Pulled VND 100,000 trillion through the treasury bond channel in 7 consecutive sessions

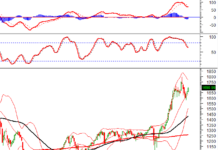

In the trading session on March 19, the State Bank of Vietnam continued to withdraw VND 10,000 trillion from the system through treasury bond tools with a 28-day term. There were a total of 13 members participating in the bidding and 10 members winning the bidding. The winning interest rate on March 19 decreased by 0.05 percentage points compared to the beginning of the week to 1.35% per annum. This is the 7th consecutive session the Central Bank has offered treasury bonds to reduce liquidity in the banking system.

In the previous week, from March 11 to March 15, the State Bank of Vietnam started the initiative to resume bond auctions after more than 4 months of pause. According to experts, the resumption of bond auctions shows the direction of reducing excess liquidity in the banking system of the Central Bank, thereby promoting VND interest rates in the interbank market to increase and indirectly restrain the upward trend of the USD/VND exchange rate – which is currently under a lot of pressure and is trading at historically high levels.

Therefore, after 7 sessions of resuming bond auctions, from March 11 to March 19, the State Bank of Vietnam has netted approximately VND 100,000 trillion through the treasury bond channel, with the winning volume in the previous 6 sessions reaching VND 15,000 trillion/session and today’s session is VND 10,000 trillion. The winning interest rate ranges from 1.35% to 1.4%.

The State Bank of Vietnam has started the initiative to resume bond auctions after more than 4 months of pause

However, interbank rates have reversed downward trend in the last 2 trading sessions. According to the latest data released by the State Bank of Vietnam, the average interbank VND interest rate for overnight term (the main term accounting for about 90% of transaction value) has decreased to 0.79% in the session on March 15, from the level of 1.21% recorded in the session on March 14 and 1.47% in the session on March 13.

The interest rates of other key terms have also tended to decrease: 1-week term decreased from 1.68% to 1.1%; 2-week term decreased from 1.81% to 1.43%; 1-month term decreased from 2.01% to 1.6%.

This decrease in interbank interest rates combined with the number of members participating in bond auctions at a relatively high level reflects that the system’s liquidity is still quite abundant. This will encourage the possibility of the State Bank of Vietnam to continue issuing more bonds in the future.

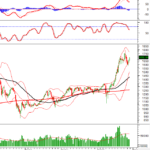

Looking back at the most recent bond issuance period from September 21 to November 8, 2023, the State Bank of Vietnam has conducted bond issuance in 35 consecutive sessions with a total volume of VND 360,345 trillion. In which, the highest net withdrawal volume (cumulative bond issuance volume – cumulative bond maturity volume) in this period is VND 255,600 trillion.

After the State Bank of Vietnam withdrew money, the exchange rate began to decrease and maintained its declining trend until the end of November 2023. Overnight interbank interest rates increased sharply to over 2% in the period from September 21 to October 25, 2023 – in response to the withdrawal. The State Bank of Vietnam has suspended bond issuance since the session on November 9, 2023 when the exchange rate began to cool and gradually pumped money back into the system.

Will credit soon rebound?

Evaluating the State Bank of Vietnam’s initiatives during this period, economic expert – TS. Can Van Luc, a member of the National Financial and Monetary Policy Advisory Council, said that net withdrawals are mainly due to the system’s liquidity. In the early months of this year, credit growth was very slow and even negative, while mobilizing capital also grew slowly but higher than credit.

Credit by the end of February decreased about 1% and mobilized capital was estimated to decrease about 0.7%

Citing data from the State Bank of Vietnam, the expert said that credit by the end of February decreased about 1% and mobilized capital was estimated to decrease about 0.7%. This has led to abundant system liquidity and a sharp decrease in interbank interest rates. In the session on March 11, the overnight interbank interest rate decreased to 1.17% per annum, significantly lower than the peak level reached on February 21 (4.14%), approaching the lowest level maintained for a long time in the previous excess liquidity period (about 0.14 – 0.15% per annum).

“Having abundant liquidity, the State Bank of Vietnam needs to withdraw liquidity. However, this is not yet the most important reason,” said the expert.

He further added that the purpose of withdrawing money through bond auctions is to push interbank interest rates higher, nearer to the USD interest rates in order to reduce exchange rate pressure. According to the latest meeting of the US Federal Reserve (Fed), interest rates will not be lowered at least until the first half of this year.

“The fact that the Fed maintains high interest rates while Vietnam’s interest rates are too low will create exchange rate pressure. Evidence is that the exchange rate has fluctuated recently, from the beginning of the year until now, the USD/VND exchange rate has increased by about 1.5%,” analyzed TS Can Van Luc.

The expert also stated that last year, the State Bank of Vietnam had used this tool in September and is now starting to use it again. Depending on the liquidity at the banks, as credit growth is low, the State Bank of Vietnam will decide on the net withdrawal volume.

“However, in my opinion, this initiative will not be used too often, the State Bank of Vietnam will not intervene too strongly because its cost is interest rate,” said the expert and added that it would be difficult to have a scenario where the State Bank of Vietnam continuously netted a lot like the September period last year.

Meanwhile, an expert with many years of experience in capital source business at banks believes that the scale of this bond issuance can be equivalent to or less than the September 2023 period as credit will soon rebound, making the system’s liquidity no longer excessive.

In a newly published analysis report, BSC stated that net bond issuance is a business, a regulatory tool, and does not imply a policy reversal. The short-term goal when the State Bank of Vietnam issues bonds is to regulate market liquidity in the short term to affect exchange rates. In the long run, bond issuance to stabilize exchange rates, interest rates, liquidity… serves the long-term goals of monetary policy.

Prior to that, in the period from 2018 to 2023, the State Bank of Vietnam had been carrying out this business regularly several times a year. Statistics from BIDV Securities Company (BSC) show that the State Bank of Vietnam had netted an average of about 9.7 times/year in this period, the number of days from the beginning to the end of each cycle on average was about 13.4 days. The average net withdrawal value per cycle was VND 43,385 trillion. The largest net withdrawal value per cycle was VND 191,100 trillion in 2022.

With the above assessments, BSC forecasts that the largest net withdrawal scale (cumulative bond issuance volume – cumulative bond maturity volume) in this period can be around VND 150,000 trillion.

Meanwhile, SSI Securities forecasts that the State Bank of Vietnam may continue to maintain net withdrawals for at least the next 2 weeks. If the issuance speed remains the same as now (VND 15,000 trillion/session), based on SSI’s estimate, the total net withdrawal volume is estimated at over VND 200,000 trillion, similar to the late period of 2023.