I. MARKET DEVELOPMENT OF WARRANTS

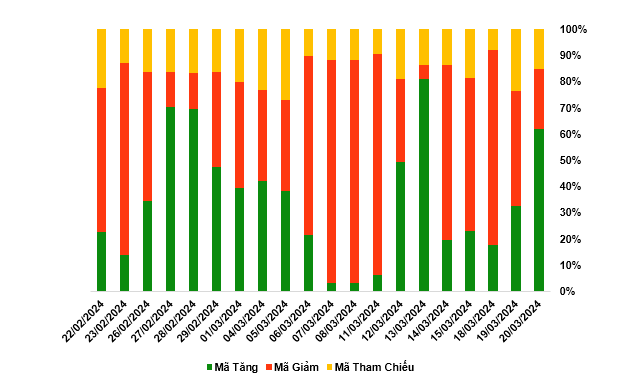

At the end of the trading session on March 20, 2024, the whole market had 108 warrants increasing, 40 warrants decreasing, and 26 reference warrants.

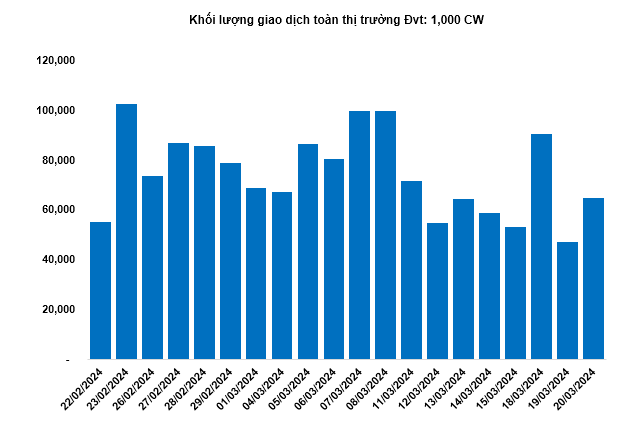

Market breadth in the last 20 sessions. Unit: Percentage (%)

Source: VietstockFinance

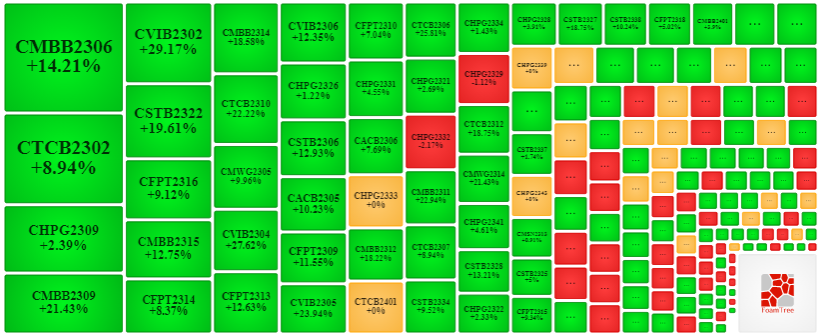

In the trading session on March 20, 2024, the buying side returned to lead the market, causing most warrant codes to increase sharply. Specifically, the major warrants in the group that increased in price were CMBB2306, CTCB2302, CHPG2309, and CVIB2302.

Source: VietstockFinance

The total trading volume of the whole market in the session on March 20 reached 64.67 million CW, up 37.62%; the trading value reached 60.63 billion VND, up 52.15% compared to the session on March 19. Among them, CSTB2322 led the market in terms of volume with 4.91 million CW; CMWG2316 led the market in terms of trading value with 3.71 billion VND.

