Net Income of CSM – Q1 2017-2023

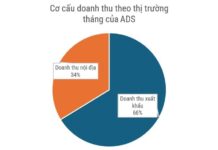

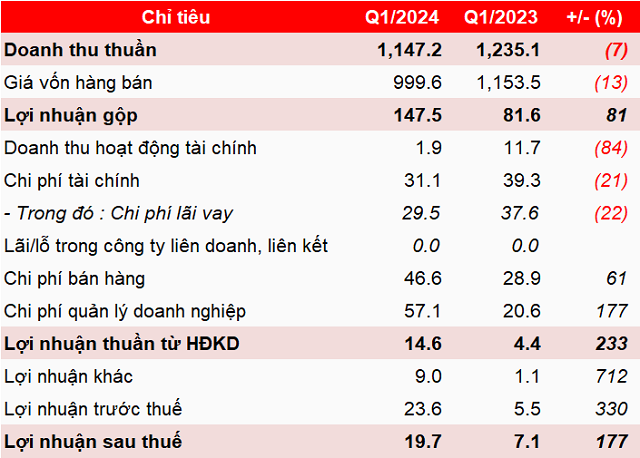

In the first quarter of 2024, **CSM**’s net revenue recorded over VND 1.147 billion, a decrease of 7% year-over-year. According to the Company, the domestic market has not recovered, consumption is low, and the economic downturn has led to export customers requesting lower sales prices.

However, the gross profit margin improved by 6.3 percentage points to 12.9%, resulting in an 81% increase in gross profit to over VND 147 billion.

Financial revenue decreased by 84% to nearly VND 2 billion, due to no exchange rate gain recorded. However, financial expenses also decreased by 21% to VND 31.1 billion due to lower interest on loans. As a result, the financial performance did not change significantly, with a loss of only about VND 1 billion.

SG&A expenses increased significantly, with sales expenses increasing by 61% to nearly VND 47 billion due to promotions to boost product consumption and distributor support, as well as higher freight costs due to increased export revenue. Administrative expenses increased by 177% to over VND 57 billion, due to increased expenses for management personnel.

Other income increased significantly by 712% to VND 9 billion, positively impacting **CSM**’s net income of nearly VND 20 billion, an increase of 177%.

CSM’s Business Results for Q1 2024 (Unit: Billion VND)

Source: VietstockFinance

According to the recently announced annual general meeting document for 2024, **CSM** plans revenue of over VND 5,204 billion and pre-tax profit of VND 80 billion. If the plan is approved at the general meeting of shareholders on April 23, **CSM** will end the first quarter with over 23% of its revenue target and nearly 30% of its profit target.

Casumina aims high for export revenue, pre-tax profit increases 14%

As of March 31, 2024, **CSM**’s total assets were approximately VND 3,770 billion, a 3% decrease compared to the beginning of the year. Of which, inventory decreased by 9% to nearly VND 1.201 billion, accounting for 32% of total assets, mainly due to a significant reduction in raw materials.

On the other hand, short-term receivables increased by 17% to over VND 1.043 billion, representing 28% of total assets. Notable customers with increased receivables include **TNHH MTV** Tan Duc Dien Gia Company and PT Tire Company.

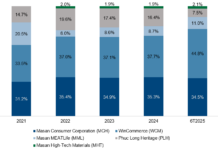

In terms of the capital structure, **CSM** had nearly VND 1.925 billion in loans, a 3% decrease compared to the beginning of the year, but 1.4 times its equity. Overall, the loan-to-equity ratio has been higher than 1 for several years.

CSM’s Loans Start Sustaining High Proportion Since 2017