Anh Trần Văn Tiến (Hoàng Mai, Hà Nội) shares that when he saw the price of apartments increase sharply, at the end of 2023, he and his wife decided to buy a 70m2 apartment in Ngọc Hồi Street (Hoàng Mai, Hà Nội) for 2.7 billion VND. Just 3 months later, Mr. Tiến was surprised to see the selling price of similar apartments in the same project he just bought had increased by 300 million VND.

“Currently, apartments with similar location and size to the one I bought are being listed for sale at prices ranging from 3 to 3.1 billion VND. I was very surprised because when I bought this apartment, I thought the price was already quite high, but who would have thought that the price would continue to rise after the Lunar New Year,” Mr. Tiến said.

Similarly, Ms. Trần Nguyệt Minh (Hà Đông, Hà Nội) also made a profit of 200 million VND after a few months of investing in an apartment. In December 2023, she and her husband bought an apartment in Linh Đàm (Hoàng Mai, Hà Nội) with the intention of riding the market trend. At the time of purchase, the price of a 60m2 apartment was 2.6 billion VND. But now, her apartment has been offered to buy back for 2.8 billion VND.

Price of apartments continues to rise in early 2024. (Illustrative photo: Công Hiếu).

“While it is tempting to make a high profit, if I sell this apartment now, it will be difficult to buy a similar apartment at the same price. In the context of continuously increasing apartment prices, I have decided not to sell but to switch to renting, which gives me a monthly income and also increases the value of the asset over time,” Ms. Minh said.

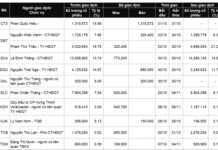

According to the latest report from PropertyGuru Vietnam on the real estate market in February 2024, in Hà Nội, the prices of high-end apartments (over 50 million VND/m2) and mid-range apartments (30-50 million VND/m2) continue to increase, by about 4% and 3% respectively compared to January.

According to data from the Vietnam Real Estate Brokers Association, the average selling price of primary apartments nationwide is currently high as all products launched on the market have prices above 40 million VND/m2. The market is completely devoid of affordable projects with prices below 30 million VND/m2.

Thus, the price level in all apartment segments, from affordable to mid-range and high-end, has been and is being re-established.

According to real estate experts, the recent increase in apartment prices is due to the continued scarcity of supply in this segment. In addition, low interest rates for loans and deposits have led to a “hot market” for apartment purchases.

Expert Nguyễn Quốc Anh believes that Hà Nội’s urbanization rate is currently about 51%, which means Hà Nội needs about 70,000 apartments per year to solve the housing problem for laborers. However, the actual supply to the market is much lower than the demand. Mr. Quốc Anh predicts that apartment prices will continue to rise this year.

Nguyễn Văn Đính, Chairman of the Vietnam Real Estate Brokers Association, also analyzed that the buying, selling, and renting prices of apartments have been continuously increasing over the past time, breaking the stereotype that investing in apartments is “uneconomical”. Previously, most investors believed that apartments were a type of investment that did not generate profits, only losses, and choosing residential land was the optimal solution because of its easy liquidity and high profit potential.

However, currently, investing in apartments and then renting them out has become a popular trend in major cities because it not only provides a steady income from monthly rentals – higher than savings interest rate, but also benefits from the potential for price appreciation.

Chairman of the Vietnam Real Estate Brokers Association believes that rental prices will continue to increase, but at a slower pace. The prospects of the apartment market are becoming clearer as production and business activities are gradually fully recovering, leading to a high demand for housing in major cities.