The trading session on 20/03 saw the VN-Index gain 17.62 points (1.42%), reaching 1,260.08 points; the HNX-Index rose 1.87 points (0.79%), reaching 238.03 points.

Among them, 7 banking stocks were among the top 10 that drove the VN-Index up, including BID, TCB, CTG, MBB, VPB, VIB, and VCB.

| Top 10 stocks that had the strongest impact on the VN-Index on 20/03 session |

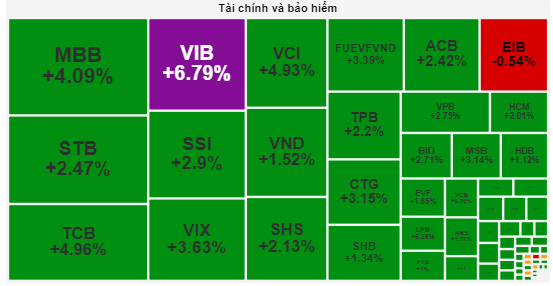

The 20/03 session also marked the comeback of the “king stocks” group, as almost all stocks saw an increase in price. VIB hit the ceiling price at 23,600 VND/share with over 27 million shares traded. Other stocks also witnessed an increase, such as LPB (+5.26%), TCB (+4.96%), MBB (+4.09%), CTG (+3.15%), etc.

EIB was the only stock that experienced a decline, dropping by 0.54%, with nearly 9 million shares traded.

|

Price movement of banking stocks on 20/03 session

Source: VietstockFinance

|

Ms. Ha Thi Thu Hang – Head of Stock Analysis and Market Analysis Division, Tan Phong Securities JSC shared some insights on the return of the “king stocks” group.

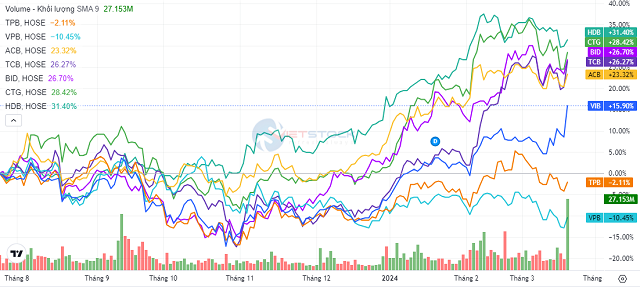

In terms of market capitalization, the banking sector has a significant impact on the VN-Index. Looking back at historical data, during the market recovery periods in 2016-2017 and 2020-2021, banking stocks always showed outstanding growth. Therefore, it is not only in today’s session (20/03) that the banking stock group led the recovery of the index, as this has happened many times in the past.

Ms. Ha Thi Thu Hang believes that there are 3 main reasons why banking stocks are attractive to investors. Firstly, the positive expectation of economic recovery in 2024 helps credit growth to revive and bad debts to decrease. Secondly, the NIM ratio of banks is expected to improve due to faster reduction in deposit costs compared to lending rates. Thirdly, the estimated post-tax profit of the banking industry is expected to increase by about 10-15%, making the valuation of banking stocks currently quite attractive.

|

Some banking stocks saw a strong price increase on 20/03

Source: VietstockFinance

|

Han Dong