Selling pressure showed a slight increase in the afternoon session but was not enough to exert significant pressure. HoSE’s trading volume increased by about 6% compared to the morning session, and the VN-Index closed slightly down 1.1 points. The positive point is that the breadth still reflects the differentiation, but foreign investors are still maintaining a very large net selling intensity.

The amount of new stocks in the account this afternoon mostly had losses, but the losses were not yet significant. The massive volume of stocks that need to arrive tomorrow is currently in good profit. Therefore, it may take until tomorrow for the cumulated pressure to be large.

The two listed exchanges only matched about 10.504 trillion VND in the afternoon session, an increase of 3% compared to the morning session. HoSE alone matched 9.809 trillion VND, an increase of 6%. This is the session with the lowest liquidity in the past 9 sessions.

Selling pressure to push down prices showed signs of increasing in the afternoon. First, the breadth, by the end of the morning session, the VN-Index had 235 stocks up / 194 stocks down, but by the end of the session, there were 216 stocks up / 242 stocks down. Secondly, in the morning session, HoSE had 52 stocks down more than 1%, but closed with 82 stocks. Even in the VN30 basket, there were 18 stocks that fell from the morning, with only 8 stocks increasing. VN30-Index closed down 0.08% with 9 stocks up / 16 stocks down, also lower than the morning session.

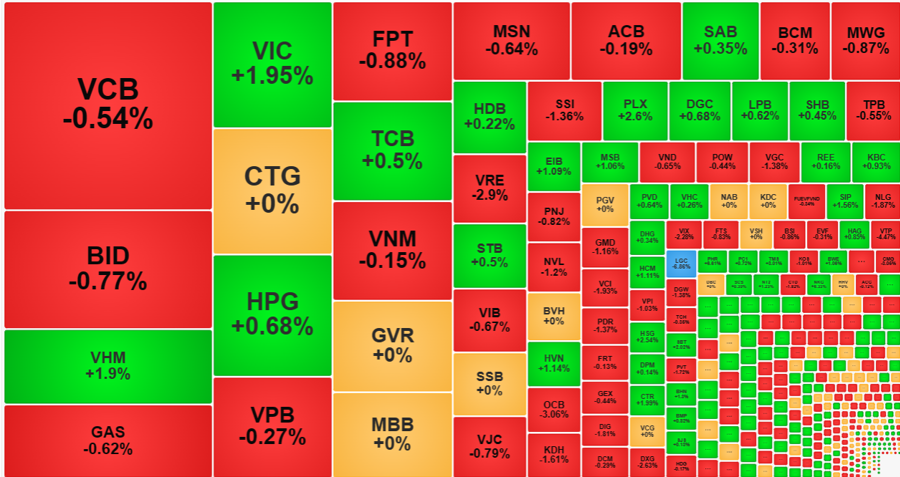

Fortunately for the VN-Index, the two pillars VIC and VHM were positive in the afternoon: VIC increased by 2.51% compared to the morning closing price, successfully reversing to an increase of 1.95% compared to the reference price. VHM had a breakthrough of 1.54%, resulting in a 1.9% increase at the closing. These two stocks are still large, with VHM ranking third by market capitalization and VIC ranking fifth in the VN-Index, thereby supporting a decrease of 1.7 points.

However, the number of stocks experiencing price declines is still larger, although the amplitude is not too large. VCB fell an additional 0.32%, ending with a total decrease of 0.54%. VNM fell an additional 0.44%, turning from green to red by 0.15%. VPB fell 0.82%, ending with a 0.27% decrease compared to the reference price. MSN even dropped by 1.53%, resulting in a 0.64% decrease overall. GAS, CTG, MWG, VRE… also showed much weaker performance compared to the morning session. Even strong stocks like HPG fell 2.3% this afternoon, narrowing the increase to only 0.68% compared to the reference price…

In general, the decrease in stock prices in the afternoon session is not difficult to predict. Some investors who did not sell yesterday had to make a decision today after the price rebounded. Investors who already have stocks and bought at a good price yesterday can also sell immediately in T1… Although the market achieved very high liquidity and had a recovery session yesterday, there is still no guarantee that the adjustment is over. Therefore, gradually reducing the weight as prices recover is normal.

The stocks that bore the most downward pressure today are still the ones that are counter-cyclical or have performed well before, meaning that investors still have profits if they bought and held for a long time. Real estate stocks that reversed in the previous session, today DIG, VRE, PDR, DXG, HDC, NVL, NLG… all turned around, all decreased by more than 1% with liquidity ranging from 100 billion to 800 billion VND. Securities stocks such as VIX, SSI, VCI continue to decline. On the other hand, there are also quite a few strong stocks: NKG, EIB, CII, VHM, HSG, VIC, BCG, PHR, HCM are stocks that increased by more than 1%, all with liquidity exceeding one hundred billion VND. Thus, the strength also has significant differentiation and is not based on the industry group but on specific supply and demand.