It is a fact that at present, no American can buy a Chinese electric car. No one can be sure when these electric cars can enter the US market. However, the prospect of super cheap electric cars produced by China has caused many sleepless nights in the US auto capital of Detroit.

The main threat comes from cars like the BYD Seagull hatchback. The Seagull has a sleek design, a two-tone dashboard with a seagull and six airbags. The car even has a 10-inch rotating touch screen for the entertainment system. The company’s motto, “Build Your Dreams”, is printed on the back of the car.

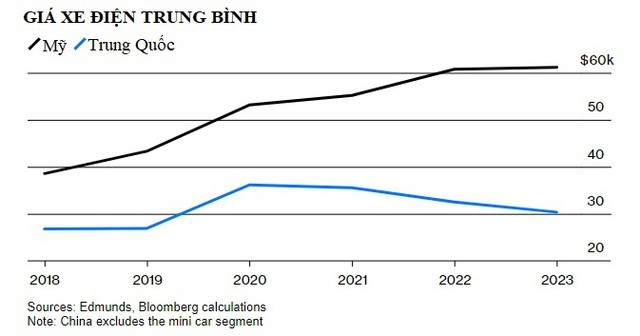

However, the most “special feature” of the car lies in its price of $9,698 (about 240 million VND). This price is significantly lower than the average price of an electric car in the US, which is over $50,000. In fact, it is only slightly higher than the price of a high-end Vespa scooter.

Such low prices indicate that Chinese automakers may force American manufacturers to shift from primarily producing expensive cars for a wealthy group of customers to producing affordable electric cars for everyone.

As the long-standing concern about a revolutionary electric car from the US tech giant Apple has waned, American car manufacturers now face an even bigger challenge from Asia. China, long a center for the production of Western companies’ products, is determined to expand the operations of its own companies globally.

This is the largest market for electric vehicles and they are leveraging their production scale and expertise to boost sales of competitively priced Chinese models for an increasingly climate-conscious world.

Currently, China’s aggressive push is being held back in the US by strong tariffs and measures to erect even stronger trade barriers against its political rival.

However, with China accounting for about 70% of total global electric vehicle sales, their lower prices are causing an undeniable ripple effect in the long term — even as US lawmakers’ political actions attempt to slow down the growth of this Asian giant, making it harder for them to enter the world’s most profitable car market.

Jeff Schuster, global automotive research vice president at consulting company GlobalData, said: “This threat has people on edge.”

Auto company executives and politicians in Washington are sounding the alarm about an existing threat to US car brands and the millions of workers employed by the industry. The American Manufacturing Alliance — a trade group supported by major manufacturers and labor unions — is calling for new trade protection measures against China to prevent a “level of extinction event”.

Michael Dunne, an auto-industry consultant who once worked for General Motors Co. in Asia, said: “Chinese companies today are highly competitive. The question in every boardroom now is how can we compete with them?”

THE THREAT

Ford Motor, Tesla, and other carmakers are rapidly remaking their EV strategies to compete with new, cheaper models being sold outside the US. Ford CEO Jim Farley called the Seagull “pretty good” and warned that any car company unable to compete with China globally in the near future risks losing up to 30% of its revenue. One of Farley’s top EV executives called Chinese electric cars a “monumental competitive threat”.

BYD’s Atto 3, a 5-seater SUV designed by a team led by former Audi and Lamborghini design chief Wolfgang Egger, is even more impressively equipped. The proud car features a Tesla-like dashboard with a large touchscreen in the center that can rotate vertically or horizontally; the gear lever on the center console looks like throttle control in a jet cockpit.

In addition, the car includes a full suite of safety features, including forward and rear crash warning sensors, blind-spot monitoring, cross-traffic alert, and automatic emergency braking. And to own all those features, you only need to spend from $31,000, about half the average price of an electric car in the US.

