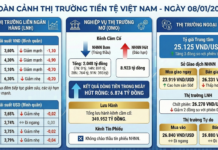

As reported, on 11/3, the State Bank unexpectedly resumed issuing bonds after about 4 months of suspension. After 5 sessions from 11-15/3, the State Bank of Vietnam (SBV) has issued nearly 75,000 billion VND in bonds, thereby draining the corresponding amount of money from the system.

Recently, BSC Securities Company published an analysis report on the bond issuance activities of the SBV.

According to BSC, the SBV bonds are short-term papers issued by the SBV to implement the national monetary policy. The entities participating in the buying and selling of bonds are the SBV and credit institutions with payment accounts in VND at the SBV. The short-term objective when the SBV issues bonds is to regulate liquidity in the market in the short term to impact the exchange rate. In the long term, bond issuance is to stabilize the exchange rate, interest rates, liquidity,… to serve the long-term objectives of the monetary policy.

Through bond issuance, the SBV regulates the excess liquidity of the system that credit institutions have not used. This is considered a measure to limit the speculation in foreign currencies.

According to BSC, the bond issuance activities are a normal, fundamental business of the SBV. In Vietnam, during the period of 2018-2023, the SBV has implemented this business several times a year.

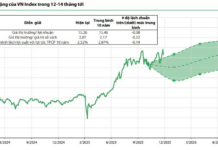

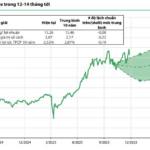

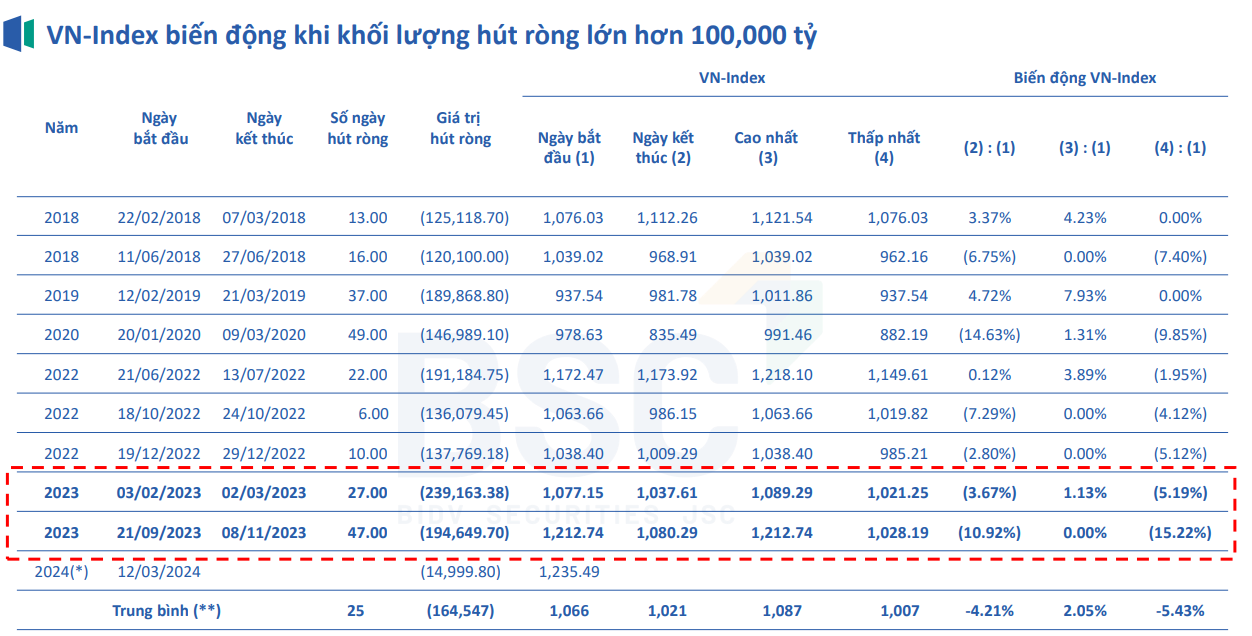

According to BSC’s data, when the net withdrawal value is less than 100,000 billion VND, the probability of VN-Index decreasing in the withdrawal cycle is 33.33%. When the net withdrawal value is more than 100,000 billion VND, the probability of VN-Index decreasing in the withdrawal cycle is 66.67%. On average, the probability of VN-Index decreasing in withdrawal cycles is 50%.

Looking back at the most recent bond issuance period, which is the period from 21/9 to 8/11/2023, the SBV has net withdrawn 194,649 billion VND during this period. The withdrawal trend started when the USD/VND exchange rate increased significantly (increased by 3.48% from the beginning of Q3/2023 to 21/9/2023). Also during this period, the excess liquidity of the system with interbank interest rates since July 2023 was at a low level of less than 1%.

After the SBV’s withdrawal of money, the exchange rate started to decrease and maintained the downward trend until the end of November 2023. The overnight interbank interest rates increased by more than 2% during the period from 21/9 to 25/10/2023 – in response to the withdrawal trend, but then quickly decreased.

For the bond issuance period from 11/3/2024, BSC believes that the reason for the SBV’s return to using bond tools is to support the exchange rate when the recent exchange rate increased strongly due to: (1) the difference in interest rates between VND and USD; (2) DXY-Index increased (but still at a low level of 102.8); (3) Fed signaled a postponement of interest rate cuts from Q1 to Q2/2024. BSC also forecasts that the net withdrawal scale of this period could be around 100,000-150,000 billion VND. The average bond interest rate is about 1-1.3%/year.

Thus, the SBV’s reopening of bond activities from 11/3/2024 has some similarities and differences compared to the period from September to November 2023. BSC recommends that investors can monitor important indicators in the coming time such as: Exchange rate (including free exchange rate), DXY index, net withdrawal scale as well as bond issuance rates along with interbank interest rates, sectors with strong point reduction fluctuations in the past as indicators for the extent of impact on the stock market, if any.

BSC believes that bond net withdrawal activities are a regulatory tool, a means of regulation, and do not imply policy reversals. BSC recommends that investors should not be too concerned, but should objectively evaluate the information in the market to have appropriate investment strategies.