Gold falls heavy before holding billions.

After a string of consecutive gains and setting new records, on March 13 the domestic market witnessed continuous fluctuations in the price of gold. In just one day, the price of gold adjusted down by more than 2 million VND.

By the end of the afternoon of March 13, SJC gold of Saigon Jewelry and Gemstone Company was still bought at 78.2 – 80.7 million VND/tael and sold at. Bao Tin Minh Chau’s gold ring is 67.88 – 69.38 million VND/tael.

Therefore, if customers buy in the early morning, they will lose more than 4 million VND/tael because the price difference is and the have decreased.

Many investors bought at the highest price on the morning of March 12. Mr. Nguyen Huy (Hoan Kiem, Hanoi) bought 10 SJC gold bars at 82.25 million VND/tael. When buying, Mr. Huy expected the gold price to increase to 95 million VND/tael, he would close the profit. However, when the gold price decreased, he was “shocked” because in just 2 days he lost 40 million VND. Mr. Huy still decided to hold onto gold and wait for the price to increase again.

Many investors who buy gold rings lose heavily even though they only receive appointment slips for gold after 1 month.

Even many investors received gold ring appointment slips after 1 month when buying from 4 taels of gold or more.

Mr. Duong Quoc Minh (in Hai Ba Trung district) bought 7 taels of gold rings at 68.88 million VND/tael 1 week ago, he said: “With a sharp drop in gold prices like this, up to now, I have temporarily lost 7 million VND. I believe the price of gold rings will increase sharply soon even though I still hold appointment slips to get gold on April 2.”

As for Ms. Minh Hoa (in Long Bien district), she bought 15 taels of gold rings on March 12 with a price of 71.3 million VND/tael. After just 1 day, Ms. Hoa temporarily lost more than 51 million VND even though she only received gold on April 10.

Should you sit still?

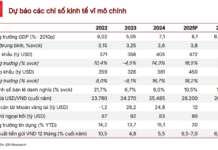

Mr. Ngo Thanh Huan – Director of FIDT Investment Consulting and Asset Management Joint Stock Company – analyzes, looking back at the history of gold market, 2012 was the bottom of the recession, the gold price increased to 43 million VND/tael.

However, after the stabilization of the economy, the recovery trend since 2014, the gold price created a bottom at the price of 36 million VND/tael. By 2019, the gold price only rebounded to the price of 43 million VND/tael.

Therefore, if someone bought gold in 2012, they had to hold it for 7 years to get their capital price. For example, spending 300 million VND to buy gold, after 7 years they did not receive any extra amount.

According to Mr. Huan, if you look at the economic recovery story in 2026, the gold price will start to decrease and go sideways. Therefore, the financial specialist believes that you should not buy gold at this time because it is possible to “jump in” at any time during the 10-year cycle.

Mr. Huan recommends that at this time, you can hold gold but also should not buy more. In the investment portfolio, gold should not account for more than 15% of the total.

According to another financial expert , when the gold price goes “crazy”, the lesson is to sit still instead of jumping in and hugging it, it’s never old.

Regarding the trend of gold prices, the financial expert believes that when the US Federal Reserve (Fed) does not have a roadmap to reduce interest rates, the gold price cannot decrease, it still “anchors” at a high level.

Many other experts believe that the current world gold price is around 1,160 USD/ounce and is likely to increase to 2,200 USD/ounce. Accordingly, the gold price in the country will soon break the old record.