This is a calculation carried out by the Private Economic Development Research Committee (Committee IV) when reporting on the effective implementation of Project 338 – investing in the construction of 1 million social houses.

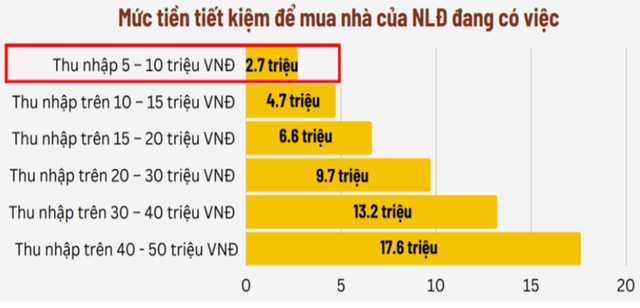

Workers can only save about 2.7 million VND/month with income under 11 million VND – Source: Committee IV |

According to regulations, in order to buy a social house, the buyer must pay 20% of the value of the house upfront and pay the remaining amount periodically, starting from the time the house is handed over; the minimum rental period for a social house is 5 years, from the date the lessor hands over the house to the lessee.”

The price of a social house in a approved project (according to Document No. 126/SXD-KTXD dated January 6, 2023, issued by the Hanoi Department of Construction on determining the selling price and rental price of social houses) is 19,523,116 VND/m2 (including VAT and excluding maintenance costs). The maintenance cost is 371,869 VND/m2. Therefore, a 70m2 house will cost about 1.36 billion VND, and the worker has to pay at least 273 million VND.

The Committee IV calculated that for workers with an income of less than 11 million VND/month, the average savings rate is about 2.7 million VND/month. Therefore, it would take them 7 years to save enough money for the initial contribution (or around 3-4 years for families with 2 workers with the same income), making it very difficult to access social housing.

In addition, workers participating in the survey with Committee IV said they encountered difficulties in preparing documents and proof of eligibility to register to buy social housing or to obtain preferential loans.

The preferential interest rate for people buying social houses needs to be stable below 8% for a minimum of 10 years. Illustration |

For example, workers need to have confirmation documents from social insurance because this contribution is used as a basis for calculating the debt repayment income; or proof that they are not subject to personal income tax, do not own other houses, proof of residency, etc.

Notably, regarding interest rates for homebuyers, according to calculations by experts, the interest rate of 8.2% per year for homebuyers is currently too high compared to the financial capacity of the target group, which includes individuals with average incomes in urban areas, making it difficult for social housing projects to meet the target groups.

“Calculations show that an attractive interest rate for homebuyers, stable below 8% for a minimum of 10 years, is suitable for the majority of workers with incomes below the personal income tax threshold to participate in purchasing social housing…” – Committee IV proposed.

At a recent conference on removing difficulties and promoting the development of social housing, Prime Minister Pham Minh Chinh requested that to achieve the goal of developing social housing, all levels of government, the state, the people, businesses, must take action and put themselves in the shoes of others, “in me there is you, in you there is me”, putting themselves in the position of those who do not have housing.

According to a report from the Ministry of Construction, although some key localities have high demand for social housing, investment is limited compared to the targets of the Project by 2025 (Hanoi has 3 projects, 1,700 houses meeting 9%; HCMC has 7 projects, 4,996 houses meeting 19%; Danang has 5 projects, 2,750 houses meeting 43%…). Some localities have not started any social housing projects from 2021 until now, such as Ha Giang, Cao Bang, Dien Bien, Lai Chau…

Thuy Linh