Need to mobilize capital due to financial difficulties

After more than several hours of indictment, on the morning of March 19, the court isolated defendant Do Anh Dung (Chairman of Tan Hoang Minh Group) for interrogation of the remaining defendants.

In the first response, defendant Do Hoang Viet (Dung’s son) stated that at Tan Hoang Minh, he held the position of Deputy General Director in charge of finance and accounting.

“Why did Tan Hoang Minh choose 3 companies in the indictment to issue bonds?” the chairperson asked. Defendant Viet believed that since 2021, due to the rampant Covid-19 pandemic, it has been very difficult to borrow credit, so the company issued bonds to mobilize capital from the public.

Viet stated that during this time, the Group had many overdue debts, but it couldn’t directly borrow to repay them.

Viet further revealed that Chairman Do Anh Dung proposed the bond issuance plan, and after the plan was approved, Viet and his father met with the Group’s leadership. At this meeting, Mr. Dung instructed Viet and the key officers of Tan Hoang Minh to come up with a plan.

“Then I personally summoned a separate meeting with the group of officers to discuss the implementation method,” said Viet.

Regarding the use of three companies, Ngôi Sao Việt, Cung Điện Mùa Đông, and Soleil, to issue bonds, Viet said he had reported to Dung… and instructed the staff to work with the auditors to legally report the financial statements.

Additionally, Viet also directed the staff to contact the Valuation Companies to issue appraisal reports as required by the consulting unit.

Regarding the “cash flow running” plan to create “illusionary” value, Viet explained that specialized departments executed this themselves. However, Viet’s response was interrupted by the chairperson who asked, “If the value grew from 1 to 10, who did it if the defendant didn’t instruct it?” Viet evaded the question but later had to admit that he had instructed the staff.

The defendants at the trial.

Complying with instructions, no benefits received

Regarding the accusation of “collusion” with the Valuation Companies and Audit Company, Viet stated that the specialized departments implemented based on the initial bond issuance plan approved by the Chairman and General Director. When the bonds were sold on the market, all proceeds were reported to the General Director.

“How much has Tan Hoang Minh compensated for the victims?” the chairperson asked. Defendant Viet stated that he had paid over 6,000 billion VND, in addition to the amount refunded by the investigating agency, which had fully compensated for the damages so far.

In turn, defendants Hoang Quyet Chien (Deputy Director of the Finance and Accounting Center, Finance and Accounting Director), Le Thi Mai (former Deputy Head of the Capital Source Department of Tan Hoang Minh), and Vu Le Van Anh (Deputy Director of the Capital Source Department) all admitted that the testimony of Deputy General Director Do Hoang Viet was correct.

The defendants believed that creating a “virtual” value in the financial reports was incorrect, but they only carried out the construction according to the decision made at the bond issuance meeting. The process had no material benefits, only salary benefits.

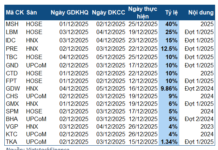

In the indictment, the prosecutor’s office accused the defendants of issuing 9 separate corporate bond packages with a total issuance value of 10,030 billion VND to mobilize money, in accordance with the plan and under the delegated authority of Do Anh Dung and Do Hoang Viet, using 3 companies: Ngôi Sao Việt, Cung Điện Mùa Đông, and Soleil.

To issue the bonds, the defendants falsely manipulated legal conditions, issuance documents, listing procedures, and bond transactions, such as simulating business activities through the signing of legal contracts, investment cooperation, deposits, stock transactions… that did not really exist within the companies.

In addition, Dung’s group also “colluded” with the auditing firm, lawfully substantiating the financial reports of the 3 issuing companies, giving the full acceptance conditions for bond issuance; signing “fake” contracts for the transfer of bonds, manipulating “fake” cash flows; and using the assets of these “fake” investment cooperation contracts as collateral, thus creating trust and using the Tan Hoang Minh Company and brand to issue bonds, mobilizing over 14,000 billion VND. Dung and his son were accused of misappropriating more than 8,643 billion VND from 6,630 investors.

According to the prosecutor’s office, although the total value of bonds exceeded 10,030 billion VND, at that time Tan Hoang Minh’s account only had 40-200 billion VND.