Vietnam’s Economy in 2023 and Prospects for 2024

Overall Demand Declines, Growth Quality Yet to Improve

On April 17th in Hanoi, the National Economics University, in collaboration with the Central Economic Commission and the Economic Committee of the National Assembly, organized a national scientific conference titled “Vietnam’s Economy in 2023 and Prospects for 2024.” The conference also presented the annual Vietnam Economic Assessment 2023 with the theme: “Stimulating Aggregate Demand for Economic Growth in a New Context.”

The conference assessed the current state of aggregate demand and its components; key achievements and persisting limitations; and analyzed the contributions of aggregate demand components to economic growth. Based on these findings, the conference proposed policy recommendations for economic management in 2024 and beyond, with a focus on stimulating aggregate demand for sustainable economic growth in a new context.

Plummeting Total Demand, Insufficient Growth Quality

Delving into the economic landscape of the past year, Professor Pham Hong Chuong, President of the National Economics University, highlighted that 2023 is considered one of the most challenging years for Vietnam’s economy in recent memory, particularly given the global risks and uncertainties stemming from decelerating global growth, persistent high global inflation, tightening monetary policies in many countries, and escalating geopolitical tensions.

“Vietnam’s growth in 2023 remains significantly below pre-COVID-19 levels. Notably, aggregate demand and key aggregate demand components such as consumption and investment have weakened, coupled with a lack of improvement in growth quality,” Professor Chuong emphasized.

Aggregate demand plays a crucial role in determining the level of economic activity and employment in an economy. Diminished aggregate demand poses the risk of economic recession, impacting overall economic growth, leading to declines in industrial production, increased unemployment, and reduced income/expenditure for individuals.

Hence, revitalizing aggregate demand is a crucial task for Vietnam, requiring swift and appropriate measures from the government and relevant ministries and agencies to strengthen growth drivers, stimulate aggregate demand, and lay the foundation for economic development in a new context.

Highlighting the challenges, Dr. Nguyen Duc Hien, Deputy Head of the Central Economic Commission, attributed the decline in aggregate demand to the weakness in all three components: investment, exports, and consumption.

Economic Growth Rate Lower Than Neighboring Countries

“Over the past 30 years (1991-2023), Vietnam’s average annual GDP growth rate has been around 6.2%. In comparison, South Korea averaged approximately 8% over a 40-year period, and Japan achieved approximately 9.4%. With the current growth rate, Vietnam’s economy will struggle to make significant progress, and the goal of becoming a developed nation by 2045 will face considerable obstacles,” said Dr. Nguyen Duc Hien, Deputy Head of the Central Economic Commission.

Specifically, the total investment implemented in 2023 increased by only 6.2% year-on-year (compared to 11.2% growth in 2022). Within total state investment, the amount disbursed from the state budget in 2023 was merely 85.3% of the annual plan and grew by 21.2% compared to the previous year.

Investment from non-state sectors increased by only 2.7%, significantly lower than the 8.9% growth recorded in 2022. Similarly, foreign direct investment (FDI) in Vietnam in 2023 rose by a mere 5.4% (compared to 13.9% growth in 2022).

Meanwhile, spending momentum also showed signs of decline. In 2023, the total retail sales of goods and consumer services increased by only 9.6%, compared to the 20% growth in 2022; reduced income levels led to a decrease in consumer demand for goods.

Data for 2023 indicates that final consumption grew by only 3.52% compared to the previous year (whereas in 2022, it increased by 7.09%). In the tourism sector, despite efforts to attract international visitors back to Vietnam, the number of foreign arrivals in 2023 reached approximately 12.6 million, 3.4 times higher than the previous year but still only 70% of pre-pandemic levels in 2019.

“Regarding international trade, financial issues in Europe and the United States, such as government debt and high interest rates, have contributed to curbing economic growth and reducing global demand, significantly impacting countries with export-led growth strategies like Vietnam,” explained Dr. Hien.

In 2023, both exports and imports significantly declined compared to the previous year, decreasing by 4.4% and 8.9%, respectively, due to reduced demand from Vietnam’s primary markets, including the United States, the Association of Southeast Asian Nations (ASEAN), the European Union (EU), and several East Asian countries.

Exports to the United States witnessed the steepest decline of 11.6%, while imports from South Korea fell by 15.5%, the most significant drop among major markets. As a result, the output of several key industrial products in Vietnam declined sharply compared to 2022.

