Closing BHXH after 42 years and 2 months, at the beginning of 2024, when receiving a monthly pension decision, Mr. Nguyen Tuan Huan (born in 1963; residing in Binh Chanh district, Ho Chi Minh City) was in shock. According to his calculations, the minimum pension he would receive would be around 4.5 million dong/month, but in reality, it was only slightly more than 3.3 million dong.

Disappointed!

Mr. Huan said that he worked as a teacher, then a vice principal, and finally a principal at several elementary and middle schools in Bac Lieu province from September 1981. The salary coefficient for his salary grade was 4.32. On January 31, 2008, he received a retirement decision and had been waiting to receive retirement benefits.

At that time, according to regulations, the retirement age for male workers was 60 and they had to have paid social insurance for at least 20 years. Mr. Huan had paid social insurance for 26 years and 6 months, but he was only 45 years old, which was not enough in terms of age and did not reach the maximum pension rate of 75%.

To be eligible for the maximum retirement rate during the waiting period, Mr. Huan took a job as a security guard at Isuzu An Lac Auto Service Company (a branch of Saigon Mechanical Transport Company) and continued to pay social insurance. At this company, his salary for social insurance contributions was divided into two stages.

From May 2008 to December 2015, the unit based his social insurance payments on the salary coefficient (salaries determined by the state) from 1.99 to 2.4. From January 2016 to December 2023, the unit changed the salary scale and adjusted the social insurance payments according to the salary regime determined by the employer, with payments ranging from 4.9 million to 6.5 million dong/month.

Mr. Nguyen Tuan Huan was disappointed when receiving a pension of only over 3.3 million dong/month

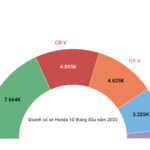

When calculating the pension, the average monthly salary for social insurance contributions was based on the general average for the entire period according to the salary regime determined by the state and the employer. However, due to the low average salary for social insurance contributions during the last 5 years, his pension, with a maximum rate of 75%, was only 3,365,129 dong/month.

In addition, Mr. Huan also received a one-time allowance of 16,825,643 dong for the surplus contributions upon retirement, equivalent to 7.5 years of contributions. The current pension is not enough to support himself, not to mention that he still has to support his nearly 90-year-old parents, so he is quite disappointed.

Mr. Huan believes that if he had stopped paying social insurance in 2008, by the time he reached retirement age, his pension would certainly be higher than the current amount because his salary coefficient for the last 5 years was high (ranging from 3.1 to 4.32). Not to mention, with the change in retirement age policy and the increase in the number of years of social insurance contributions required to receive the maximum rate from 30 to 35 years, he was disadvantaged by having to extend his working age and pay social insurance for an additional 5 years. Furthermore, his one-time allowance upon retirement also decreased, from 12.5 years of surplus contributions to only 7.5 years.

“When making changes to the social insurance policy, the authorities need to calculate and consider carefully to avoid compromising the rights and benefits of workers,” Mr. Huan expressed his wish.

Is paying more equivalent to paying less?

According to Mr. Tran Thanh Son, Head of Administration and Personnel Department of Song Ngoc Garment Company (Binh Tan district, Ho Chi Minh City), the current pension calculation method is still inadequate. This is reflected in the fact that the longer the contribution period, the higher the pension, but the difference is insignificant, or even lower.

To illustrate this point, Mr. Son used his own social insurance contribution history to make calculations. According to that, he had 42 months of social insurance contributions in the military (from February 1984 to July 1987); starting from January 1996, he paid social insurance according to the regime determined by the employer (contributions ranging from a minimum of 350,000 dong to a maximum of 18 million dong/month).

If he continued paying social insurance at the current salary level (18 million dong/month) until July 2029, when he reached retirement age and had 35 years of contributions (entitled to a maximum rate of 75%), if calculated based on the entire contribution period, his pension would be 6,211,833 dong/month. However, if only the contributions of the last 20 years were taken into account (from August 2007 to August 2029), corresponding to a 45% pension rate, his pension would be 6,010,723 dong/month. Moreover, if only the contributions made during his 31 years of service in the enterprise sector were considered (from January 1996 to August 2029), with a retirement rate of 69%, his pension would be 6,147,157 dong/month.

The results show the inconsistency when there is a 15-year difference in social insurance contributions (corresponding to a 30% pension rate), but the difference in pension is only slightly more than 200,000 dong/month; a difference of 11 years in contributions results in a pension that is only about 136,000 dong/month higher; and an additional 4 years of contributions results in a pension that is only slightly more than 64,000 dong/month higher.

According to Mr. Son, the reason for this situation is that the social insurance contributions in the early years were low but the adjustment coefficients did not match the sliding price scale. For example, the social insurance contribution based on his salary in September 2003 was 350,000 dong/month, and the gold price at that time was 704,000 dong/ti-chi (tael). If multiplied by the social insurance sliding price scale announced by the state (in 2023), corresponding to 3.46, the social insurance contribution based on the salary in 2003 would be 1,211,000 dong/month, while the gold price in September 2023 had increased to about 6.8 million dong/ti-chi.

“The pension benefits do not match the currency depreciation, which will make workers worried and calculate their losses. As a result, they may choose what is deemed most advantageous, including stopping the social insurance contributions to retire early. Therefore, in addition to adjusting the social insurance contribution level, we need to recalculate the sliding price scale to ensure that workers see the long-term benefits of participating in social insurance,” Mr. Son suggested.