360,345 billion dong of 28-day bills. After SBV reopened the bill issuing channel, the VND interbank interest rate also had strong increases in the period from late September to late October. And SBV stopped issuing bills from the session of November 9th, 2023 when the exchange rate began to cool down.