After a credit card holder with a debt of 8.5 million VND failed to make a payment, nearly 11 years later, the bank reported a total debt of 8.8 billion VND. Many people have started checking their payment accounts and credit cards to see if they suddenly owe any debts.

Mr. Nguyen Vu (residing in Thu Duc District, Ho Chi Minh City) said that after the incident with the credit card holder, he became curious and checked his bank account.

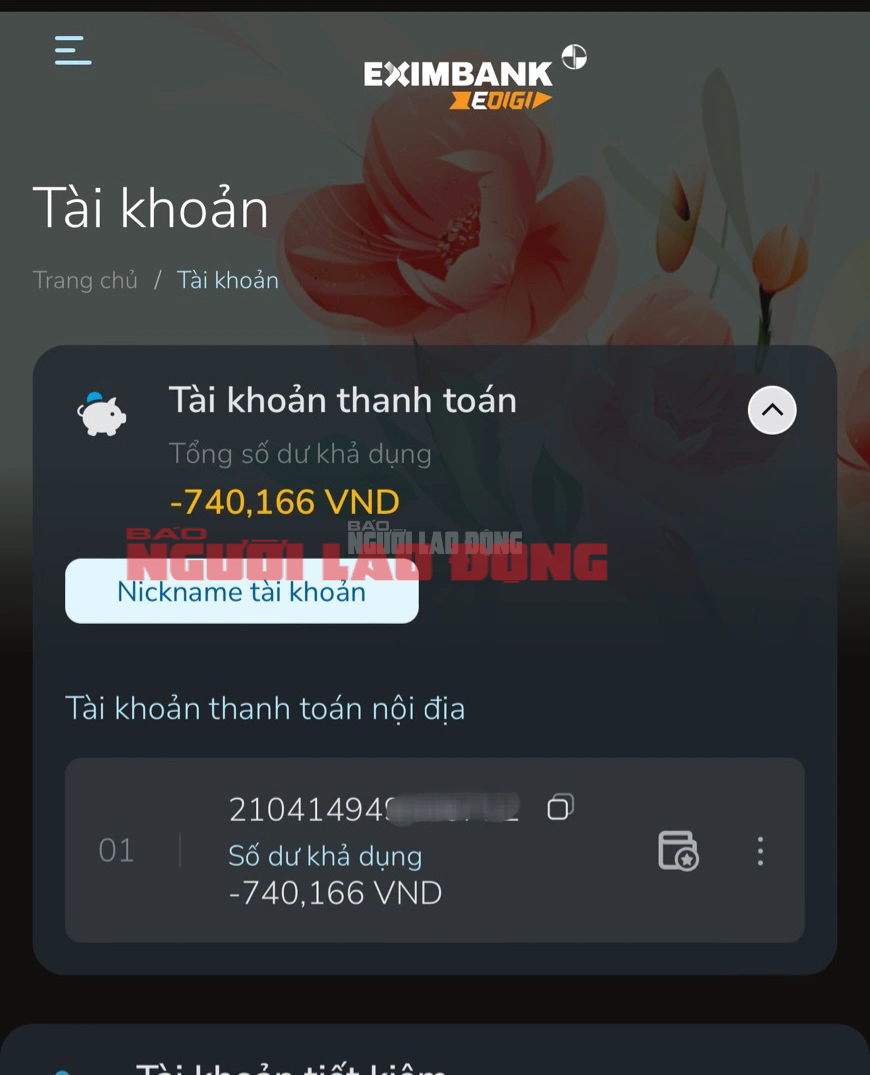

“The result is that my Eximbank salary account has not been used since 2021, and I see an overdraft of 740,000 VND. I was quite surprised because I’m not familiar with the regulations regarding account management fees, and since the agency transferred the salary to another bank, I haven’t paid much attention”, Mr. Vu said.

Not only Mr. Vu, but some colleagues in his organization and the readers also reported a similar situation with their Eximbank accounts. The account management fees continue to be charged even when there is no money left in the customers’ accounts.

Mr. Vu’s account is overdrawn by more than 740,000 VND after not being used for a few years.

It is known that in the schedule of account opening and management fees of Eximbank, the monthly fee for non-terms payment deposit accounts is 10,000 VND (charged when the average balance in the account is below 300,000 VND). This means that when customers do not use their accounts and the balance is below 300,000 VND, the bank will deduct a fee of 10,000 VND per month…

An Eximbank teller explained that if customers do not use their accounts, they should proactively close them, and the account closing fee (within 1 year from the opening date) is 50,000 VND.

According to the reporter’s research, the account management fee is the cost that customers have to pay monthly if they want to continue using the accounts and related services of the bank. In some banks, this fee is around 3,000 – 10,000 VND per month, while other banks do not charge it.

Ms. Ngoc Cam (residing in District 3, Ho Chi Minh City) said that because of the nature of her work, she uses many bank accounts. TPBank, VIB, and Dong A Bank, where she opened accounts, all charge this fee. At VIB, if the average balance in the customer’s transaction account exceeds 2 million VND per month, the account management fee for payment accounts opened at the counter will be waived. Otherwise, for balances below 2 million VND, a fee of 9,000 VND per month will be charged.

At TPBank, the account management fee is 8,000 VND per month. If the account has been inactive for 6 consecutive months, this fee will be reduced to 5,000 VND per month. OCB Bank charges a fee of 5,000 VND per month for account management if the balance is below the minimum level…

Some banks stated that even if the account has not been continuously active for less than 12 months and the balance is 0 VND, the account will not be locked. Many banks still charge account maintenance fees, regardless of whether the account has any transactions or not. Therefore, when there is no need to use the account, users are encouraged to close it with a fee of about 50,000 VND per account.

Similarly, with credit cards, annual fees are still charged regardless of whether the cardholder uses them or not. Therefore, customers are advised to close their card accounts if they have no need to use them.