Services

After the remarkable business growth in 2023, shares of Techcombank (HOSE: TCB) have become a sensation in the stock market at the beginning of 2024 with strong gains. Several notable highlights have been highlighted, including impressive business results with a profit before tax of VND 22,888 billion – exceeding the annual plan. Criteria such as Capital Adequacy Ratio (CAR), CASA, customer growth, fee income ratio to total income, ROAE… continue to maintain the top position among banks in Vietnam. It is noteworthy that Techcombank is expected to propose a cash dividend payout of at least 20% of post-tax profit each year. Let’s decipher the reasons behind the skyrocketing growth of TCB.

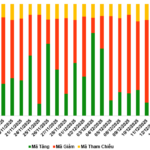

ATTRACTING NEW CUSTOMERS

(Unit: million customers)

In 2023, Techcombank attracted an additional 2.6 million new customers, double the number of new customers attracted in previous years. In which, the collaboration between Techcombank and Masan to create the Winlife ecosystem has helped the bank gain approximately 1 million new retail customers, while the digital channel has attracted 1.2 million customers. The number of new SME customers in 2023 also increased by more than 50% compared to 2022.

In 2023, Techcombank attracted an additional 2.6 million new customers, double the number of new customers attracted in previous years. In which, the collaboration between Techcombank and Masan to create the Winlife ecosystem has helped the bank gain approximately 1 million new retail customers, while the digital channel has attracted 1.2 million customers. The number of new SME customers in 2023 also increased by more than 50% compared to 2022.

This unprecedented growth in the number of customers marks Techcombank’s rapid penetration into new segments, including the mass market segment and the high-income segment, supported by digital capabilities and ecosystems of partners.

Currently, Techcombank owns one of the most digitized customer files of any bank in the world. About 94% of transactions by individual customers are conducted online, and the bank’s digital banking platform records over 50 logins per customer per month.

To increase understanding of customers as well as enhance the digital service experience, Techcombank has made strong investments to establish Adobe’s Experience Cloud platform, allowing for super personalized experiences, with marketing campaigns, content, and messaging tailored to each customer.

DIVERSIFY INTO NEW SEGMENTS AND INDUSTRIES

Efficient digitization and cost and risk control at checkpoints are the driving forces for Techcombank to confidently step into 2024 despite the challenging economic context.

According to Techcombank, business activities on the bank’s digital platform recorded an amazingly efficient CIR (cost-to-income ratio), with costs being up to 14% lower than branch channels. Meanwhile, at Techcombank Securities Joint Stock Company (TCBS), thanks to the application of technology and digitization to most processes, the cost to serve one customer is now only about $20, compared to more than $300 in 2016, creating strong room for the company’s scale expansion.

The emergence of the digital and big data revolution has created new opportunities. According to bank leaders, Techcombank’s data and digitization capabilities, built up over the past decade, are helping the bank establish a pioneering position to capture new growth opportunities in expanded customer segments.

SMALL AND MEDIUM ENTERPRISES: THE “TRUMP CARD” FOR GROWTH JOURNEY OF 2024

Another important area of growth for Techcombank is the small and medium-sized enterprise (SME) segment. In 2023, Techcombank attracted more new SME customers by more than 50% compared to 2022. At the same time, the bank focused on launching and improving its products and services, helping customers solve “headaches” in business such as how to efficiently collect and manage money, how to optimize idle cash flows, and gain quick access to loans to not miss out on business expansion opportunities.

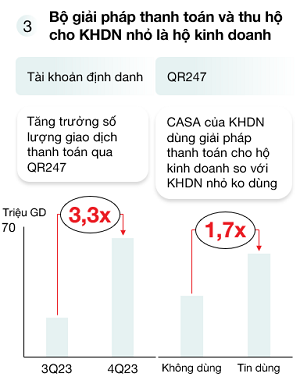

According to Techcombank, with over 5 million business households across the country, this is a very dynamic segment of the Vietnamese economy, contributing over 30% to GDP. Understanding the difficulties in managing cash flows of individual business households, Techcombank deployed appropriate payment and collection solutions for business households in 2023, including payment services through convenient QR code scanning method and the new Account Identification feature.

According to Techcombank, with over 5 million business households across the country, this is a very dynamic segment of the Vietnamese economy, contributing over 30% to GDP. Understanding the difficulties in managing cash flows of individual business households, Techcombank deployed appropriate payment and collection solutions for business households in 2023, including payment services through convenient QR code scanning method and the new Account Identification feature.

With this solution, store owners can create additional QR codes for multiple selling points. All transactions received via QR codes will be reported separately for each selling point, helping store owners easily separate personal and store funds. Each transaction through the QR code will be automatically reported on both the Techcombank Mobile and Techcombank Business applications, helping store owners easily track the total number of transactions and total revenue on a daily/weekly/monthly basis for each store with visual charts.

The number of transactions through QR code payment method of business households has increased 3.3 times in the fourth quarter compared to the third quarter, attracting business households to choose Techcombank as their main transaction account. This can be clearly seen through the average CASA balance of this customer group, which is 1.7 times higher than the average CASA balance of regular transaction customer group who have not used this solution. A similar payment and collection solution has also been provided to individual micro-business customers, helping the number of customers in this segment using Techcombank’s services increase 2.6 times compared to the third quarter, reaching 327,000 customers by the end of 2023, including 187,000 new customers.

