Accordingly, KAFI plans to offer 100 million shares to existing shareholders through the rights offering method. The subscription ratio is 3:2, meaning that for every 1 share owned, shareholders will be entitled to purchase 1 right, and 3 rights can be used to purchase 2 new shares. The offering price is VND 10,000 per share and is expected to be completed before April 30, 2024.

The maximum foreign ownership ratio is 49% of the charter capital based on the results of the offering.

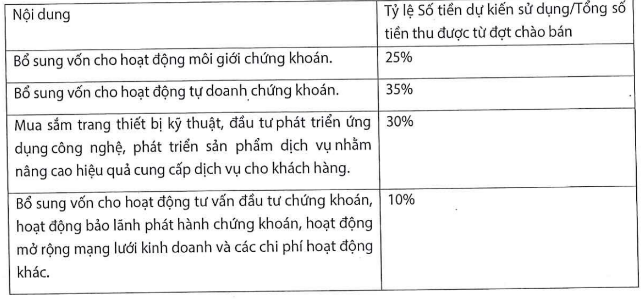

The entire amount raised (VND 1,000 billion) will be allocated to 4 purposes for use in 2024, including: Supplementing capital for securities brokerage activities, accounting for 25% of the allocation; Supplementing capital for proprietary trading activities, accounting for 35% of the allocation; Purchasing technical equipment, investing in technology development, developing products and services, accounting for 30% of the allocation; and Supplementing capital for underwriting securities issuance, expanding the business network, and other operating expenses, accounting for 10% of the allocation.

|

Capital utilization plan from the offering

Source: KAFI

|

In addition, the allocated funds can be flexibly transferred between activities to ensure the efficient use of the company’s capital over time.

After the above-mentioned offering of 100 million shares, the charter capital of the company will increase from VND 1,500 billion to VND 2,500 billion.

Prior to that, the 2023 Annual General Meeting of Shareholders approved the increase of charter capital from VND 1,000 billion to VND 2,000 billion, including 2 phases: Phase 1 to increase charter capital from VND 1,000 billion to VND 1,500 billion and Phase 2 to increase charter capital from VND 1,500 billion to VND 2,000 billion. As of August 2, 2023, KAFI successfully completed the first phase of the capital increase.

| Fluctuation in KAFI’s charter capital during the period 2022-2023 |

However, the Board of Directors has made adjustments to the plan for the second phase of the capital increase. The Board of Directors believes that the company needs to increase its charter capital to a maximum of VND 2,500 billion to meet the capital needs for expanding business activities in the future, enhancing financial capacity, and meeting legal requirements. The Annual General Meeting of Shareholders approved this adjustment through written consent, according to the resolution of the Annual General Meeting of Shareholders on December 22, 2023.

At the same time, the General Meeting of Shareholders also approved the addition of derivatives business, including activities such as derivative securities brokerage, derivative proprietary trading, and derivative securities investment advisory. Providing clearing and settlement services for derivative securities transactions; and other related services.

In 2023, KAFI Securities recorded notable business results. Operating revenue reached VND 484.6 billion, more than 4 times higher than the previous year; and after-tax profit amounted to VND 128 billion, more than 6 times higher than the previous year.

| After-tax profit of KAFI Securities during the period 2019-2023 |