Moreover, according to Dorsati Madani, Senior Economist at the World Bank (WB), Vietnam’s GDP growth slowed in 2023, and despite gradual recovery in the first quarter, indicators suggest an uneven recovery in early 2024.

Ms. Madani acknowledged that Vietnam’s economy faces risks but also opportunities. Global risks remain, such as the pace of recovery in the domestic real estate market and unresolved financial sector vulnerabilities. Nonetheless, growth opportunities arise from increased external demand and declining global interest rates.

The WB expert expressed optimism that economic activity will begin to strengthen from the second half of 2024, driving growth prospects to 5.5% in 2024 and 6% in 2025.

Evaluating the Effectiveness of Fiscal and Monetary Policies

Assessing the efficacy of economic growth support policies in the past year, Professor To Trung Thanh, representing the research team of the National Economics University, noted that monetary policy effectiveness was limited, accompanied by signs of decline in the health of the monetary and financial system.

According to Professor Thanh, monetary policy in 2023 was considered flexible in adjusting credit growth targets and reducing interest rates four times. However, credit growth remained below the target, while loan interest rates fell less than deposit rates.

Professor Thanh analyzed that the diminished demand in the economy led to a reduction in capital absorption in various sectors, but it also reflected inefficiencies in the transmission channel of monetary policy, primarily the financial and monetary system, as evident in three main areas.

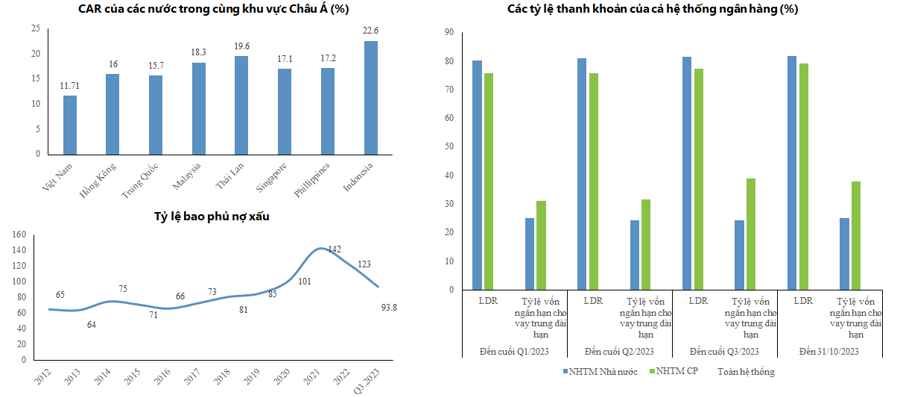

Firstly, the capital adequacy ratio of commercial banks, despite efforts to improve, remains relatively low compared to international standards and neighboring countries.

Secondly, in terms of asset quality, due to economic difficulties and a stagnant real estate market, the ratio of bad debts has increased across most loan categories. Non-performing loans at near 5% reflect the economic challenges that are seeping into the monetary and financial sector.

Thirdly, maturity mismatch is a significant constraint. Short-term deposits account for over 80% of banks’ total sources of funds, while the ratio of medium and long-term loans has reached almost 50%.

Furthermore, the capital market, including the bond market and the stock market, has faced challenges, leading to investor uncertainty. The demand for long-term capital continues to burden commercial banks, exacerbating maturity and liquidity risks.

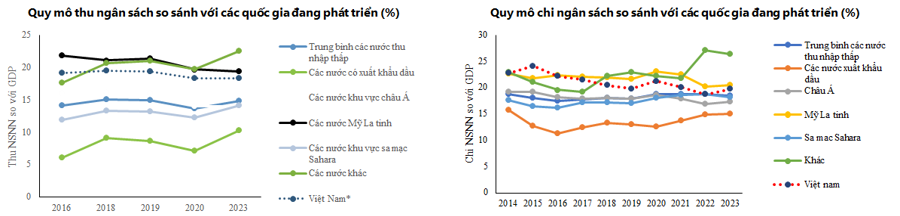

“Fiscal policy faces a dilemma, as the room for economic stimulus is shrinking. The government revenue/GDP ratio is decreasing, but we are aiming to simultaneously increase government spending and reduce taxes to support economic growth, which could increase borrowing risks,” said Professor Thanh.

Recalculating the budget deficit ratio from 2019 onwards shows that the budget deficit has increased while public debt remains manageable. It is clear that while there is still room for fiscal policy to support growth, it is limited.

According to the National Economics University, given the lack of substantial improvement in the economic model, to achieve high growth in the short term (2024), the government must rely on demand-side policies,