In the context of abundant capital, deposit and lending interest rates decrease, but businesses still have difficulty accessing bank capital, leading to negative credit growth. This issue is being concerned by the society.

Only good businesses can borrow at low interest rates

According to the State Bank, credit debt in the entire system as of the end of February 2024 decreased by 0.72%. The main reason is the narrow output of many businesses, and people reduce borrowing and spending… although the average lending interest rate is now around 6.4% per year, decreasing by 0.7 percentage points compared to the end of 2023.

Survey at some banks in Ho Chi Minh City, the reporter of Bao Người Lao Động recorded short-term (3 to 6 months) lending interest rates ranging from 4.3% – 7% per year; for medium and long-term loans (12 months and above), interest rates are about 6.8% – 10% per year.

Banks have excess money, businesses lack capital but difficult to access loan capital. Photo: TẤN THẠNH

For example, Vietnam Export Import Commercial Joint Stock Bank (VietinBank) has recently announced a loan package of VND 300,000 billion (USD 13 billion), with the lowest interest rate of 5% per year for short-term loans. Accordingly, this particularly competitive interest rate is prioritized for enterprises engaged in import-export activities using diverse products and services at VietinBank, transferring export revenue to transactions at this bank, customers operating in priority sectors…

Maritime Bank (MSB) is also deploying a VND 3,000 billion (USD 130 million) green credit package, with interest rates from 4.3% per year for short-term loans and from 6.8% per year for medium and long-term loans. The lending target is enterprises with investment projects in the areas of energy, water resources, waste, construction, and processing industries, green transformation that meet green project criteria… Enterprises with projects or production-business plans in sustainable development sectors of textiles, aquaculture, and agriculture are also prioritized for credit support by MSB.

Meanwhile, at Nam A Bank, the lowest interest rate for loans is 6% per year for good enterprises and enterprises in priority sectors. “In the current context, loans for consumer spending or high-risk loans, the bank will maintain a competitive interest rate compared to other banks. For loans in priority sectors, the bank will continue to reduce interest rates in the coming time,” said a Deputy CEO of Nam A Bank.

However, in reality, customers can only enjoy the lowest interest rate when borrowing a large amount, participating in multiple financial services that bring profits… At the same time, borrowers must have feasible production-business plans, ensure income to repay debts, have sufficient collateral assets, and no bad debts…

On the other hand, banks will lend at the highest interest rate when customers only meet conditions of sufficient income and collateral assets. Meanwhile, businesses without collateral assets almost cannot access credit.

Collateral barrier

At the conference on implementing monetary policy tasks in 2024, focusing on removing difficulties for production and business, promoting growth and macroeconomic stability chaired by Prime Minister Pham Minh Chinh on March 14, many businesses reflected that the lending interest rate is still high, especially in old loans associated with existing debts.

Many effective businesses, especially small businesses, reported that they could not borrow money due to encountering barriers related to collateral assets. This is a factor that businesses need support in accessing bank capital.

A senior leader of Vietnam Export Import Commercial Joint Stock Bank (Eximbank) admitted that many businesses have good revenue, stable cash flow. However, these businesses still cannot borrow from banks because they do not have collateral assets or the value of the assets is not enough to secure the loan. “To solve these two bottlenecks, Eximbank and many other banks have considered helping businesses based on cash flow, as the basis for unsecured loans,” said a leader of Eximbank.

Mr. Nguyen Van Than, Chairman of the Small and Medium Enterprises Association, said nearly 1 million small and medium enterprises are currently facing a shortage of capital, but banks have excess money – a prolonged contradiction without a solution.

Believing that lowering lending standards is not possible because it does not ensure capital safety, according to Mr. Than, the government needs to find new ways to support businesses. “For example, the treasury policy currently has loan programs with an interest rate of 1% per year. The government can consider promoting the effectiveness of these loan programs. From there, businesses will have additional sources of capital for access,” said Mr. Than.

However, financial expert – bank – Dr. Nguyen Tri Hieu believed that the core of supporting businesses is that banks should further reduce lending interest rates and the state should guarantee loans for businesses. When that happens, banks will feel secure in lending.

According to Mr. Hieu, commercial banks should cancel payments for a board member hundreds of millions of VND/month. This action will further reduce operating costs for banks to reduce interest rates. Instead, banks only pay a modest amount of remuneration to these individuals for each meeting. Because board members are emergency personnel who only help banks with business strategies.

Regarding collateral guarantees for business loans, the government needs to amend legal regulations on the operation of Credit Guarantee Funds to be suitable to reality. Currently, the law stipulates that the operation of Credit Guarantee Funds in provinces and cities must not suffer from a capital shortage. This has made the leaders of these funds afraid of responsibility, leading to ineffective operations. “On the other hand, the government can propose the National Credit Guarantee Fund with a capital of tens of thousands of billion VND from the state budget and supplement it with capital annually. The National Credit Guarantee Fund must operate as a professional financial organization to evaluate scale, capacity, production plan… to guarantee loans for businesses from commercial banks. If for any reason, businesses lose the ability to repay bank loans, the National Credit Guarantee Fund will use its capital to pay off commercial banks. After that, this fund will work with businesses to recover capital,” proposed Mr. Hieu.

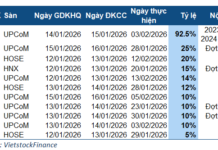

Banks announce average lending interest rates

Commercial banks must announce the average lending interest rate as per the State Bank’s policy by April 1, which is also the factor to create pressure to reduce lending interest rates in the near future. Currently, some banks and financial companies have begun to announce average lending interest rates.

According to financial experts, when borrowing interest rates are publicly announced, market comparison and monitoring will occur from the market, customers… So that banks can proactively reduce operating costs and therefore reduce interest rates.