Services

Strong growth in money “waiting” to participate in economic activities

CASA (Current Account Savings Account) is defined as non-term deposits. This is the type of deposit that customers actively keep at banks for regular payments and receive very low non-term interest rates.

If a year ago, high interest rates were the main reason for the decline in CASA in the entire market, banks were struggling with the “double challenge” that increased capital costs, then 2024 is forecasted to be the year when banks will have “double advantages” to improve capital costs. Since the second half of 2023, the declining interest rates have narrowed the difference in profit margins between term and non-term deposits, at the same time promoting the business activities of the economy, the stock market has become more active when capital costs have become “easier” and businesses have positive business prospects. The volume of money “waiting” to participate in economic activities increased, causing the CASA balance of the entire industry at the end of 2023 to increase by ~25% compared to the end of 2022 (according to the financial statements of listed banks). Statistics according to the financial statements of 27 banks show that many banks have recorded impressive CASA growth in 2023. Over half of the banks surveyed have improved this ratio compared to the end of 2022.

Along with that, analysts believe that loosening macro policies will be the dominant trend this year. On February 7, 2024, the State Bank of Vietnam issued a written request for credit institutions to continue implementing instructions on interest rates, and report the situation of average lending interest rates, the difference between deposit and average lending interest rates.

Which bank will seize the CASA throne in 2024?

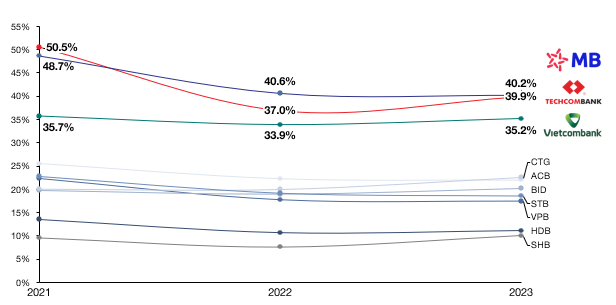

In recent years, the majority of banks have identified increasing the CASA ratio as one of the important objectives in business operations. Banks that are able to maintain and excel in CASA will have an advantage to overcome market difficulties and challenges. That is why the competition to increase CASA is becoming more intense, especially when most commercial banks have exempted digital banking services. According to the 2023 banking business results report, the Top 3 CASA ratios are still led by MB Bank, Techcombank, and Vietcombank, in which the difference between the champion and runner-up in this race is only 0.3 percentage points (between 39.9% and 40.2%).

CASA ratio in the 2021-2023 period of the top 10 banks by total assets

|

According to forecasts, the CASA index of banks often tends to decrease slightly in the early months of the year, related to the consumption and investment cycle of both individual and corporate customers at the end of the year. However, the CASA recovery momentum will usually return in the following quarters. A eagerly anticipated question is which bank will have the strongest breakthrough in the CASA race in 2024?

Looking back at the business results in 2023, as well as the ability to attract CASA, this race is probably still led by the 2 most potential candidates, MB Bank and Techcombank.

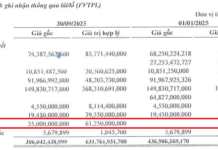

When considering the ability to attract CASA in the context of the economy becoming less difficult and market liquidity returning, Techcombank is emerging with a dramatic transformation when the CASA balance has increased by 37% compared to the beginning of the year, from VND 132.5 trillion to VND 181.5 trillion. Meanwhile, CASA of MBB also increased by 16.4%, from VND 180.2 trillion to VND 228.1 trillion.

Pioneering solutions for digital transformation, promoting CASA

So what has helped Techcombank become such a strong CASA attraction machine in the past year?

|

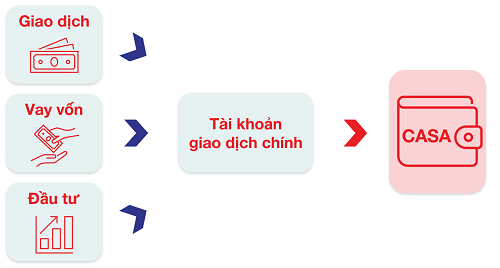

According to the bank’s leaders, Techcombank focuses on three important customer needs: transaction needs, loan needs, and investment needs. When customers are satisfied and trust to use payment services, credit products, and investments at Techcombank, the transaction account at Techcombank will become the main transaction account and money will regularly circulate through it. Money that keeps moving is CASA, while remaining money is term deposit.

Along with that, the bank also leads in digital transformation to provide customers with superior experience and service quality – a key factor in promoting CASA. In January 2024, Techcombank once again affirmed its pioneering position in the banking industry with the launch of a breakthrough product called Auto Earning. The product is designed to help customers optimize their idle money and receive attractive interest rates. The difference with Auto-Earning lies in its simplicity, convenience, and time-saving for customers, as users only need to activate the “automatic interest-generating” mode on the Techcombank Mobile application. Therefore, Auto Earning is expected to be a powerful assistant for customers on their financial journey, thereby helping Techcombank increase customer loyalty and indirectly improve the CASA balance.

In 2023, the bank implemented payment and collection solutions (based on QR247 and identity account methods) for all customer segments from large corporate customers to small and medium-sized enterprise customers, and individual customers with business activities. This solution helps them not only make convenient payments but also efficiently manage each transaction and cash flow in a simple manner. Customer files using Techcombank’s payment-collection solution have recorded increased CASA balances compared to before and are much higher than the group of customers in the same segment who have not used this solution. Among them, small business customers using Techcombank’s payment-collection solution have recorded an average CASA balance that is 1.7 times higher than other small business customers.

Similarly, special loan products, especially flexible and convenient online loans, also encourage customers to focus their funds at Techcombank as their primary transaction account. The application of automatic credit models helps the bank accelerate the pre-approval capacity for small and medium-sized enterprise customers while ensuring strict risk control.

Techcombank has also continued to be honored by international card organizations such as Mastercard and Visa as the “leading bank in total card transaction volume” for the fourth consecutive time, affirming its position as the top choice to meet customers’ card transaction needs. All card services can be performed on Techcombank’s digital banking channel, from issuing new cards, reissuing cards, to managing automated card services… with the highest level of security, alongside other attractive benefits that are suitable for customers’ needs.