According to a report by SSI Research on March 11, 2024, the supply of industrial zones (IZs) in the South mainly comes from converted rubber land.

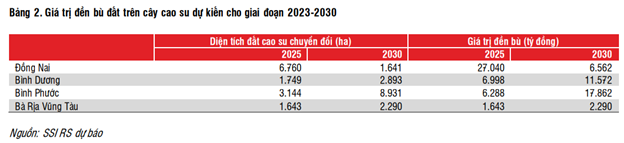

Specifically, according to the master plan for IZs in Dong Nai, the area of IZs converted from rubber land approved by the Prime Minister is 6,760ha (accounting for 91% of the total area) by 2025 and 2,000ha in the period of 2025-2030 (accounting for 48% of the total area).

At the same time, the area of rubber land converted to IZs in Binh Duong, Binh Phuoc, and Ba Ria – Vung Tau by 2025 is estimated at 3,084ha, 2,994ha, and 3,933ha, respectively.

The conversion of rubber land to IZs has advantages such as large contiguous land area, quick land clearance compensation due to clear guidance on land valuation, providing a basis for determining transfer prices and low land filling costs due to the high land rigidity.

Therefore, SSI Research believes that converting rubber land to IZs will help provide new supply in the context where the occupancy rate in the IZs in the South such as Dong Nai and Binh Duong is over 93%.

SSI Research also pointed out the companies with large converted areas such as Dong Nai Rubber (Vietnam Rubber Industry Corporation – HOSE: GVR), Dong Phu Rubber (HOSE: DPR, GVR holds 55.81%), Phuoc Hoa Rubber (HOSE: PHR, GVR holds 66.62%), Tan Bien Rubber (UPCoM: RBT, GVR holds 98.46%), Ba Ria Rubber (UPCoM: BRR, GVR holds 97.47%), Phu Rieng Rubber (GVR holds 100%), Dau Tieng Rubber (GVR holds 100%).

What is the appropriate method for determining compensation prices for rubber tree planting?

According to the Land Law 2024, which will be applied from 2025, the valuation of long-term tree planting land will be based on 4 methods close to market transaction prices.

SSI Research’s analysis team believes that the most suitable income method for determining compensation prices for rubber tree planting includes factors such as revenue from tree exploitation in the last 3 years, tree exploitation costs in the last 3 years, and the discount rate based on the average 12-month fixed-term deposit interest rate of banks held by the State over 50%.

In addition, SSI Research also compared past land compensation transactions for rubber trees at projects such as VSIP 3 – Binh Duong (compensation price of VND 2.5 billion/ha), Nam Tan Uyen 3 – Binh Duong (compensation price of VND 2.5 billion), Minh Hung 3 – Binh Phuoc (compensation price of VND 1.5 billion/ha), and Hiep Thanh IZ – Tay Ninh (compensation price of VND 1.3 billion/ha) as a basis for determining compensation prices for rubber tree land for future transactions.

According to SSI Research, the cost of compensating for rubber tree land includes 2 components: the rubber tree compensation price determined according to the province’s regulations; and support types (including support for assets on the land, support for investment costs in the remaining land, support for cessation benefits, and support for ensuring stable living, production, and fairness to people whose land is withdrawn). Of which, support costs account for 70-80% of the total compensation cost for rubber tree land.

Based on current transactions and exchanges with enterprises in the industry, SSI Research forecasts that the expected compensation cost for rubber tree land may increase by 30-50% compared to the cost of past transactions and apply according to the valuation methods in the amended Land Law.

Therefore, with the increase in land clearance compensation costs, SSI Research predicts that the gross profit margin of new IZs may decrease to around 25-30% compared to the current rate of over 42% for active projects.