The market has had some pretty firm options, but it remains to be seen whether the Bank of Japan is finally ready to exit the negative interest rate cycle.

Here are some important financial events around the world that will take place in the week of 18-22/3:

1/ Will the Bank of Japan change interest rates?

The monetary policy meeting of the Bank of Japan (BOJ) will begin on Monday (18/3) and last for 2 days. The market has repeatedly predicted that the BoJ will end negative interest rates and reconsider its massive stimulus program, but that has not yet happened. However, this time, after the labor negotiation results of Japan Inc with strong wage increase, many people began to believe that the time has come.

Recent comments from BOJ officials, including Governor Kazuo Ueda, also seem to signal the end of extremely loose monetary policy for many years, even though that did not happen in March.

The market in general predicts that BOJ will change interest rates in June. Investors have benefited from selling short-term bonds as the increase in the central bank’s deposit rate will cause money to be quickly withdrawn from bonds into cash. But that is only a prediction and the result still needs time to answer.

Japanese bond yields.

2/ Is the US economy experiencing sustainable growth?

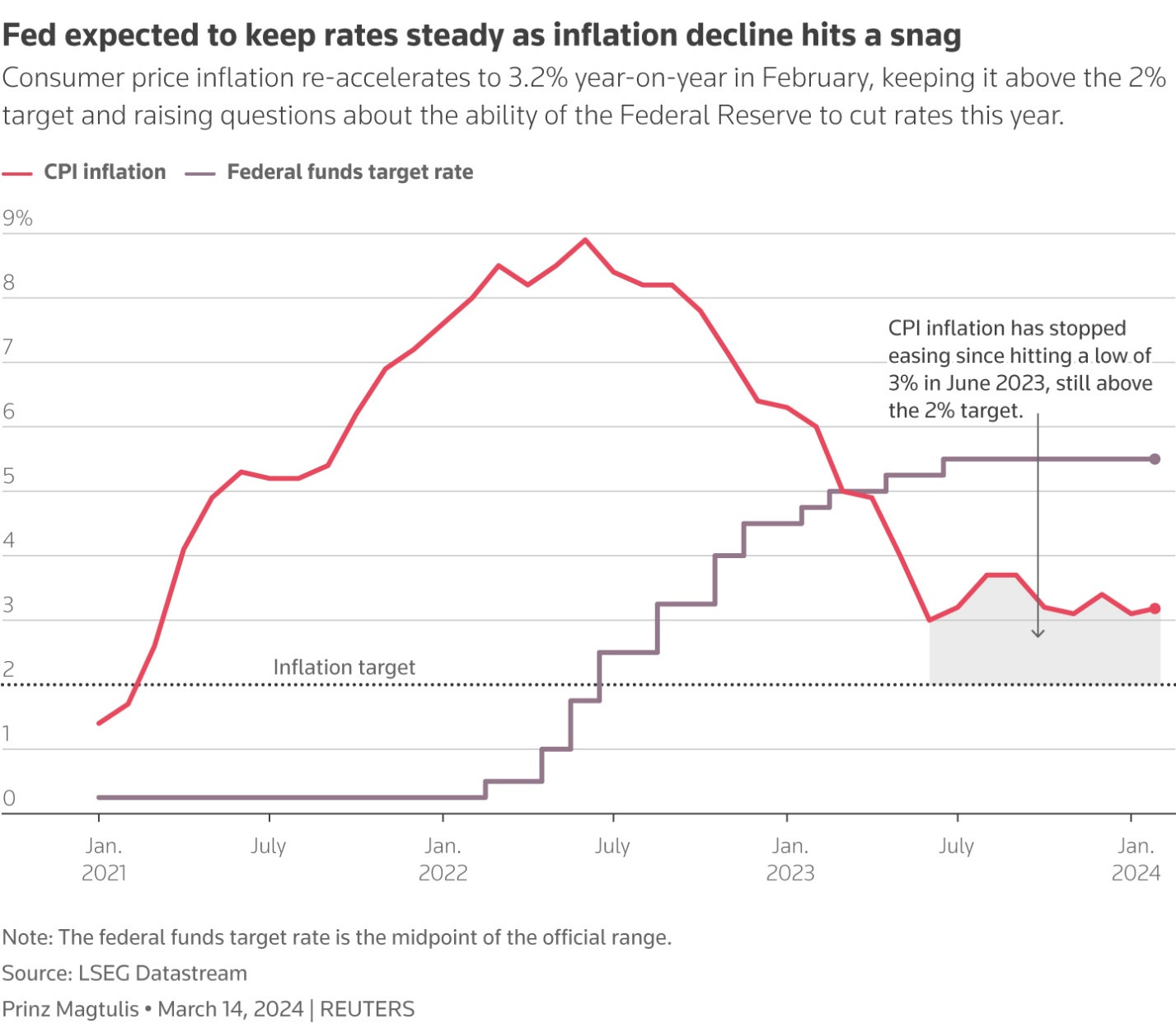

The meeting of the US Federal Reserve (Fed) on Wednesday (20/3) will focus on assessing the policy makers’ views on the timing of interest rate cuts, the resilience of the US economy and the possibility of inflation returning.

Strong employment and inflation data have caused the market to change its view on how much policy makers will cut interest rates this year. Fed Funds Futures currently predicts that the Fed will cut interest rates a total of 80 basis points in 2024, lower than the 150 basis points predicted in January.

However, that has not prevented the rise in the US stock market, which has brought the S&P 500 to a new record high this year. However, Powell’s tightening monetary policy stance may cause equity investors to temporarily pull out.

Also, this week will see the GTC 2024 conference organized by Nvidia at the San Jose Convention Center from 18 – 21.3. It is expected to have more than 300,000 people register to attend in person and online. The conference will feature an important speech by CEO Jensen Huang. The AI-driven frenzy has pushed Nvidia’s stock up nearly 80% as of the present time.

US inflation and interest rates.

3/ The Bank of England collects data, the Swiss National Bank may cut interest rates

The Bank of England (BoE) may wait for further data before announcing interest rates on Thursday (21/3). They need to know more about wage growth, which is still higher than the US or the euro area.