American automakers have expressed concern that China is setting a new global standard that they cannot ignore. Chinese brands have gained a foothold in key markets in the region including Europe, Mexico, and the Middle East and they want to continue growing.

Exports are important to Chinese automakers’ profits as they are bogged down. In the past three years, China has quickly grown to become the world’s largest exporter of cars, producing 5.2 million cars last year, up from 1 million in 2020. “Most Chinese automakers are not making profits at home so they are racing overseas,” Dunne said.

Both BYD and Zhejiang Geely Holding Group have won the favor of car buyers worldwide with special models that feature many amenities. Some are equipped with advanced technology, such as the ability to self-park. And many are significantly cheaper than the prices of long-selling cars on those export markets.

Stellantis NV CEO Carlos Tavares told reporters in February: “The Chinese onslaught could be the largest risk that companies like Tesla and we are facing today. We have to work very, very hard to make sure we bring better products to consumers than the Chinese.”

Western carmakers are striving to stimulate demand for their own battery-driven models. Ford and GM recently cut production of electric vehicles as demand slowed in part due to high prices, hardware and software glitches in deployment, as well as US consumers’ concerns about a shaky charging infrastructure.

GlobalData’s Schuster said: “The competitive threat is real and present, even though we haven’t seen any Chinese vehicle yet. It’s not a question of if; it’s when they come.”

Ford is responding by shifting its attention from large electric cars to smaller, lower-cost ones. As a result, plans to manufacture a three-row electric SUV have been delayed. Instead, Ford is focusing on developing small electric vehicles through a dedicated team in Irvine, California.

According to Bloomberg’s investigation, the team consists of fewer than 100 people working on a new electric platform to support a compact SUV, a compact pickup truck, and potentially a vehicle that could be used for ride-hailing calls. The person said the first model will roll out by late 2026, with a starting price of about $25,000 — in line with the anticipated base price of a budget electric car that Tesla is studying.

The person said, initially, Ford’s small electric car will run on lithium iron phosphate batteries, which are about 30% cheaper than traditional lithium-ion batteries, but the company is exploring other battery technologies to further reduce costs.

Farley made it clear that the small electric vehicle must be profitable within a year of its market launch. That’s a tall order for a company projected to lose $5.5 billion on electric vehicles this year.

Meanwhile, officials in Washington are scrambling to eliminate Chinese electric cars. There have been discussions about hiking the existing 27.5% tariff on cars produced in China and sold in the US. The current tariff is high enough to effectively ban most Chinese-made electric vehicles, except for a few models sold in the US by Swedish brand Volvo Cars and its sister brand Polestar — both automakers owned by China’s Zhejiang Geely.

US President Joe Biden is even considering a ban on Chinese-connected vehicles on the Internet due to national security concerns. Such a move could prohibit the import of all types of vehicles produced by China because most modern cars are equipped with modems and thus have the ability to collect data.

Both the American Manufacturing Alliance and the United Auto Workers union are pushing for these policies. In comments submitted to the Office of the US Trade Representative in January, the auto workers union called for “increasing “taxes on automobiles and auto parts, especially electric vehicles and related components” from China.

While these measures are designed to prevent China’s exports from entering the US, experts warn that they could lead to “innovative” solutions. In the 1980s, tough US trade measures — including voluntary export restraints imposed on Japanese automakers — led Honda Motor, Nissan Motor, and Toyota Motor to establish non-unionized plants in the US.

No Chinese brands have announced plans to build plants in the US, but BYD is looking for a plant site in Mexico where they can bring in duty-free cars to the US under the US-Mexico-Canada Agreement, or USMCA.

Mark Wakefield, the global auto practice co-leader at consulting firm AlixPartners, said Western companies must learn to utilize the latest low-cost technologies that China has mastered, but they must also remember that the Chinese have made more progress in designing for global car buyers.

Wakefield said: “Their vehicles are generally very attractive, and if you compare them to many Western designs, you will see they are different, competitive, and even better. It’s hard to find something that’s deemed as really ugly.”