Market liquidity increased significantly compared to the previous trading session, with the trading volume of VN-Index reaching over 1.616 billion shares, equivalent to a value of over 40 trillion VND; HNX-Index reached nearly 183 million shares, equivalent to a value of nearly 3.8 trillion VND.

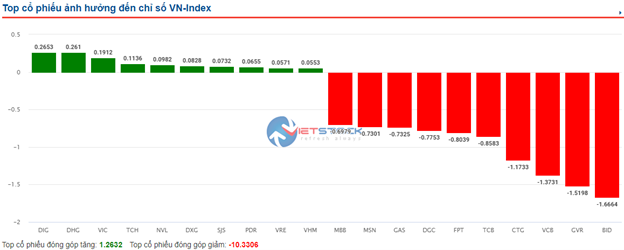

VN-Index opened the afternoon session quite positively as buying pressure appeared right from the beginning of the session, helping the index narrow its decline and maintain its recovery until the end of the session. In terms of impact, GVR, CTG, VCB, and GAS were the most negative stocks, taking away more than 6.3 points from the index. On the other hand, VIC and VRE were the most positive stocks for VN-Index with an increase of nearly 2.8 points.

| Top 10 stocks impacting VN-Index session 18/03 (in points) |

HNX-Index also had a similar trend, in which the index was negatively affected by stocks such as LAS (-9.35%), DTD (-6.45%), BVS (-6.12%), DXP (-5.56%),…

|

Source: VietstockFinance

|

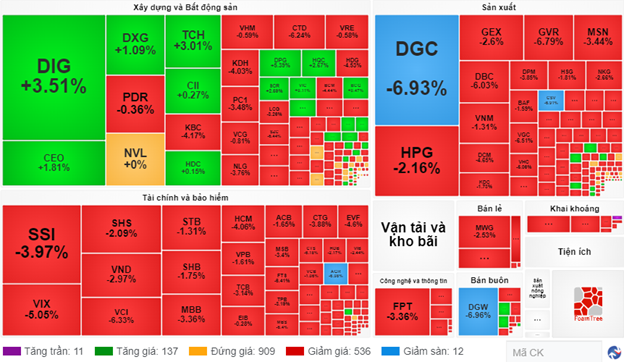

The plastics – chemicals industry had the biggest decrease with -5.21%, mainly due to stocks like GVR (-5.92%), DGC (-6.93%), DCM (-3.94%), and DPM (-4.53%). Following that is the other financial sector and the securities industry with a decrease of 3.9% and 3.51% respectively. On the other hand, the healthcare industry had the strongest recovery with a 1.93% increase, mainly thanks to stocks like DHG (+5.95%), DMC (+2.36%), and DHT (+0.79%).

In terms of foreign trading, they continued net selling over 1.031 trillion VND on HOSE, focusing on stocks like VHM (178.36 billion), DGC (166.34 billion), VPB (126.88 billion), and VNM (99.76 billion). On HNX, foreign investors net bought nearly 56 billion VND, focusing on stocks like CEO (29.87 billion), SHS (20.48 billion), and IDC (18.79 billion).

| Net buying – selling of foreign investors |

Morning session: VN-Index tumbles, but liquidity explodes

VN-Index after being in a tug-of-war around the reference level for the first half of the morning session suddenly plunged with negative points. At the same time, the continuous net selling from foreign investors indicates a more pessimistic situation. At the end of the morning session, VN-Index decreased by 35.91 points, equivalent to 2.84%. HNX decreased by 5.63 points, equivalent to 2.35%.

The trading volume of VN-Index recorded in the morning session reached nearly 738 million shares, with a trading value of nearly 19 trillion VND. HNX-Index recorded a trading volume of over 125 million shares, with a trading value of nearly 2.5 trillion VND. The trading value of all 3 exchanges reached over 30 trillion VND in the morning session.

Source: VietstockFinance

|

Most large-cap sectors were in the red in the morning session. The plastics – chemicals, rubber products, securities, seafood processing, and mining industries were among the most negatively affected.

