Sudden sharp drop in gold price

After several consecutive days of hitting new highs, today (13/3), domestic gold prices suddenly turned downwards. Specifically, according to the survey, at 2:30 PM, SJC gold price at Saigon Jewelry Company was listed at 77.8-80.3 million VND/tael, a decrease of 2.4 million VND/tael for the buying price and 2.2 million VND/tael for the selling price compared to yesterday.

Meanwhile, 24k plain gold ring price also plummeted, now only at 67.1 million VND/tael for buying and 68.5 million VND/tael for selling, which is 2.6 million VND lower than the same period yesterday.

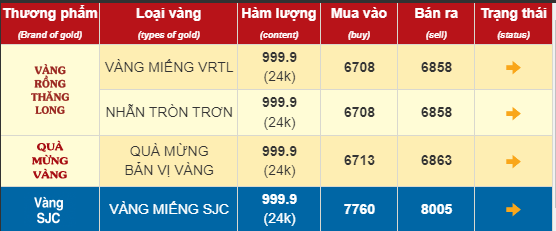

Gold prices listed at Bao Tin Minh Chau.

Since this morning, gold prices have started to decline. At 9:45 AM, at Saigon Jewelry Company, plain gold ring price was listed at 68.0-69.3 million VND/tael. Compared to yesterday, this type of gold has decreased by 1 million VND/tael. SJC gold price also continued to decrease to 79.8 – 81.8 million VND/tael. Bao Tin Minh Chau listed plain gold ring price at 68.48 – 69.88 million VND/tael, a decrease of 1.4 million VND/tael compared to yesterday. And the downward trend continues into the afternoon.

When will gold prices start to rise again?

With the sudden decline like the present, will gold prices turn around and start to rise again? Mr. Nguyen Tri Hieu, an economic analyst, said that Vietnamese people have a tradition of storing gold, especially plain gold rings. Profit is only one part, but this is a safe investment channel with good liquidity. Especially in the context where stocks are still fluctuating, real estate is facing difficulties, and deposit interest rates are low, gold is still a safe investment channel.

According to Mr. Hieu, typically, due to high demand for gold, people rush to buy gold. When demand increases and supply is limited, gold prices will inadvertently be pushed up. On the other hand, when gold prices rise, people rush to sell, and gold prices experience downward pressure.

Mr. Hieu’s explanation of the fluctuations in gold prices shows that the sharp increases and sudden decreases of this investment channel largely depend on the demands of the people. Previously, in a survey yesterday, the price for plain gold rings was still hovering at over 70 million VND/tael. Many people rushed to sell gold. But today, gold prices suddenly plummeted.

Regarding the gold price forecast, Mr. Nguyen Tri Hieu believes that gold prices are still affected by the tightening monetary policy of the Fed, and investors’ expectations about the possibility of the Fed reducing interest rates.

Mr. Hieu emphasizes that gold prices are still subject to many conflicting influences and are difficult to predict from the economic situation. He also believes that when the policy on gold supply is revised, domestic gold prices may be adjusted.

Mr. Nguyen The Hung, Vice Chairman of the Vietnam Gold Business Association, said that the sharp drop in domestic gold prices is equivalent to the decline in global gold prices.

He predicts that with limited gold supply, the strong demand for gold will soon push prices back up.