SSI Securities Corporation (SSI Stock Code) has recently announced the Board of Directors’ resolution approving the business plan for 2024 and the program for the Annual General Meeting of Shareholders in 2024.

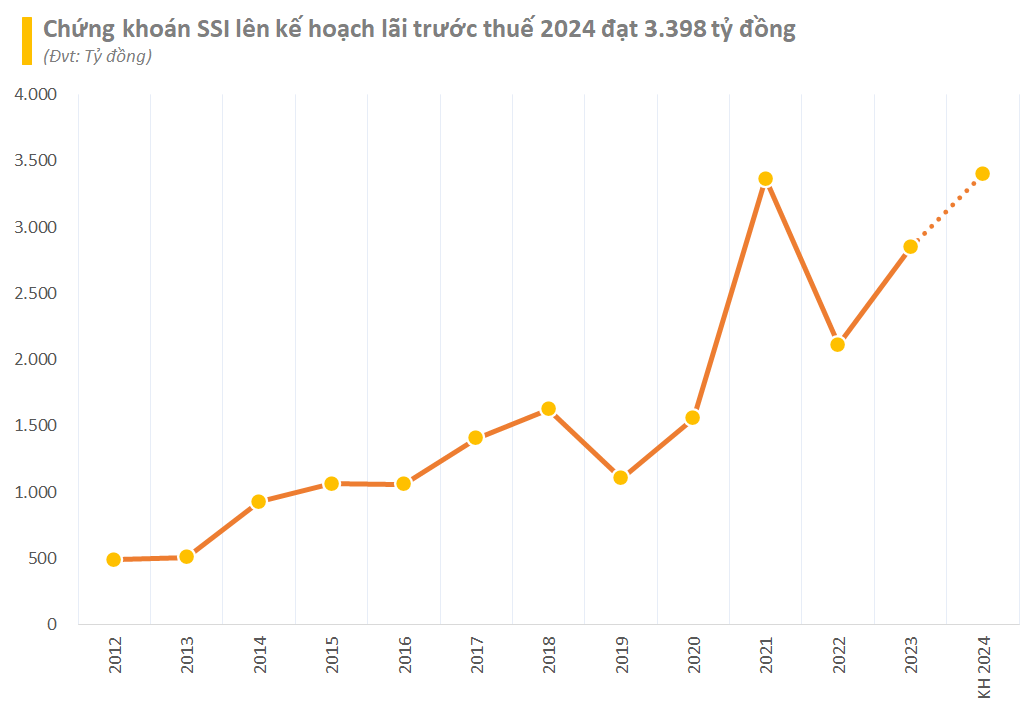

Specifically, SSI plans to achieve a consolidated revenue of 8,112 billion VND in 2024. The target for consolidated profit before tax is 3,398 billion VND, equivalent to a 19% increase compared to the previous year. If successfully achieved, this will be the highest profit level in the history of the securities company.

This business plan will be presented for shareholder feedback at the scheduled 2024 Annual General Meeting, which will take place on April 25, 2024 in Ho Chi Minh City. In addition to the above business plan, SSI plans to propose some important matters at the meeting, such as the 2024 Employee Stock Option Plan (ESOP), continued implementation of the share issuance plan approved by the General Meeting of Shareholders in 2023, election of 2 new members to the Board of Directors, and other related issues.

In 2023, SSI achieved a total operating revenue of 7,158 billion VND, a 13% increase compared to 2022. The pre-tax profit reached 2,849 billion VND, a 35% increase compared to the same period and exceeded the 12% target set. As of December 31, 2023, the total assets and equity of SSI reached 68,519 billion VND and 22,584 billion VND respectively, a 33% and 3% increase compared to the end of 2022. SSI’s margin loan balance reached 14,672 billion VND, a 35% increase compared to the end of 2022.

At the end of December 2023, SSI shareholders approved two capital increase plans, including the issuance of over 302.2 million bonus shares at a ratio of 100:20 and the sale of over 151 million shares to existing shareholders at a price of 15,000 VND per share at a ratio of 100:10. In total, SSI will issue more than 453.3 million new shares. The charter capital of SSI is expected to increase from over 15,111 billion VND to nearly 19,645 billion VND, consolidating its position as the number one company in terms of capital among securities companies.

On the market, SSI’s stock price closed at 36,150 VND/share on March 19th.