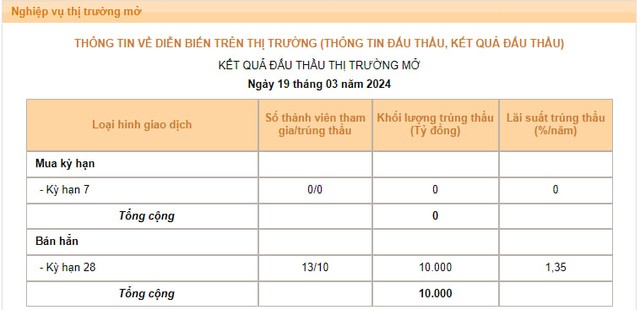

After 6 consecutive sessions maintaining the close level of VND 15,000 billion, the volume of bonds issued by the State Bank in the session on March 19 decreased to VND 10,000 billion, and the winning bid rate also decreased from 1.4% to 1.35%.

The decreasing trend in the volume and winning bid rate indicates that the State Bank is no longer aggressive in its liquidity absorption activities.

Source: SBV

As we reported earlier, the State Bank resumed the issuance of bonds from the session on March 11 after more than 4 months of suspension. After 7 consecutive sessions of bond issuance, the State Bank has withdrawn nearly VND 100,000 billion from the banking system. This amount of money is not circulating in the economy and will be pumped back into the system by the State Bank from April 8.

The reactivation of the bond issuance activity shows the orientation of reducing excess liquidity in the banking system by the Controller, thereby pushing up VND interest rates in the interbank market and indirectly restraining the upward trend of the USD/VND exchange rate – which is currently under pressure and is trading at a record high level.

Meanwhile, the interest rates in the interbank market have reversed and decreased in the last 2 trading sessions. According to the latest figures released by the State Bank, the average VND interbank interest rate at the overnight term (the term that accounts for about 90% of the transaction value) has decreased to 0.79% in the session on March 15 from the level of 1.21% recorded in the session on March 14 and 1.47% in the session on March 13.

Interest rates for other key tenors have also tended to decrease, such as: the 1-week tenor decreased from 1.68% to 1.1%; the 2-week tenor decreased from 1.81% to 1.43%; the 1-month tenor decreased from 2.01% to 1.6%.

Furthermore, despite the State Bank withdrawing a total of VND 100,000 billion, the USD exchange rate at commercial banks continues to maintain at a historically high level, at 24,900 – 25,000 VND per USD in the selling direction.

The decrease in interbank interest rates, along with the number of participants in bond auctions remaining relatively high, reflects that the system’s liquidity is still relatively abundant. This, along with the continued pressure on exchange rates, will encourage the State Bank’s ability to continue to issue more bonds in the coming trading sessions.

Looking back at the most recent bond issuance period from September 21 to November 8, 2023, the State Bank has issued bonds in 35 consecutive sessions with a total volume of VND 360,345 billion. In which, the highest net withdrawal (the accumulated volume of bonds issued – the accumulated volume of bonds due) in this period is VND 255,600 billion.

After the State Bank withdrew the money, the exchange rate began to decline and maintained a downward trend until the end of November 2023. The overnight interbank interest rate increased sharply to over 2% in the period from September 21 to October 25, 2023 – in response to the money withdrawal move. The State Bank stopped issuing bonds from the session on November 9, 2023 when the exchange rate began to cool down and gradually pumped back the amount of money previously withdrawn from the system.

According to the assessment of SSI Securities in the latest monetary market report, the purpose of the State Bank’s bond issuance is to reduce short-term market liquidity 2 to alleviate pressure on exchange rate speculation in the short term and limit the impact on interest rates in the market 1.

Analysts believe that the State Bank’s bond issuance move can be seen as a means to adjust short-term liquidity in the system and is a common practice among Central Banks. SSI also affirmed that this action does not imply a reversal of monetary policy. The short-term goal when the State Bank issues bonds is to regulate market liquidity in the short term to impact exchange rates. In the long term, the issuance of bonds is used to stabilize exchange rates, interest rates, liquidity,… to serve the long-term objectives of monetary policy.

Prior to that, in the period from 2018 to 2023, the State Bank carried out this operation many times each year. Statistics from BSC showed that the State Bank carried out net withdrawal at an average of about 9.7 times/year in this period, and the number of days from the beginning of the cycle to the end of the cycle on average/session was about 13.4 days. The average net withdrawal value/cycle reached VND 43,385 billion. The largest net withdrawal value/cycle was VND 191,100 billion in 2022.

With these assessments, BSC predicts that the highest net withdrawal scale (the accumulated volume of bonds issued – the accumulated volume of bonds due) in this period may reach about VND 150,000 billion.