|

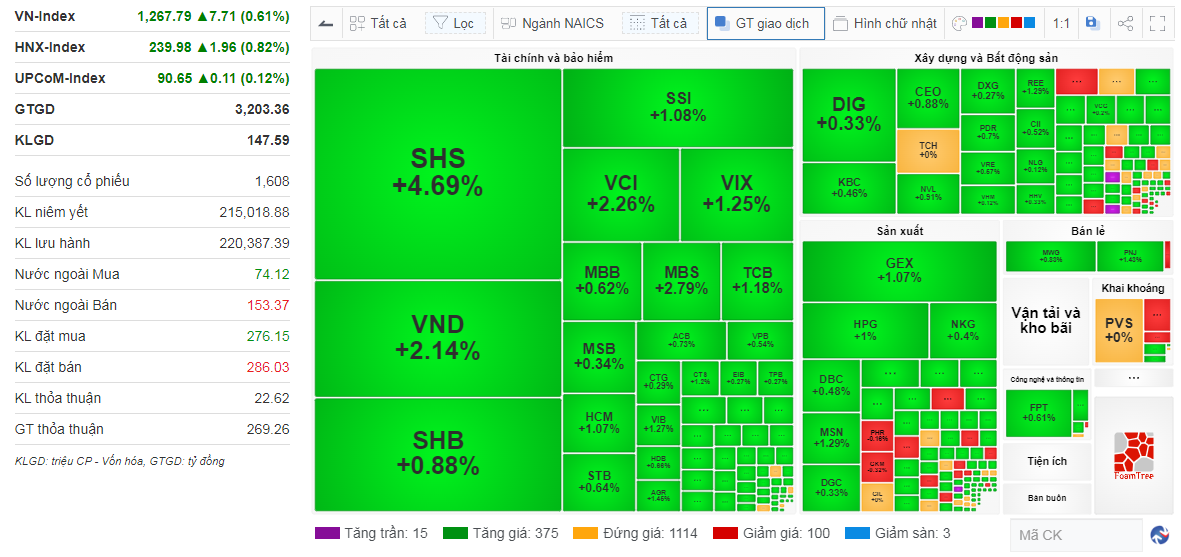

Source: VietstockFinance

|

The derivative expiry effect does not seem to affect the upward trend of today’s session. The liquidity of the VN-Index also increased significantly, with the average trading value reaching over 27.565 trillion dong, equivalent to an increase of about 30% compared to the previous session.

As mentioned from the beginning of the session, the securities group continued to have active trading in the main story related to the information that the SSC is seeking opinions to allow foreign investors to trade without 100% reserve. This solution is basically agreed upon and evaluated as feasible by market members, World Bank, and FTSE Russell. Stocks such as VND and SHS, with a point increase of more than 3.6%, made an impression throughout today’s session.

The “king” stocks group is also actively positive, with impressive increases in stocks such as TCB (+6.62%) and HDB (+5.75%), VIB stocks increased nearly 3% and MBB stocks increased over 2%. However, EIB went against the trend, decreasing by 1.6%.

The real estate group had more active trading in the afternoon session. “The most beautiful purple flower forest”, PDR has risen to its highest level in today’s trading session; this is one of the largest ETF fund stocks in Vietnam, with Fubon buying an additional 4.3 million shares from 07-19/03/2024.

It inspired other stocks in the construction and real estate group such as DIG (+4.28%), KBC (+4.86%) – which has had a stable upward trend since the beginning of the session, continue to increase strongly. Other stocks such as DXG, CEO, NVL, VRE, LCG, HUT, HDC, KDH, HHV… are also covered in green.

In addition, HPX is another stock that has risen to its highest level. HPX stock has its second ceiling increase, after 6 months of trading suspension.

In the top stocks that positively impact the index, TCB quickly caught up with the leader VCB to become the duo with the most positive contributions to the index; with a combined impact of both over 5.3 points. This is much larger than the negative impact of 0.58 points from the combination of the top stocks that negatively impact the index, led by LGC.

In terms of foreign investors, they sold nearly 194 billion dong on all three exchanges. HOSE alone sold net 275 billion dong; among them, VNM stocks suffered the strongest net selling (nearly 200 billion dong), followed by VHM (-158 billion dong), and DIG (-149 billion dong). On the contrary, VND stocks were the most bought on HOSE, with nearly 186 billion dong, followed by KBC, 142 billion dong.

| Top 10 stocks most strongly bought – sold net by foreign investors on the 21/03/2024 session |

Morning session: VN-Index continues to be optimistic

At the end of the morning session, VN-Index temporarily stopped at 1,270.78 points, up 10.7 points as the positive momentum from the start of the session was maintained and advanced.

