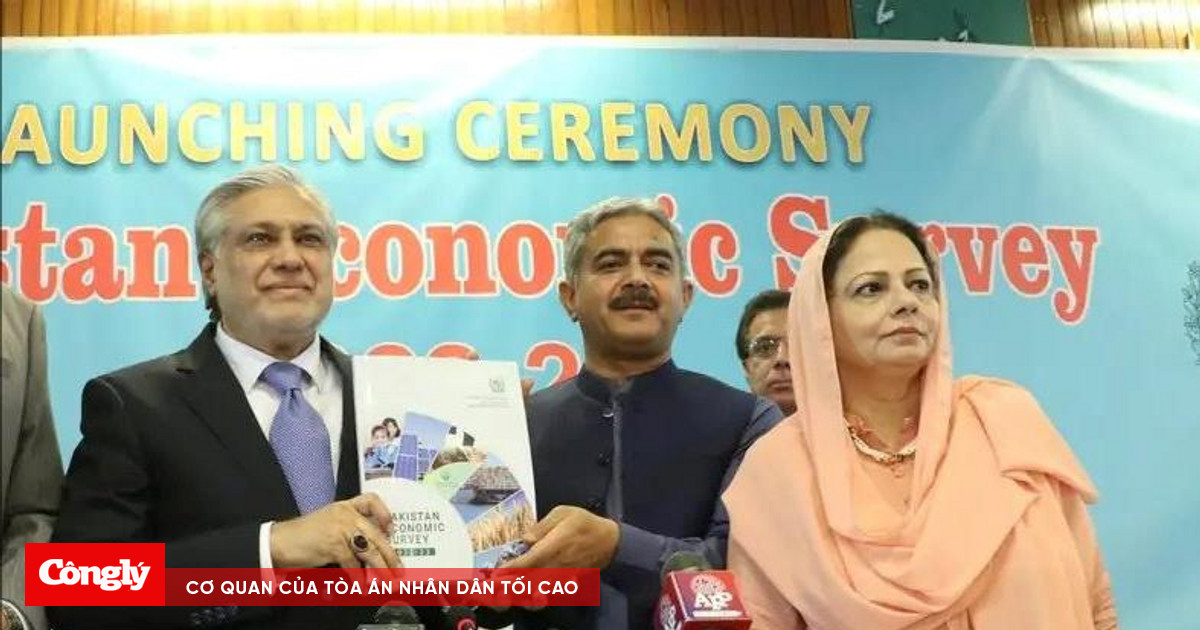

The International Monetary Fund (IMF) has requested the Federal Board of Revenue (FBR) of Pakistan to impose capital gains tax (CGT) on cryptocurrency investments as a condition to receive $3 billion from the bailout fund.

The IMF also recommends Pakistan to adjust the tax rate on capital gains for real estate and listed securities. Additionally, property developers may have to adhere to stricter monitoring and reporting requirements, accompanied by hefty penalties for non-compliance, and ultimately the enforcement of new tax regulations in the real estate market.