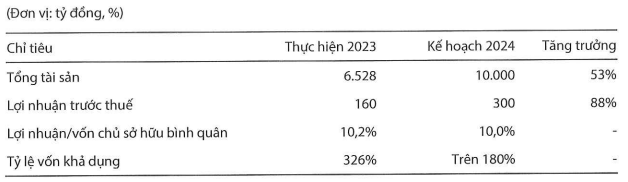

In which KAFI plans to hold the Annual General Meeting of Shareholders in 2024 reaching a pre-tax profit of 300 billion VND, up 88% compared to the previous year. Total assets at 10,000 billion VND, an increase of 53%. Return on Equity (ROE) is 10% and the target of available capital ratio is over 180%.

|

The 2024 Business Plan of KAFI Securities

Source: VietstockFinance

|

Looking back on 2023, KAFI stated that this is the second year of a new phase of business strategy transformation, expanding its presence in the Vietnamese financial market. The company achieved notable business results with operating revenue reaching 484.6 billion VND, more than 4 times the previous year; and profit after tax reaching 128 billion VND, more than 6 times the previous year.

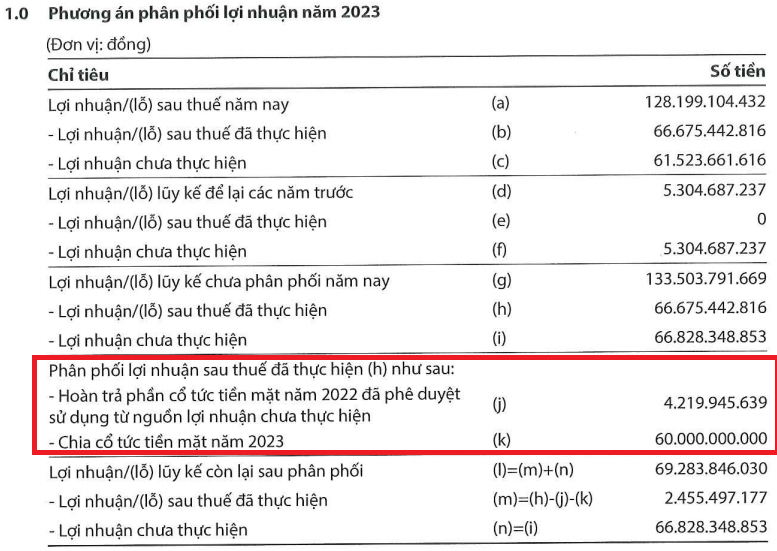

According to the documents of the AGM, KAFI also plans to propose a profit distribution plan for 2023, including 4.2 billion VND for cash dividends for 2022 approved from unrealized profits and 60 billion VND for cash dividends for 2023.

Source: KAFI Securities

|

With regard to the activities of the Board of Directors in 2023, the document states that the Board of Directors has completed the majority of the contents and resolutions approved by the AGM, but due to many objective reasons, 2 resolutions have not been implemented.

Firstly, the proposal to change the registered office address in an expanded direction, supplementing a part of the ground floor at Sailing Tower as a trading location for customers; and secondly, the proposal to approve the adjustment of charter capital in the second phase, supplementing derivatives securities business. The Board of Directors will update the progress of these contents to the AGM at the latest annual meeting.

Regarding the above-mentioned increase in charter capital plan, on March 13, the State Securities Commission announced that it had received a registration file for the sale of shares to existing shareholders of the company.

Accordingly, KAFI plans to offer 100 million shares to existing shareholders through the exercise of rights. The exercise rate is 3:2, with shareholders owning 1 share entitled to 1 right to purchase, and 3 rights to purchase enabling the purchase of 2 new shares. The offering price is 10,000 VND/share, and the plan will be completed before April 30, 2024.

The entire amount, estimated at 1,000 billion VND, will be allocated for 4 purposes, including: Supplementing capital for brokerage activities, with a distribution ratio of 25%; Supplementing capital for proprietary trading with a distribution ratio of 35%; Purchasing technical equipment, investing in technological application development, developing products and services, with a distribution ratio of 30%; and supplementing capital for underwriting securities issuance, expanding the business network, and other operational costs with a distribution ratio of 10%.

If successful, the company’s charter capital will increase from 1,500 billion VND to 2,500 billion VND.

|

The Annual General Meeting of Shareholders of KAFI Securities (KAFI) will be held on April 5th at Sofitel Saigon Plaza Hotel, 17 Le Duan Street, Ben Nghe Ward, District 1, Ho Chi Minh City. |