The index sometimes suddenly became optimistic, surging to 1,272.85 points, an increase of 12.77 points. At the end of the morning session, there were 29 stocks that hit the ceiling, 475 stocks increased, 895 stocks stayed unchanged, and 204 stocks decreased, with 3 stocks hitting the floor.

The market liquidity at the end of the morning session recorded an average of over 13.270 trillion dong, an increase of about 43% compared to the average of 9.300 trillion dong in the previous session.

In terms of sector performance, the securities group is still attracting a lot of attention from investors. Stocks such as VND and SHS are showing positive trends, with increases of around 4%.

The construction and real estate group is also showing similar trends, with some prominent stocks such as DIG, KBC, PDR making the biggest impacts in the morning.

In the production group, it can be seen that ASM is dominating distinctive purple spots on the market’s heat map, while DGC and KDC are in the red. Stocks in the steel group such as HPG, NKG, and HSG are maintaining their steady increases.

In the banking group, it plays a key role in contributing to the index’s gains, with VCB making a contribution of nearly 2.9 points and TCB contributing an increase of 0.6 points. Following are large-cap stocks such as HPG, VHM, PLX, or MSN. Conversely, BID leads the group of stocks that negatively impact the index, but seems to be weaker, contributing a decrease of 0.14 points.

While the index is experiencing positive trends, foreign investors are net sellers on all three exchanges with a value of over 204 billion dong. In particular, HOSE sold net 260 billion dong, with DIG stocks being the most heavily net sold, with over 155 billion dong, and VND stocks being the most heavily net bought, with over 161 billion dong.

10:40 am: Inertia in increasing points is maintained

Continuing the morning session’s developments, VN-Index continues to maintain positive upward trends. As of 10:27 am, VN-Index is trading around 1,266.48 points, up more than 6.5 points compared to the previous session; the average trading value is recorded at over 9.300 trillion dong, higher than the 5.822 trillion dong of the previous session.

The securities group still maintains positive point increases, with some prominent stocks such as VND and SHS, with increases of about 4%.

In the banking group, the overall trend is still positive, with a few stocks not following the general upward trend of the sector, such as MSB, MBB, TPB, or EIB.

The construction and real estate group is somewhat differentiated. Some stocks such as KBC, PDR have increased by about 3%. Meanwhile, DIG, CTD, PC1, NLG are showing signs of weakness.

In the production group, ASM stocks are heavily increased for no reason. The steel group stocks such as HSG, HPG, NKG have positive upward trends.

In the top stocks that positively impact the index, VCB is still the driving force, followed by TCB, HPG, and CTG. However, on the contrary, VIC leads the group of stocks that negatively impact the index.

Market Opening: Green dominates

The stock market opened strongly, with VN-Index trading around 1,268 points, up nearly 8 points compared to the previous session. The Large Cap, Small Cap, and Mid Cap indices also have similar positive trends.

Market development at 9:25 am. Source: VietstockFinance

|

Clearly, VN-Index is highly correlated with the US stock market as all 3 main indices, Dow Jones, S&P 500, and Nasdaq Composite not only increased but also closed at all-time highs on Wednesday (20/03).

Everything happened right after the most powerful central bank in the world – the US Federal Reserve (Fed) decided to keep interest rates at 5.25% – 5.5% after a two-day meeting of the Federal Open Market Committee (FOMC). The dot-plot chart shows that the Fed members predict 3 interest rate cuts this year, each 25 basis points reduction.

The sensitivity of the securities group is evident in the information that the SSC is seeking opinions to allow foreign investors to trade without 100% reserve, with the positive upward trend right from the beginning of the session and significant green areas on the market’s heat map. Similarly, the “king” stocks of the banking sector joined the upward trend in the previous session, continuing to maintain green color.

However, everything is only the beginning, today the market may encounter the effect of the VN30F2403 futures expiry.

In terms of stocks that impact the market, VCB is playing the leading role in the top stocks that have positive impacts, with a contribution of nearly 1.7 points; followed by TCB with a smaller contribution, recording 0.4 points. The group that has negative impacts on the market is VSH, FRT, and NAB.

Kha Nguyen