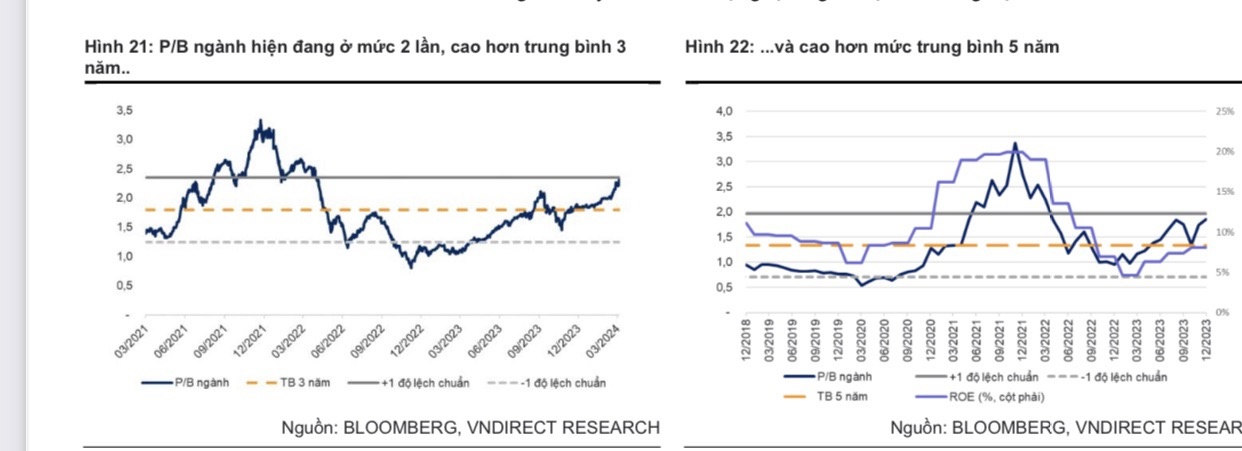

The average P/B ratio in the industry is currently about twice the average of the past 3 years, even 5 years. This reflects the relatively long-term price appreciation prospects reflected in the current stock prices. In which many products that generate profits will come to the fore to suit the trend.

According to my observations, the long-term price appreciation prospects have been reflected in the current stock prices.

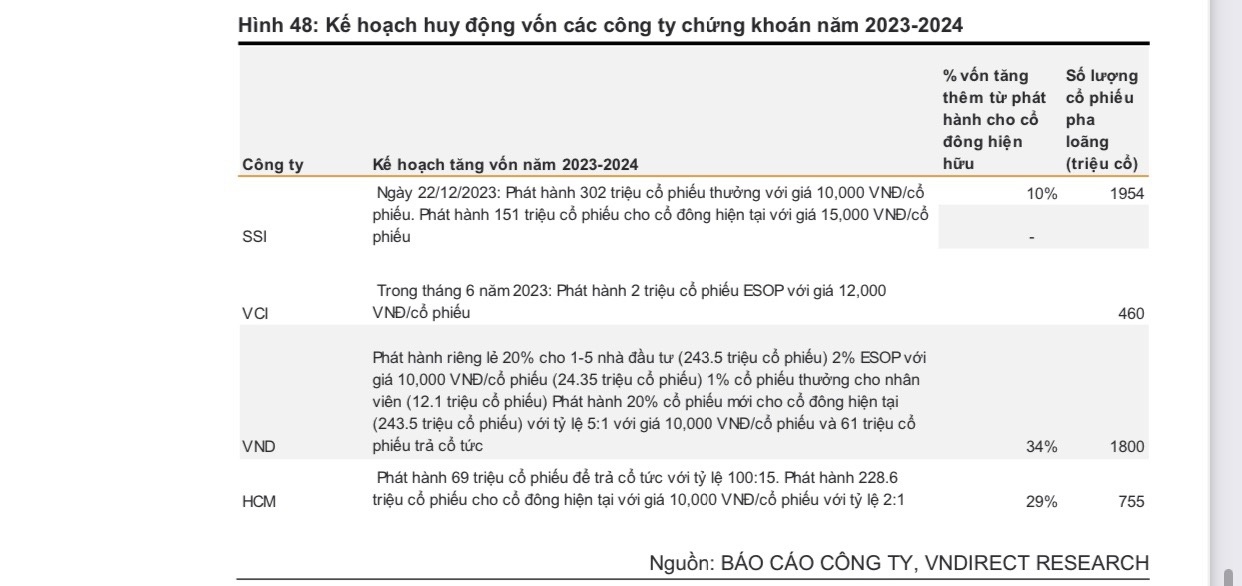

VNDIRECT has just released a report updating the prospects of the securities industry, in which it emphasizes that the business model of the industry is undergoing many changes. In which, in 2024, successful capital mobilization is the main driving force for growth.

