The news about a credit card debt of 8.5 million from 2013 to 2024, with a total principal and interest amount of over 8.8 billion, has caused a stir. Currently, the cardholder has hired a lawyer to help resolve the related information and protect their rights.

However, after the incident was published, many people questioned how credit card debts would be handled. Can credit card debts be criminally prosecuted?

Credit cards allow cardholders to make card transactions within the credit limit agreed upon with the card issuer.

According to the regulations in Clause 2, Article 17 of Circular 19/2016, amended by Clause 9, Article 1 of Circular 17/2021, the principles of using cards are as follows: Cardholders must use money for the correct purpose and make full and timely payments to card issuers for the loan amounts and interest incurred from using the card under the contract signed with the card issuer.

Currently, banks usually provide an interest-free period of about 45 days, including the interest-free period between two payment cycles and the extended time.

If the full amount is not repaid during this period, the customer will have to pay a late fee, also known as a late payment fee. This fee is applied by the bank and is a minimum of 5% per transaction on the total amount you have used from your credit card, plus interest for the bank.

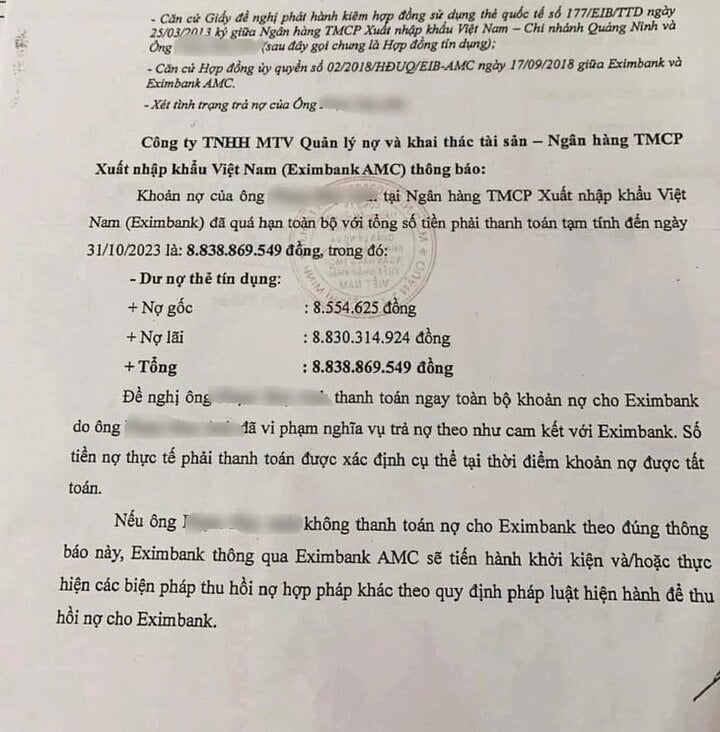

The credit card debt has increased from 8.5 million to over 8 billion for a customer in Quang Ninh – Photo: NVCC

The unpaid amount will continue to accrue interest on a daily basis until you repay it in full.

Therefore, not repaying credit card debts will result in late payment fees and interest on the remaining debt, depending on the contract signed with the bank.

Can you receive up to 20 years in prison for not repaying credit card debts?

If you spend on a credit card but do not repay the debt and show signs of fleeing or deceiving to avoid repayment, you may face criminal charges for the offense of abuse of trust and misappropriation of property.

If you do not repay credit card debts, you may be fined or face criminal charges, with a maximum sentence of up to 20 years in prison – Illustration created by AI Chat GPT

According to Article 175 of the Criminal Code 2015, amended and supplemented in 2017, depending on the level of violation and the amount of the loan, you may be subject to the following penalties:

Imprisonment of up to 3 years if misappropriating an amount ranging from 4 million to less than 50 million dong or an amount of less than 4 million dong but has been penalized for administrative violations of this behavior or has been convicted of property infringement offenses without cleared criminal records.

If misappropriating an amount from 50 million to less than 200 million dong, you may be sentenced to 2 to 7 years in prison; If misappropriating an amount from 200 million to less than 500 million dong, you may be sentenced to 5 to 12 years in prison; If misappropriating an amount of 500 million dong or more, you may be sentenced to 12 to 20 years in prison.

What if you become unable to repay credit card debts due to an accident?

A reader previously submitted a question to VOV regarding what to do if they were involved in a work accident resulting in partial paralysis and unable to repay their credit card debt.

In particular, in February 2020, they opened a credit card with a limit of 50 million dong through a personal loan. After the accident, they no longer have the ability to work and repay the 45 million dong credit card debt starting from August 25, 2021. Subsequently, the bank filed a lawsuit requesting payment of up to 72 million dong.

According to VOV’s advice, if they were involved in a work accident, became paralyzed, and no longer have the ability to work, they are not exempt from the obligation to repay the debt. However, they can submit a request to the Bank to consider restructuring the repayment period according to the provisions in Clause 3, Article 18 of Circular 39/2016/TT-NHNN or requesting a reduction or exemption of the interest amount to be paid.

In addition, if their credit contract includes credit insurance, they can request the insurance company to fulfill the obligation to repay the debt according to the agreement in the insurance contract.