Exchange rate increased by 1%, Vietnam Airlines lost 300 billion VND

At the conference on the implementation of monetary policy tasks in 2024 focusing on overcoming difficulties for production and business, promoting economic growth and macroeconomic stability held on March 14, Mr. Dang Ngoc Hoa – Chairman of the Board of Directors of Vietnam Airlines shared:

In the aviation industry, during the recent period, the COVID-19 period, the post-COVID-19 period, had a significant impact. However, Vietnam Airlines has gradually recovered its business operations.

Vietnam Airlines has proposed some suggestions regarding monetary policy. In particular, with regard to the exchange rate, Mr. Dang Ngoc Hoa stated: As Vietnam Airlines is an aviation industry, a 1% change in the exchange rate also costs us 300 billion, if it is 5%, then the cost will increase to 1.5 trillion annually. Vietnam Airlines hopes for a stable exchange rate at the lowest possible level.

Photo VGP/Nhat Bac

Due to the nature of Vietnam Airlines’ production and business activities, it has a large amount of borrowing and financial leasing to purchase aircraft and machinery and equipment, and to pay costs for foreign partners with high value, so the exchange rate risk of VNA mostly comes from the fluctuation of the USD/VND exchange rate.

According to Bao Dau tu (2021), with aircraft leasing costs being a large proportion of fixed costs, accounting for 14-16% of total costs (pre-Covid-19 period) and up to 31-32% in the period of 2020-2021 (Covid-19 period).

If we take into account the total cost of aircraft, the total cost of aircraft (including leased and owned aircraft) accounts for about 20-22% (pre-Covid-19 period) and increases to 37 – 42% in the period of 2020-2021 (Covid-19 period).

According to Tuoi tre newspaper, the cost structure of airlines is 70% in USD.

In the same conference, one person suggested the lowest possible exchange rate, while another person was distressed because the exchange rate made exports more expensive than competitors

Mr. Le Tien Truong, Chairman of the Board of Directors of Vietnam National Textile and Garment Group: Without support, we may lose the fiber industry. Photo VGP/Nhat Bac

Contrary to Vietnam Airlines, for export-oriented enterprises, the lower the exchange rate, the less competitive they are in the international market.

Also at the conference, Mr. Le Tien Truong, Chairman of the Board of Directors of Vietnam National Textile and Garment Group, compared the relationship between exchange rates of the domestic currency of textile and garment-exporting countries in the top 5 textile and garment-exporting countries in the world. In the years 2022 and 2023, after the COVID-19 pandemic and recovery, large textile and garment-exporting countries such as China, Vietnam, India, Bangladesh, and Turkey all tended to stimulate exports.

Mr. Truong said that the four countries used a fairly strong tool, which is reducing the exchange rate of their national currencies to boost exports. In the years 2022 and 2023, the country that reduced its currency the most was Turkey (by 50%); the second is Bangladesh, down 21% in 2 years, China down 11% from 6.2 yuan to 7.2 yuan, and Vietnam down more than 3%.

In terms of exchange rate relationship, in the years 2022 and 2023, Vietnamese textile and garment is generally more expensive than the top 5 countries by about 15%. That is also one of the reasons why textile and garment exports decreased by 10% in the two years 2022 and 2023, and Vietnam reduced the most among the top 5 textile and garment-exporting countries.

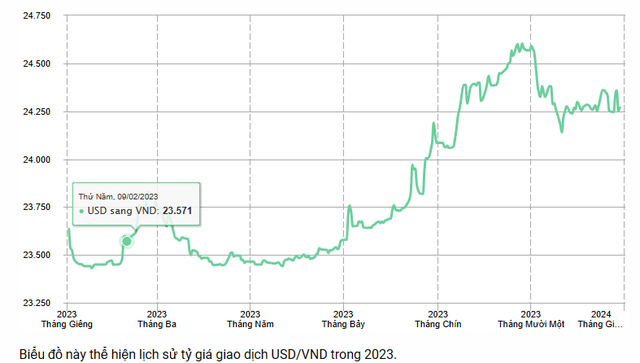

Exchange rate developments in 2023 and forecasts for 2024

According to a report by Arrow Capital (2023), the USD/VND exchange rate is assessed to still be within the active control capability of the State Bank of Vietnam. Part of the reason is due to significantly improved macroeconomic factors such as the total FDI capital realized increased by 2.4% compared to the same period in 2022.

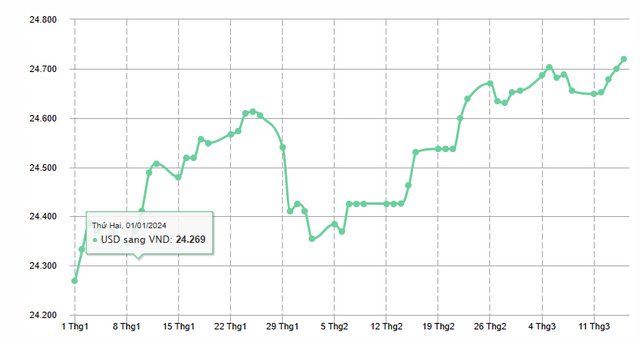

As of the end of 2023, the central exchange rate increased by 1.1%; the buying and selling exchange rate of USD at banks increased by 3.04% – 3.08%; the market exchange rate increased by 4.1 – 4.3%, according to data from WiGroup data company.

Source: exchange-rates.org

In January and February 2024, foreign exchange demand began to increase again thanks to the improvement in import and export activities, and accordingly, the exchange rate at the banking system continued to increase by about 1%.

In recent days, the exchange rate has continued to increase sharply. The central exchange rate of Vietnamese Dong against US Dollar announced by the State Bank of Vietnam for March 16, 2024 is 1 US Dollar = 23,979 VND. From the beginning of 2024 to now, the USD/VND exchange rate has increased by +1.85%.

In the future, the possibility of the VND depreciation will still exist. Exchange rate developments will largely depend on the foreign exchange supply at each specific period with factors under the control of direct and indirect investment capital, remittances.

With constant exchange rate pressures, VCBS predicts that the VND may depreciate by about 3% against the USD in 2024. The VND depreciation will also create pressure to increase government bond yields.

Source: exchange-rates.org