According to preliminary statistics from the General Department of Customs, Vietnam’s coal imports in February 2024 reached 4.2 million tons, equivalent to 614.6 million USD, down 17.8% in volume and 8.3% in value compared to the previous month.

In the first 2 months of the year, imports of all kinds of coal reached over 9.2 million tons, with a value of over 1.28 billion USD, an increase of 95.9% in volume and 60.5% in trade value compared to the same period in 2022. The average import price for the first 2 months was 138.6 USD/ton, a decrease of 17% compared to the same period in 2022.

Due to the sharp price decline, Vietnam is actively importing this item from many markets. In which, China is struggling with increasing coal surplus. The reason is due to a sharp increase in domestic production and a surge in imports, flooding the market with this item. Vietnam has quickly seized this opportunity to import.

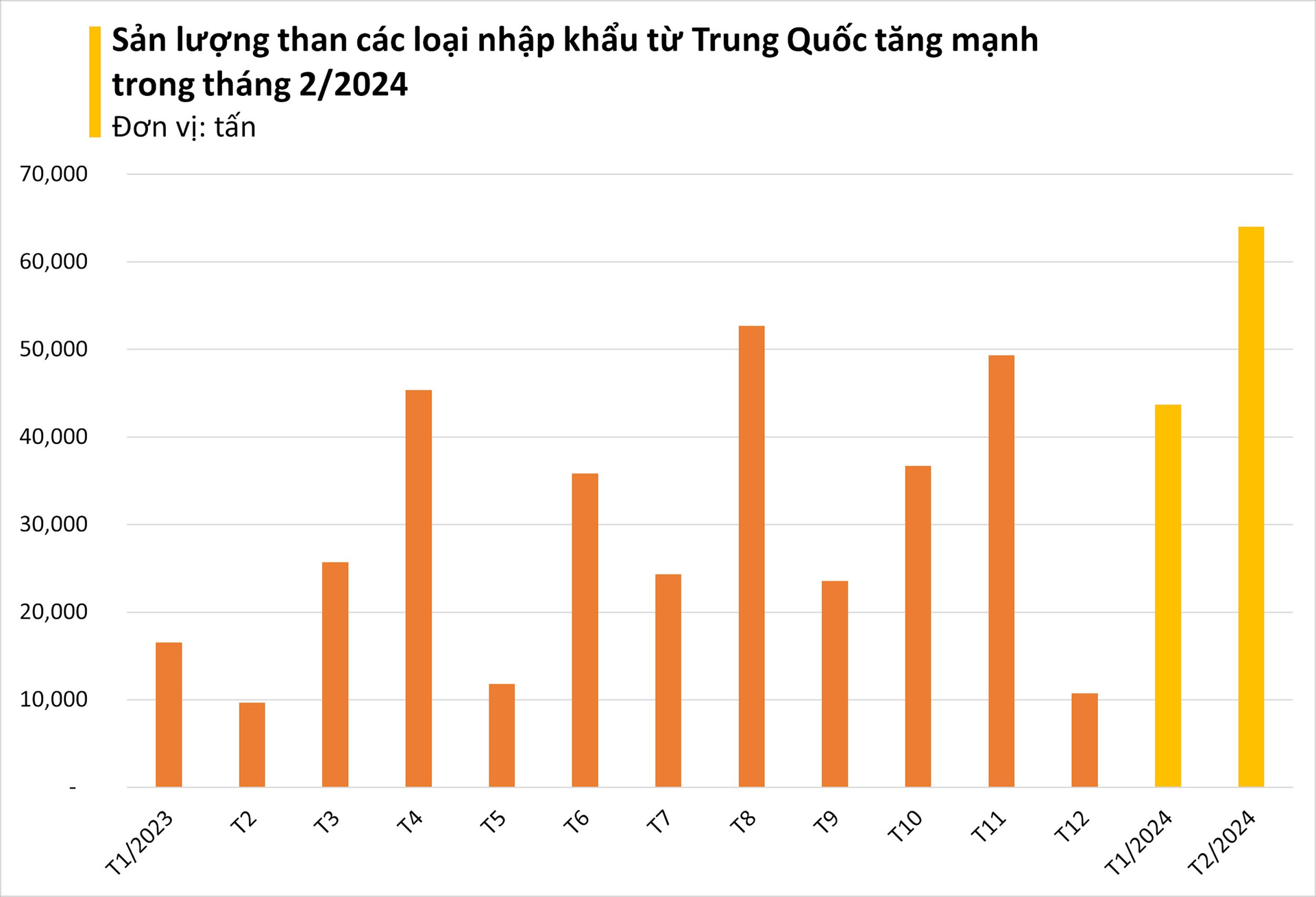

Specifically, imports of all kinds of coal from China reached 20,605 tons with a trade value of over 5.8 million USD, an increase of 113% in volume and 38% in trade value compared to February 2023.