A product that is highly favored by business customers is the Bao Loc deposit certificate, which has been integrated into the digital channel in 2023. With attractive profitability and easy transfer anytime, anywhere, the Bao Loc deposit certificate helps businesses optimize the return on idle cash. In addition, the convenience and smooth experience of online transactions without incurring any transaction costs for customers owning Bao Loc deposit certificates are also a plus point for this solution, attracting acceptance from businesses.

|

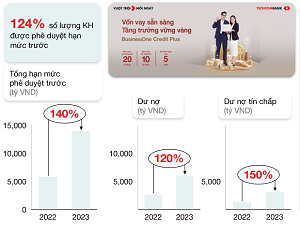

Another aspect is high competition and great volatility, so businesses that want to timely seize opportunities to increase sales need to arrange immediate funding sources when there are business expansion opportunities. Understanding this, Techcombank has focused on researching and applying big data processing capabilities and artificial intelligence to develop an automatic credit model, allowing the bank to assess the creditworthiness of a series of SME customers, thereby confidently approving available credit limits for customers with good creditworthiness.

In 2023, the total number of SME businesses approved with pre-approved credit limits increased an impressive 124% compared to the same period last year. The total pre-approved credit limits for small and medium-sized businesses increased by 140%, while actual disbursements under this program increased by 120% compared to the same period. Unsecured loans for small businesses have increased by 150% compared to 2022. With the goal of helping businesses “not miss out on good business opportunities just because of a lack of capital,” Techcombank will continue to promote programs that lend with pre-approved credit limits for small and medium-sized businesses in 2024.

Lending to small and medium-sized businesses is a field with a lot of room for development because of the large number of small and medium-sized businesses operating in Vietnam and the dynamic nature of the economy. Enhancing lending to this segment not only brings in new revenue for Techcombank but also contributes to the comprehensive financial goals, making it easier for small and medium-sized enterprises to access loans and seize growth opportunities.

FOCUS ON SERVING TARGET CUSTOMER SEGMENTS, RATHER THAN COMPETE ON PRICE

For many years, Techcombank has established a solid position by choosing the main segment as individual customers with decent and high income, along with leading reputable corporations in Vietnam leading the market in target segments.

In the retail banking sector, the bank does not compete on price, but chooses to provide quality services at costs that are appropriate for financial solutions that are “tailor-made” to the individual needs of each customer. Techcombank currently holds over 50% of the high-income customer market share in Vietnam. In this retail banking portfolio, this segment accounts for half of the operating revenue. For this priority portfolio of customers, Techcombank is not just a service provider but also plays the role of a wealth management advisor, helping customers increase wealth accumulation as well as prosperity for themselves and their families.

Similarly, in the Corporate and Financial Institution Banking sector, Techcombank has built strategic partnerships with leading corporations in Vietnam. In the Real Estate – Construction sector, the bank has developed relationships and professional services across the entire value chain from investors, project developers, project implementers, and building material suppliers… to home buyers. Bank leaders share that the ability to build deep, solid relationships and high professional expertise in financing value chains for reputable projects in Vietnam is a strength and an “invaluable asset” that Techcombank has accumulated over decades. With that success, Techcombank is gradually expanding this approach across different economic sectors. A typical example of applying this strategy in a new industry is the “Winlife” project in collaboration with Masan, bringing Techcombank’s innovative payment solution and attractive reward programs to millions of customers through a network of over 3,000 Winmart convenience stores nationwide. When accessing value chain, the deep relationship between the bank and key customers of the chain becomes the foundation, from which the bank develops a comprehensive solution set to meet payment, credit, and investment needs… for all participants in the value chain, from suppliers to end consumers.

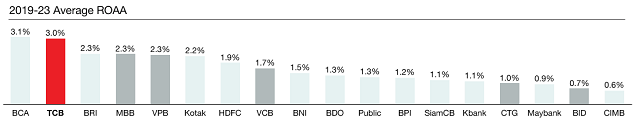

Thanks to a deep understanding of and trust between the bank and members of the value chain, Techcombank can access the best customer files, creating differentiated value in the market. This has helped the bank maintain top asset quality with virtually zero bad debts for the corporate customer portfolio, while establishing a strong position with over 50% market share in the high-end individual customer segment. The close relationships based on this understanding and trust between the bank and all members of the value chain help minimize risks and increase cooperation opportunities among all parties. This is one of the factors that has helped Techcombank continuously maintain the ASEAN market leader in ROA over the years.

This is an important differentiating value that other banks find difficult to replicate, helping attract new customers and enabling the bank to better meet the housing needs of customers as it continues to be the most preferred asset channel for Vietnamese people and creates the most attractive profit margin segment. Therefore, dominating the absolute advantage in this segment helps Techcombank continuously maintain the leading ROA in the ASEAN market over the years.

ROA of Southeast Asia & India banks with book value over 3 billion dollars during the 2019-2023 period (except BPI and CIMB which are 2019-2022 figures due to 2023 data not yet updated)

|