According to information from DeelStreet Asia, Sky Mavis, the Vietnam-based company behind the “money-making” game Axie Infinity reported a loss of nearly 19 million USD (approximately 450 billion VND) in the fiscal year ending on March 31, 2022. This figure is 78 times higher than the loss amount in the previous year. This was also the time when a theft of 625 million USD in digital assets occurred from Ronin – the blockchain platform underlying Axie Infinity.

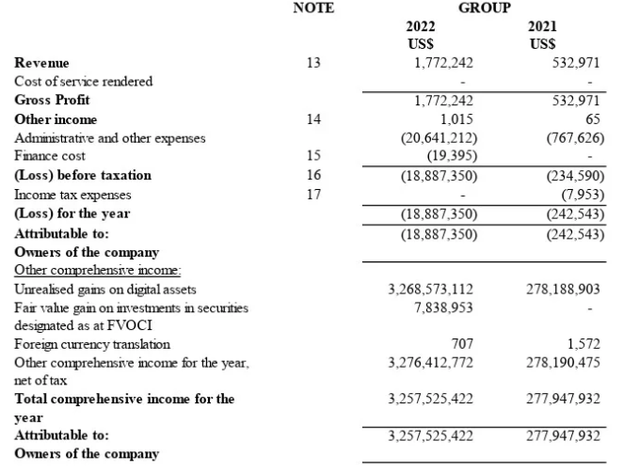

The company’s revenue in fiscal year 2022 reached 1.77 million USD, 3.3 times higher than the same period last year.

In its financial statements, Sky Marvis recorded an unrealized profit of 3.27 billion USD from digital assets. This item was classified as other income for the year. In 2021, Sky Marvis only recorded this item at 278.2 million USD.

Unrealized profits from digital assets reflect the increase in value of assets held by a company or individual, but have not been sold or converted into cash. Digital assets can include cryptocurrencies, tokens, NFTs, and other digital financial assets.

These profits are considered unrealized because they only represent potential paper profits based on the current market price, but the actual profits have not been realized through transactions.

The financial statements also show that Sky Marvis is under pressure from high costs. Especially administrative expenses and other expenses amounted to 20.64 million USD, 27 times higher than in 2021. The net cash used in operating activities by Sky Mavis also almost tripled to 1.41 million USD in fiscal year 2022, indicating a significant increase in cash burn.

Sky Mavis’ total assets reached 3.7 billion USD (approximately 85 trillion VND), while short-term liabilities were 2.84 million USD, an increase of 284.33 million USD and 1.85 million USD respectively in 2021. Cash and cash equivalents were 132.58 million USD at the end of fiscal year 2022.

The company’s financial statements also note that the cryptocurrency market is cyclical and volatile. This leads to extreme price fluctuations for the digital assets held by Sky Mavis.

“The company manages this by maintaining a significant amount of cash and reserves, allowing continued operation and development of products in a prolonged bear market,” the report said.

At a meeting in Manila in November last year, Sky Mavis said they were transitioning to the next goal: Demonstrating a sustainable business model after the “play-to-earn” frenzy subsides and the attack on the platform becomes the largest cryptocurrency theft to date.

Sky Mavis, one of the world’s largest NFT gaming ecosystems, was founded in 2017 by Nguyen Thanh Trung and Doan Minh Tu. In 2018, Aleksander Larsen, Andy Ho, and Jeffrey Samuel Kim Zirlin joined as co-founders.

Sky Marvis’ shareholder structure.

According to DealStreetAsia’s report in July last year based on registration documents, the company raised 11.1 million USD in a Series B-X funding round from Andreessen Horowitz (a16z) and Animoca Brands.

At that time, a spokesperson for the company told DealStreetAsia that this funding was part of a 150 million USD funding round they raised in 2022 to compensate users affected by the 620 million USD attack on the Ronin Network.

The spokesperson said, “As we investigated the Ronin attack and what it took to compensate all users, Sky Mavis and Axie Infinity were able to deposit funds into the bridge and refund the money using the company’s balance sheet.”

“Thanks to Sky Mavis’ strong financial position and crisis management capabilities, we were able to significantly reduce the funding round. Ultimately, Sky Mavis raised 11 million USD instead of the originally allocated 150 million USD. This deal was just recently completed.”

According to the company’s gaming registration with ACRA, a16z is contributing 10 million USD to this funding round, with the remainder provided by Animoca.