The plastics – chemicals industry was the most negatively affected sector, with a decrease of 5.75%. Leading stocks such as GVR decreased by 6.21%, DGC decreased by 6.93%, DCM decreased by 5.07%, DPM decreased by 5.49%,…

On the other hand, the rubber products industry was also in a pessimistic situation. This was mainly due to stocks like DRC decreased by 5.55%, CSM decreased by 6.08%, and SRC decreased by 2.85%.

The healthcare industry, on the contrary, had a good performance with only green colors. This was mainly thanks to stocks like DHG increased by 6.67%, DBT increased by 2.07%, and DTG increased by 0.77%.

Foreign investors continuing net selling contributed to the negative trend of the morning session for VN-Index. Among them, DGC and VHM were the most heavily sold stocks, with a dominant proportion compared to other stocks such as VPB, SSI, DCM, VNM, STB,…

10:30 AM: VN-Index plunges, at one point decreased by 30 points

Selling pressure suddenly appeared, causing all indexes to drop sharply. At the same time, foreign investors continued heavy net selling, indicating a more negative situation. As of 10:30 AM, VN-Index decreased by 29.27 points, traded around 1,234 points. HNX-Index decreased by 4.22 points, traded around 235.26 points.

The VN30 basket of stocks had a mixed performance but selling pressure dominated. Specifically, BID, GVR, VCB, and CTG took away 1.66 points, 1.51 points, 1.37 points, and 1.17 points from the index respectively. On the other hand, DIG, DHG, VIC, and TCH were being actively bought and contributed more than 0.8 points to the VN30-Index. However, the contribution level was not significant.

Source: VietstockFinance

|

The plastics – chemicals industry is under strong selling pressure with major stocks such as GVR decreasing by 4.62%, DGC decreasing by 6.85%, DCM decreasing by 4.23%, and DPM decreasing by 3.43%.

On the other hand, the healthcare industry is showing a relatively good performance with notable stocks such as DHG increasing by 6.67%, DBT increasing by 2.07%, DTG increasing by 0.77%, and PPP increasing by 1.04%.

In addition, the real estate sector also has a relatively positive trend, but trading is concentrated on a few large-cap stocks. In particular, VIC increased by 0.23%, NVL increased by 0.3%, PDR increased by 0.53%, and DIG increased by 4.74%.

Compared to the opening, there is a fierce struggle between buyers and sellers, with more than 921 stocks standing at the same price, and sellers slightly outnumbering buyers, with 158 stocks increasing (10 stocks hitting the ceiling) while 528 stocks decreasing (10 stocks falling to the floor).

Liquidity increased dramatically. As of 10:30 AM, the trading volume on HOSE reached nearly 467 million shares, with a trading value of nearly 12 trillion VND. The trading volume on HNX reached over 81 million shares, with a trading value of nearly 1.7 trillion VND.

Source: VietstockFinance

|

Opening: Tug-of-war appears

A tug-of-war scenario appeared at the beginning of the trading session, showing cautious investor sentiment with major indexes fluctuating around the reference level.

VN-Index decreased by nearly 2 points, traded around 1,265 points; HNX-Index reached 240 points.

In the volatile opening period, the VN30 basket of stocks had 16 stocks decreasing, 9 stocks increasing, and 5 stocks standing at the same price. Among them, MSN, FPT, and MBB were the stocks with the most significant decrease. On the other hand, GVR, VIC were the stocks with the most significant increase.

The construction and real estate sector was one of the most unpredictable sectors in the market. Stocks such as DIG increased by 2.28%, DXG increased by 1.90%, and CEO increased by 1.36%

Furthermore, the securities sector showed positive signs at the beginning of the session, particularly stocks such as SHS increased by 1.57%, VIX increased by 0.24%, and VND increased by 0.21%.

On the other hand, the retail sector was dominated by red colors in the morning session. Stocks such as MWG decreased by 0.29% and PNJ decreased by 1.80%.