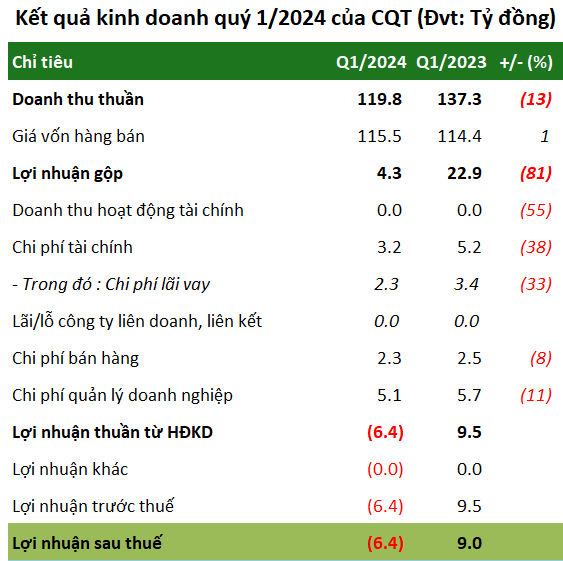

In the first quarter of 2024, Quan Trieu Cement JSC (UPCoM: CQT) recorded net revenue of nearly VND120 billion, down 13% year-on-year, but the high cost of goods sold “eroded” nearly all of the company’s profit. After deductions, CQT‘s gross profit was over VND4 billion, down 81%. Gross profit margin also decreased from 17% (same period last year) to nearly 4%.

A bright spot in the period was that almost all expenses decreased. Of which, financial expenses were over VND3 billion, down 38%; selling expenses were over VND2 billion and enterprise management expenses were over VND5 billion, down 8% and 11%, respectively. However, it was not enough for the company to avoid a loss-making quarter.

As a result, CQT suffered a net loss of over VND6 billion, compared with a profit of VND9 billion in the same period last year.

Source: VietstockFiance

|

Quan Trieu Cement said that the cement industry in 2024 is still considered to face many difficulties, from weak domestic demand, supply continuing to outstrip demand, some new production lines coming into operation, and the real estate market still unable to recover… All these difficulties make it difficult for the cement industry to consume cement and clinker. In addition, fuel and material prices, as well as electricity prices, are also rising.

Accordingly, CQT set a cautious business result for 2024 with total revenue of over VND620 billion, almost unchanged compared to 2023; while pre-tax profit was nearly VND23 billion, down 25%. Compared to the annual plan, CQT has completed nearly 1/5 of the total revenue target and is “marking time” in terms of pre-tax profit target after the first quarter.

As of March 31, 2024, CQT‘s total assets were over VND587 billion, almost the same as at the beginning of the year. Of which, the company holds nearly VND12 billion in cash and cash equivalents, up 55%; inventory was nearly VND51 billion, down 12%.

On the other side of the balance sheet, CQT had nearly VND310 billion in liabilities, up 2% compared to the beginning of the period. Of which, total short-term and long-term financial debt was over VND158 billion, accounting for 51% of total debt and 27% of the company’s capital.