Custody lending, asset management, and investment advisory take the lead

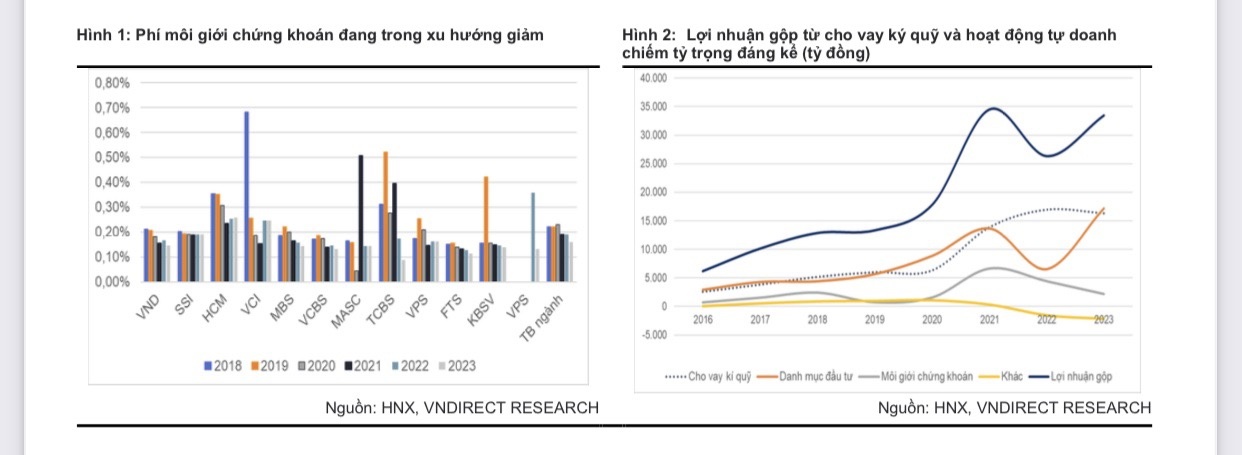

Experts from VNDIRECT Securities Company believe that, this year, companies are focusing on individual customers, reducing transaction costs, and shifting to completely free trading and instead, generating profits from other products such as custody lending, asset management, or investment advisory.

Some companies that have successfully pursued this model are: SSI, MBS, VND. Companies targeting institutional clients face challenges as the corporate bond market and initial public offerings (IPOs) still face many challenges. Companies that pursue this strategy include VCI and HCM.

Custody lending along with investment will be the main source of revenue for companies in the industry, and this is also the business model that many companies are heading towards. For most companies, custody lending contributes the majority of their gross profit, except for SSI and VND. This is not due to differences in business orientation but to optimize the surplus capital for borrowing to the maximum level.

Therefore, companies that can develop a customer base, have a large brokerage market share, and have the ability to mobilize large amounts of capital will be able to develop custody lending activities in the future.

The brokerage sector is expected to continue to grow in 2024, in line with the overall recovery of the industry. However, revenue from brokerage operations tends to narrow.

Proprietary trading will quickly bring positive results to their business performance, especially suitable for growth phases of the market. However, due to the unstable nature of this field and the complexity in analyzing prospects, risks for investment opportunities, contrary to the simplicity of the custody lending model, securities companies should consider this as an optimal solution to optimize capital after meeting the demand for customers’ custody lending.

Factors supporting the VN-Index in 2024

VNDIRECT assessed that the loosened monetary policy has supported the stock price appreciation of securities stocks in 2023, especially mid- and small-cap stocks. In 2024, with the government’s target of 6-6.5% economic growth, the monetary policy will continue to be loosened to support the economy.

Some factors contributing to the increase in the VN-Index and stocks in the securities industry include: securities firms successfully increasing capital; the KRX system is expected to operate and prospects for upgrading the market to emerging markets promoting market liquidity; and the return of foreign investment capital flows.

The first factor, successful capital mobilization is the main driving force for growth. Capital increase is an important motive in a business model based on lending activities and proprietary trading, as well as having sufficient resources to invest in information technology systems, improve user experience and pursue the zero-fee strategy to expand market share of brokerage.

The second factor, improved liquidity thanks to the KRX system and the potential of market upgrade. Recently, the Government has given priority to upgrading Vietnam’s stock market from the frontier market to the emerging market.

Many investors believe that upgrading is significantly important to the stock market and helps attract more capital from global investment funds. Moreover, investors also expect that upgrading the stock market will help large-cap companies easily raise capital from foreign investors with abundant financial resources.

In the latest assessment, Vietnam has met 9/18 MSCI criteria and a total of 11/24 FTSE criteria (including 22 market quality criteria and 2 economic positioning criteria). Of note, the criteria not met are not significantly different from the previous assessments of these organizations, indicating little improvement over the past three years.

The third factor is that technological breakthrough will promote the penetration of the domestic securities market. As of the end of 2023, the investor-to-population ratio in Vietnam is only about 7%, much lower than other frontier markets in the region such as Thailand and Malaysia, at 7.5% and 12.5% respectively due to the professional knowledge requirements to participate in the market. However, integrating investment advisory and trading services on technology platforms and favorable demographic conditions will help securities companies expand market share quickly.

The average daily trading value (ADTV) on all three major stock exchanges in Vietnam achieved a compound annual growth rate of about 23% in the period of 2017-2023.

With ADTV reaching a peak of over VND 26,500 billion ($1.08 billion). Thanks to newly opened trading accounts of domestic investors increasing at a compound annual growth rate of 25%, reaching a peak of 4.2 million accounts in 2022.

In 2024, ADTV will increase by 25-30% due to the development of the KRX system, along with additional funds from new investors as market conditions are favorable.

The fourth factor is the return of foreign investment capital flows. Foreign investors net sold about VND 24.8 trillion ($1.01 billion) in 2023 due to the interest rate differential between the US and Vietnam. However, the net selling trend is not only in Vietnam but also appears in other developing countries. This demonstrates that once interest rate differential narrows, we can witness the return of foreign capital flows to emerging markets (including Vietnam) based on economic recovery prospects.

VNDIRECT expects net profit of securities companies to continue to increase in 2024. Specifically, expected net profits of SSI, HCM, and VCI will increase by 29.1%, 27.5%, and 45.7% respectively. The outstanding growth of VCI is mainly due to the low base effect. The industry’s return on equity (ROE) is also expected to improve this year. The projected ROEs of SSI, HCM, and VCI are 5%, 4.4%, and 3.95% respectively.