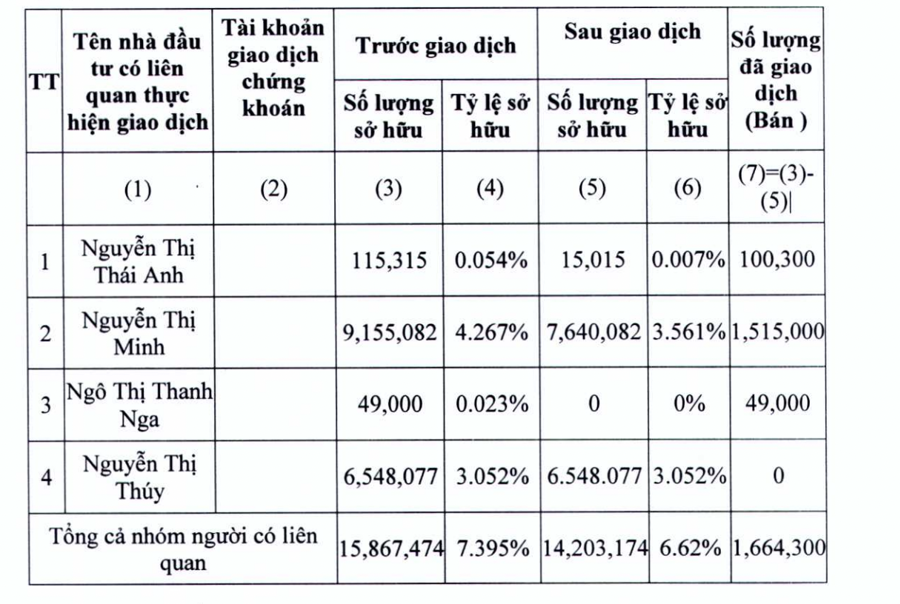

Specifically, according to the announcement, the shareholder group of Ms. Nguyen Thi Minh, including Ms. Minh and her two daughters Nguyen Thi Thai Anh, Nguyen Thi Thuy, and daughter-in-law Ngo Thi Thanh Ngan has just completed the sale of shares to restructure their investment portfolio.

Prior to March 13, this group owned more than 17.2 million FTS shares, equivalent to a total proportion of over 8%. Among them, Ms. Nguyen Thi Minh held the most with 10.47 million shares, equivalent to a ratio of 4.8869%, followed by her daughter Nguyen Thi Thuy with 6.5 million shares, equivalent to 3.05%. On March 23, this group sold 1.273 million shares, bringing the ratio down to 7.4%.

By March 15, this group reduced its ownership ratio to 6.62%, corresponding to the sale of 1.66 million shares.

After the sale, Ms. Nguyen Thi Minh reduced her ownership ratio to the current 3.56%, equivalent to the remaining shares after the transaction are 7.6 million shares.

During the above period, there were no recorded block trades in FTS shares, so it is likely that the transactions of Ms. Minh’s group were matched-orders. After the information on FTS’s value increase was announced, the stock price continuously rose sharply and reached a historical peak in the session on March 15 at 64,000 dong per share.

Based on the prices of 62,800 dong per share and 64,000 dong per share on March 13 and 15 respectively, it is estimated that this group received nearly 8 billion dong and more than 10.6 billion dong, totaling over 18.6 billion dong.

Prior to this, FPT Securities has issued documents for the 2024 Annual General Meeting of Shareholders with many important contents. The meeting is scheduled to take place on March 28, 2024 in Hanoi.

FPT Securities sets its revenue and pre-tax profit targets for 2024 at 845 billion dong and 420 billion dong, respectively, a decrease of nearly 8% and 18% compared to the previous year. The pre-tax profit to equity ratio dropped to nearly 18% from 24% in the previous year.

The above plan is built based on the actual situation in 2023 and the forecast of the domestic and international economy, as well as the stock market in 2024. Regarding the domestic economy, FPTS believes that 2024 could be a brighter year but still faces many difficulties and challenges for Vietnamese enterprises.

Regarding the stock market, liquidity and points in 2024 are expected to be supported by the low interest rate landscape and the Government’s focus on growth-stimulating policies. However, concerns about sharp exchange rate fluctuations will have a negative impact on the market; in addition, expectations for the new KRX system to officially operate. However, there will be no new products, and not many new stocks will be listed/traded on the market; competition in trading fees, margin interest rates among securities companies will be more fierce than before.

FPTS also presented a plan to issue additional shares from owner’s equity to existing shareholders at the Annual General Meeting of Shareholders. The expected number of shares to be issued is 85.8 million shares, equivalent to over 858 billion dong (at face value). The issuance ratio is 10:4 (shareholders owning 100 shares will receive an additional 40 new shares).

The capital source is derived from the undistributed after-tax profit as of December 31, 2023 in the audited financial statements for 2023, which reaches a maximum of over 858 billion dong.

FTS also plans to propose an ESOP issuance plan for management personnel of the Company at the 2024 Annual General Meeting. The expected number of shares to be issued is more than 5.5 million shares (nearly 2.58% of the total outstanding shares), with an issuance price equal to the face value of 10,000 dong per share. The source of implementation is from the employees’ contribution.

The ESOP shares issued will be restricted from transfer within 2 years, with gradual release as follows: 50% of the shares will be freely transferable after 1 year from the end of the issuance period, and the remaining 50% after 2 years from the issuance date.

The capital raised of over 5.5 billion dong will be balanced to supplement capital for lending and trading in futures.

Both of the above plans are expected to be implemented in the second and third quarters of 2024 after approval by the State Securities Commission. If successful, the Company’s equity will increase from over 2,145 billion dong to 3,059 billion dong.