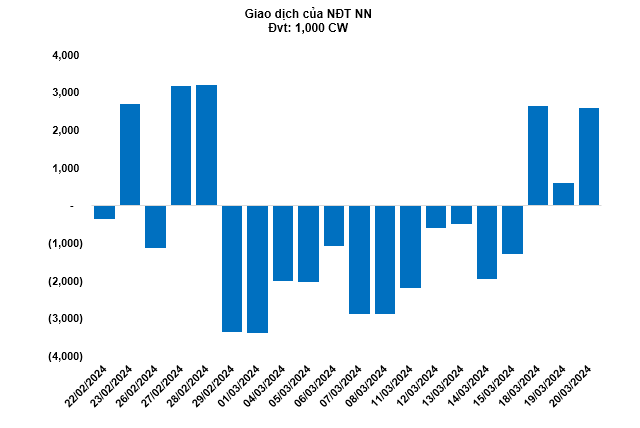

Foreign investors continued to buy net in the session on March 20 with a total net buying volume of 2.61 million CW. Among them, CSTB2331 and CTPB2305 were the two most net bought warrants.

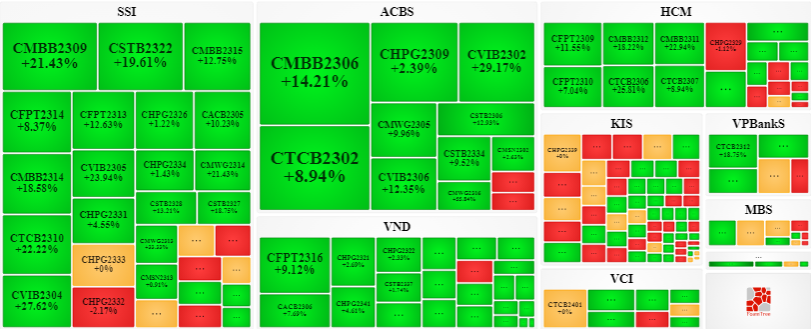

Securities companies KIS, SSI, HCM, ACBS, VND are currently the issuing organizations with the most warrants in the market.

Source: VietstockFinance

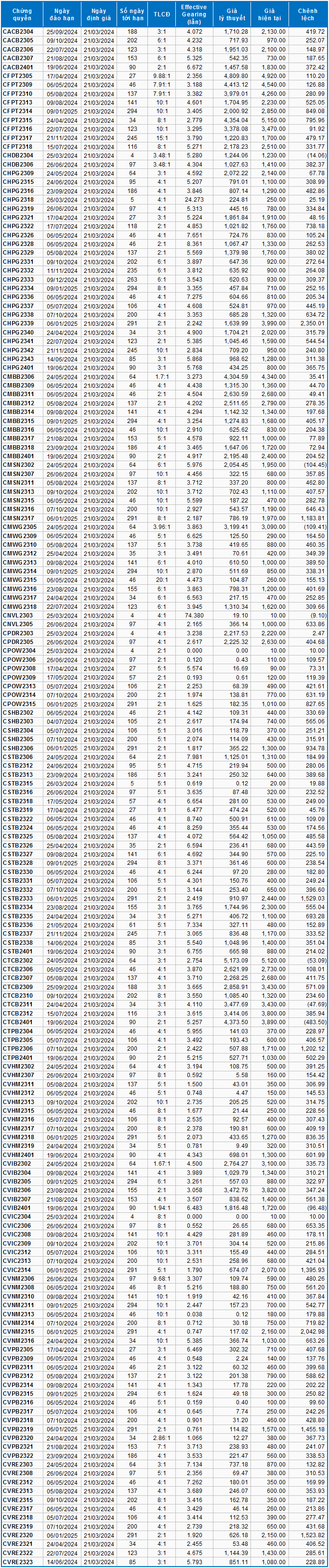

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT PRICING

Based on the appropriate pricing method as of the starting date on March 21, 2024, the fair value of warrants currently traded in the market is as follows:

Source: VietstockFinance

Note: The opportunity cost in the pricing model is adjusted to fit the Vietnamese market. Specifically, the risk-free bond interest rate (Government bonds) will be replaced by the average deposit interest rate of major banks with appropriate term adjustments for each type of warrant.

Based on the above pricing, CTCB2401 and CMWG2305 are currently the two warrants with the most attractive valuation.

Warrants with higher effective gearing will have larger fluctuations in relation to the underlying securities. Currently, CNVL2303 and CHPG2318 are the two warrants with the highest effective gearing ratio in the market.

Market Analysis & Strategy Advisory Department, Vietstock Advisory