Bad debt, also known as difficult-to-collect debt, occurs when borrowers are unable to repay their debts as promised in the loan agreements with credit institutions such as banks and financial companies. According to regulations, bad debt refers to overdue payments for more than 90 days. Once listed on the bad customer list (according to CIC classification), borrowers will encounter many difficulties when seeking loans from banks or other credit institutions in the future.

CIC (Credit Information Center) is the Credit Information Center under the State Bank of Vietnam. CIC is responsible for collecting, storing, analyzing, and providing credit information to meet the management requirements of the state bank.

In practice, there are some accidental situations that can affect users’ credit scores on CIC. There have been cases where credit card holders unintentionally get involved in bad debts. Nowadays, many banks have applied credit card management on convenient digital banking apps such as reminders, automatic payments, etc. However, for credit cards issued years ago, customers may fail to pay off or forget to repay the debt even if the remaining debt is very small. This can still lead to significant bad debts.

An even more ironic situation is when customers’ personal information is leaked, stolen, and used by criminals to open credit cards and conduct transactions without the cardholders’ knowledge. As a result, the debt incurred becomes bad and accrues continuous interest while the actual cardholders remain unaware.

Credit cards typically have high-interest rates, usually around 20-40% per year depending on the bank, not to mention late payment fees. Therefore, credit card users need to pay attention to their expenses to repay the debt on time, avoiding the accumulation of interest over a long period of time.

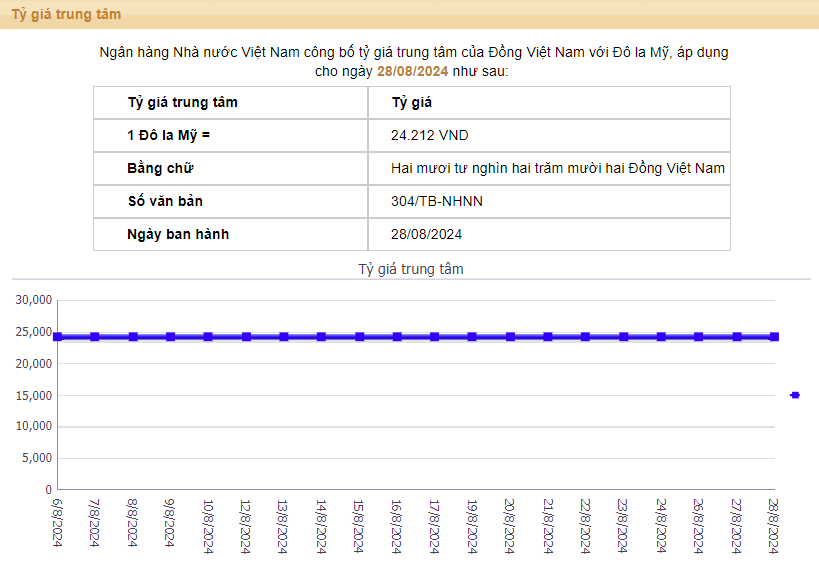

To check if one has bad debts or to check their credit score, users need to have an account on CIC. To register, users can access the official CIC website at https://cic.gov.vn/ or the CIC Credit Connect app and proceed to sign up by clicking on the registration section. Then, users enter all their personal information in the provided form, including full name, date of birth, ID number, phone number, ID card/photo identification, etc.

A personal credit information report

The personal credit information report will include details such as current credit relationship information (loan amount and lender), information on past 5-year bad debts, collateral information for loans, and credit scores.

CIC’s credit rating for individuals has 5 levels: Very Good, Good, Average, Below Average, and Bad.

Credit scores are evaluated based on all credit relationship data of the borrower at the end of the most recent month compared to the scoring point. The credit score is updated monthly by CIC according to changes in the borrower’s information.

If any incorrect information is found, customers can report it to CIC via hotline 1800585891 or the “Complaint/Feedback” section on the website: https://cic.gov.vn (along with supporting documents).

In case of any processing errors, CIC is responsible for correcting the mistakes and notifying the results to customers.

If there are inaccuracies in the information provided by the credit reporting organizations, the staff will guide customers to work with the relevant institutions to verify and address the issue. In case the error is confirmed, the Director-General of the credit reporting organization or authorized person is responsible for sending a written request to CIC to update and correct the information.