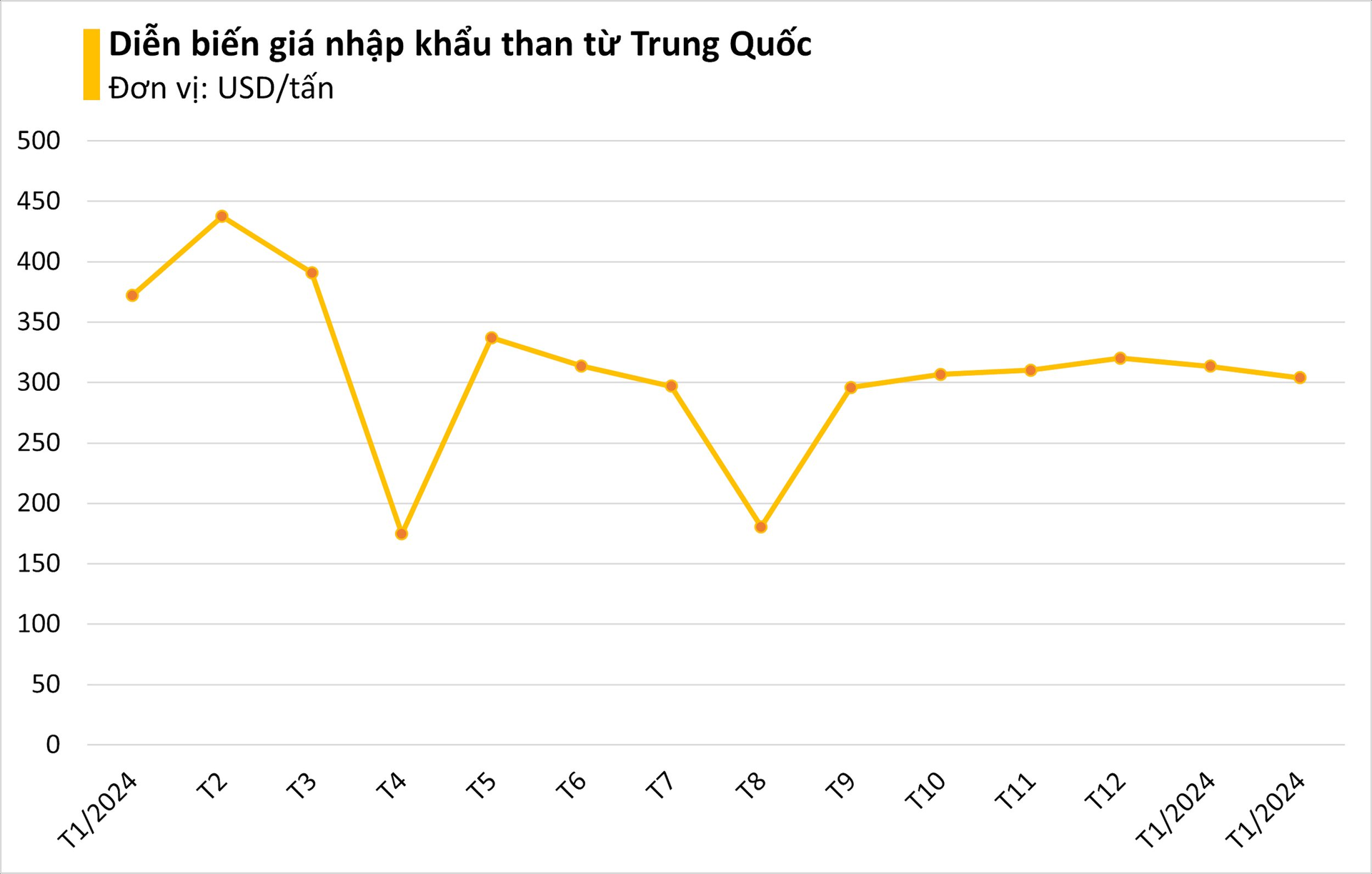

In the 2-month period, imports of this item from the populous country reached over 64 thousand tons with a trade value of over 19.46 million USD, an increase of 152% in volume and 94% in trade value compared to the same period in 2023. The average import price in 2023 reached 304 USD/ton, a sharp decrease of 23.2% compared to the same period in 2022. This is the sharpest decrease in import price among all coal supply markets for Vietnam.

China has increased coal production since the 2021 power crisis to avoid a recurrence of this situation. China’s coal imports increased rapidly in 2023, up 61.8% compared to the previous year, reaching 474.42 million tons. Demand growth has also slowed in the context of China’s difficult economic recovery.

The price of thermal coal transport by sea also decreased sharply in 2023, making this type of coal more competitive than the domestic mining sector, which had to increase rapidly to meet the increasing demand for electricity.

But it is the increase in imports that has put the market in a more serious imbalance.

“The flood” of coal marks a major turning point from this period 2 years ago. At that time, the fuel shortage led to widespread power cuts, causing damage to businesses and households. This is unlikely to happen when the coal supply is abundant, although the government is still vigilant about the risk in some areas.

The average coal price is forecasted to reach 5,500 kcal/kg at the northern ports of China and continue to decrease to 850-950 Chinese yuan/ton in 2024, from an average of 970 Chinese yuan/ton last year. China is currently building a stockpile of 600 million tons of coal to balance supply and demand and control price fluctuations in the market.

China’s record imports and the unexpected increase in exports from the second largest coal importer, India, have helped balance the coal market in 2023. India’s imports are expected to decrease in 2024 for the first time since the 2020 pandemic. Profits of the top 10 coal-fired power plants in China increased to 18.3 billion NDT in 2023.