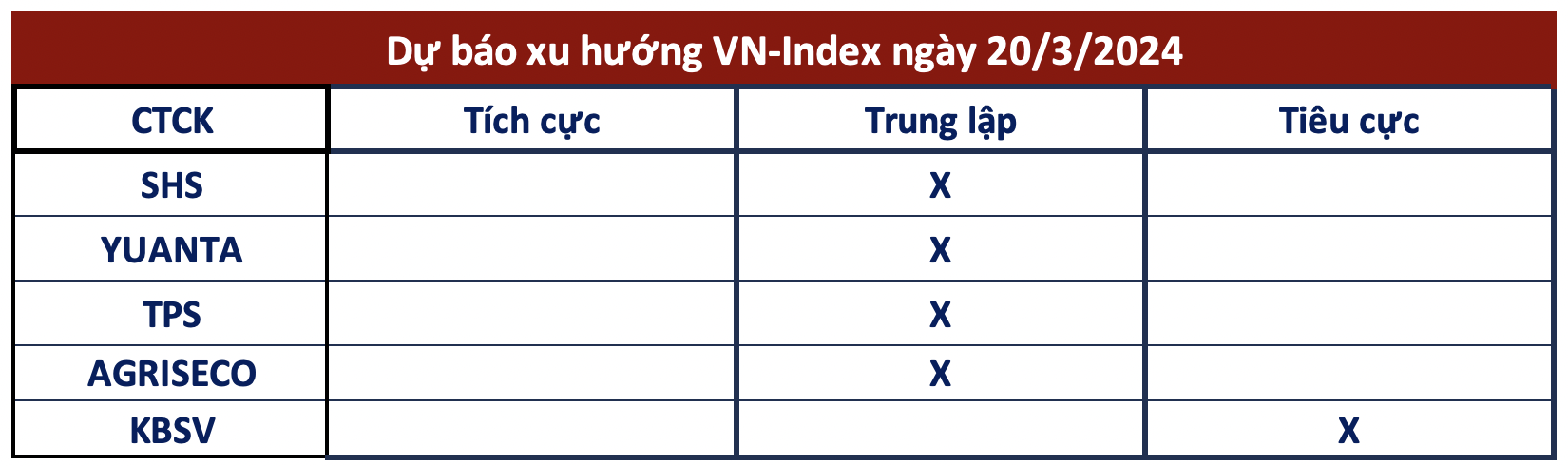

After a sharp decline in trading volume at historic levels, the VN-Index fluctuated around 1,250 points throughout the trading session on March 19. The market witnessed differentiation with many stocks absorbing buying pressure and recovering, while selling pressure continued to increase for many stocks. At the end of the session, the VN-Index fell by 1.1 points (-0.09%) to 1,242.46 points. Foreign investors continued to be net sellers with a value exceeding 900 billion VND in today’s session.

With a strong tug-of-war between buyers and sellers, most brokerages maintain a cautious stance and consider the 1,250-point threshold to be important. If this resistance level is surpassed, the market is likely to form a more sustainable upward trend. On the other hand, if the market fails to recover this level, a reversal and short-term correction scenario should be considered. Investors are advised to trade cautiously in the current context.

According to SHS Securities, the market is currently in a volatile phase in the short term. However, buying pressure is relatively good and may help the VN-Index aim for a strong accumulation phase near the 1,300 resistance level. Short-term investors should exercise caution at this stage as the main index is trading at a high score in the medium-term consolidation channel, thus increasing short-term risks.

In the positive scenario that the VN-Index soon recovers the 1,250 level, SHS evaluates the possibility of the VN-Index continuing its upward trend to the 1,300 level. However, if the VN-Index fails to reclaim the 1,250-point level in the next sessions, the possibility of the market entering a short-term correction phase around the 1,150-1,250 range is a visible scenario.

Sharing the same view, Agribank Securities (Agriseco) believes that the index is likely to have strong oscillations in both upward and downward directions in the next session. In the scenario where the VN-Index fails to reclaim the important resistance level around 1,250 points, increased selling pressure may continue to push the index back to the support range around 1,210 (+-10) points.

Agriseco Research recommends adjusting the portfolio to 40% stocks and 60% cash, observing the reactions of the index around the mentioned support levels to consider investing in leading blue-chip stocks.

Tien Phong Securities (TPS) evaluates the strong tug-of-war of the index along with significantly decreased trading volume, indicating that investors are being cautious. In the short term, the market may witness fluctuations of the VN-Index around the 1,245-1,250 point range. If this threshold is surpassed, the index will continue its recovery and test the resistance level of 1,270 points. On the contrary, if selling pressure from foreign and domestic institutional investors continues to be strong, negative sentiment could spread to individual investors, resulting in the index pulling back to the near support range of 1,230-1,235 points.

In the current cautious sentiment, KB Securities Vietnam (KBSV) evaluates that the bottom-fishing demand somewhat reflects a more cautious state and temporary funds are still on the sidelines waiting. Although volatile correction trends may continue for a few sessions, the VN-Index’s uptrend is expected to be maintained with significant support around 1,215 (+-10) points. Investors are advised to gradually increase their positions and increase trading volume for their current holdings in case the index or target stocks return to support levels.