Targeting 10% Asset Growth, 43% Profit Growth in 2024

With high consensus, the General Meeting of Shareholders has approved the 2024 business plan with total assets of VND 54,500 billion and pre-tax profit of VND 585 billion, representing a 10% and 43% increase, respectively, compared to 2023. This target reflects the efforts and determination of EVNFinance in ensuring benefits for customers and shareholders in the context of anticipated economic challenges in 2024.

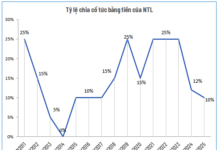

The General Meeting also approved important contents such as the 2023 profit distribution plan; the plan to pay dividends by shares from the 2023 profit; the plan to issue shares to employees to increase charter capital; the revised maximum foreign ownership ratio; the restructuring plan associated with bad debt resolution from 2021 to 2025; and the amendment of the Company’s Charter and some regulations.

EVNFinance aims to increase profit by 43% in 2024

Another noteworthy content approved by the General Meeting is the selection of the ESG-based development strategy of EVNFinance (Environment – Society – Governance) in its business operations. This means that EVNFinance seeks to strike a balance between economic development and environmental and social objectives, aiming to become a responsible financial company.

Accordingly, EVNFinance will focus on sustainable development management, sustainable risk management, and contribute to society, the community, and the environment through responsible business products.

EVNFinance will consistently pursue two important objectives: green finance development by financing clean energy and renewable energy projects, and using digital technology as a platform to develop financial services products that provide customers with enhanced experiences.

It is worth noting that the development of digital-based services has proven highly effective and increasingly contributes to EVNFinance’s business performance. With leading partners such as MoMo, Viettel…, EVNFinance’s disbursement scale for these products in 2023 increased by 43% compared to the previous year and is predicted to show positive growth in the near future.

General Meeting approves important content with high consensus

Sustainable Growth in Challenges

In 2023, EVNFinance achieved positive profit results in a consumer credit market with significant fluctuations. Its total assets reached VND 49,221 billion, an increase of 17% compared to 2022, and its pre-tax profit reached VND 409.3 billion.

The safety indicators continue to be maintained stably, with a bad debt ratio of 1.08%, much lower than the below 3% level according to the regulations of the State Bank. The capital adequacy ratio (CAR) stood at 18.29%, higher than the minimum requirement of 9%. Moreover, EVNFinance’s cost management has been steadily improving, with the cost-to-income ratio (CIR) in 2023 reaching 27.16%, which is 5% lower than the 28.6% of 2022.

EVNFinance completes the capital increase to VND 7,042 billion (equivalent to a 100% increase)

In 2023, EVNFinance successfully achieved a particularly important target of increasing its charter capital to VND 7,042 billion (equivalent to a 100% increase) and recorded a surplus of equity, reaching VND 350.5 billion for the first time. The increase in charter capital and surplus equity helped EVNFinance enhance its proactive use of capital, improve financial ratios, and especially the CAR.

To strengthen its financial and management capacity, EVNFinance has been and is expanding cooperation with financial investors and foreign investors that are suitable for its operational and management practices.

These conditions have helped EVNFinance achieve a B2 – Stable Outlook rating for the third consecutive year in 2023, as rated by Moody’s based on the Company’s significant improvement in capital and liquidity, which has greatly improved the quality of assets.