A Reuters survey showed that the BoE is expected to start cutting borrowing costs (currently 5.25% – the highest level since 2008) – in August, possibly after both the Fed and the European Central Bank (ECB).

Markets will follow any changes in the language of BoE policy makers on bank interest rates (up to now BoE has used the phrase “under consideration” when talking about this issue) and any changes in their voting results (in the February meeting, BoE policy makers were divided into 3 options). And the UK’s inflation index announced on Wednesday (20/3) may make them rethink at the last minute.

In Switzerland, meanwhile, inflation falling to a near 2-1/2-year low has raised expectations that the Swiss National Bank may cut interest rates on Thursday (21/3).

Lowest wage growth in the UK since October 2022.

4/ Global business activity shows signs of improvement

Contrary to the exceptionalism of the US, economic growth in many large economies has been slow.

Some economists believe there is too much pessimism throughout Europe, which has been more severely affected than some other countries by the energy shock – and therefore a slower recovery. That means European stocks, even when near a record high, still fall into a price slump.

The PMI index or preliminary business activity data published by economies globally in the coming days may confirm the view that the global economy outside the US is not as bad as initially thought.

While the euro area’s composite PMI index for February is still below the 50 mark, the line between expansion and contraction, it is still higher than the market’s forecast. The UK’s manufacturing PMI, which has been stuck below the 50 growth threshold since August 2022, is now increasing.

Business activity of major economies: Europe at its lowest

5/ USD strengthens, gold and Bitcoin decline

USD has experienced its strongest weekly gain since mid-January after a string of data showed the US economy still stable despite some minor weaknesses, leading to predictions that high interest rates today could be maintained for a longer period than expected or the number of interest rate cuts this year will be fewer.

The Dollar index – comparing USD against a basket of key partner currencies – rose 0.7% in the past week, the largest since mid-January, ending on Friday at 103.43, the highest in over 1 week.

A stronger USD and reduced expectations of an imminent interest rate cut have pushed gold prices down in the first week in 4 weeks, spot gold falling 0.8% to $2,159.99/ounce on Friday, pulling away from the previous week’s record high of $2,194.99.

Cryptocurrencies also reversed their sharp decline over the weekend after setting a record high for four consecutive sessions. From the record level of $73,803.25 on Thursday, Bitcoin has fallen to $66,629.96 on Friday afternoon.

Gold prices turn downward.

Reference: Reuters