Fubon ETF has begun investing in the Vietnamese stock market as the stock investment frenzy took off in March 2021. With multiple capital injections, the Taiwanese giant is now the largest ETF fund in Vietnam with a total NAV of about 28.63 billion New Taiwan Dollar, equivalent to 22,220 billion Vietnamese Dong.

Restructuring of the Taiwanese giant

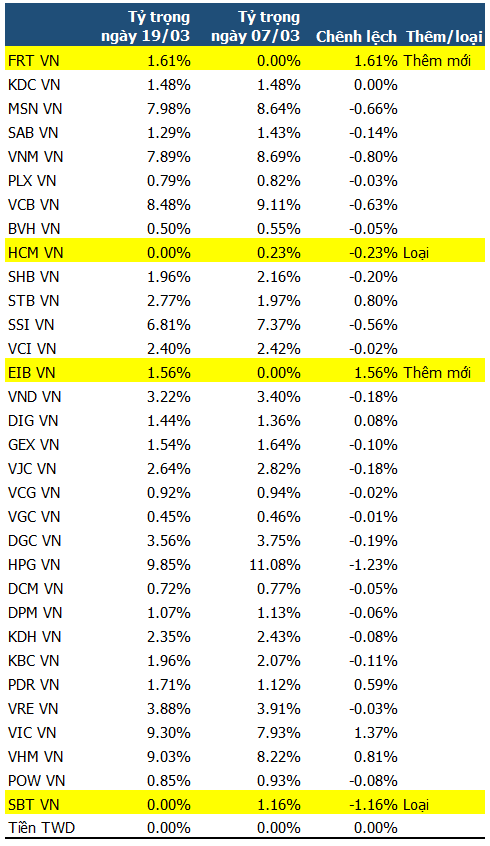

Last week, the reference index of the Fubon ETF fund underwent a portfolio restructuring, adding EIB, FRT, and removing SBT and HCM.

|

Changes in the Fubon ETF reference index

|

According to Mr. Nguyen Vu Luan, Head of Brokerage at VNDS, the reason for removing SBT is due to its low market capitalization ranking, while HCM is removed because it does not have enough foreign room and has also been removed from the FTSE Frontier Index Series.

Conversely, EIB was added because it met the requirements for addition and was also added to the FTSE Frontier Index. Mr. Luan believes that FRT was added because it qualified after EIB and to replace HCM.

Aggressively buying strong stocks

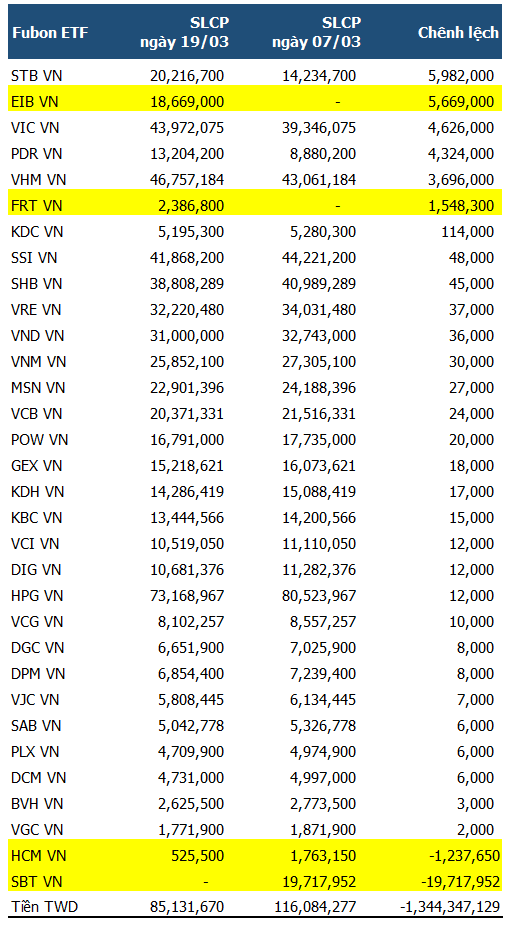

With the aforementioned changes, the Fubon ETF fund has been actively trading, mainly buying more stocks.

During the period from March 7th to 19th, 2024, the fund bought nearly 6 million shares of STB, 5.7 million shares of EIB, 4.6 million shares of VIC, 4.3 million shares of PDR, and 1.5 million shares of FRT. On the other hand, the Taiwanese fund sold all 19.7 million shares of SBT and sold 1.2 million shares of HCM. However, HCM is still not completely processed.

|

Trading of Fubon ETF during the portfolio restructuring week

|