After “breaking” 1,200 points, the market continued to record strong fluctuations in the weekend session. The pressure to close the profit quickly caused the VN-Index to decline sharply at the beginning of the session, at one point losing nearly 27 points before narrowing the decline significantly at the beginning of the afternoon session. However, increased selling pressure near the end of the session overwhelmed all previous recovery efforts of the index, the VN-Index closed the April 19 session with a decrease of 18.16 points (-1.52%) to retreat to 1,174 points. Trading volume on HOSE reached approximately 22,500 billion VND.

Foreign trading was positive as they suddenly reversed to net buy VND 656 billion across the market.

On HOSE, foreign investors net bought with a value of approximately VND 683 billion.

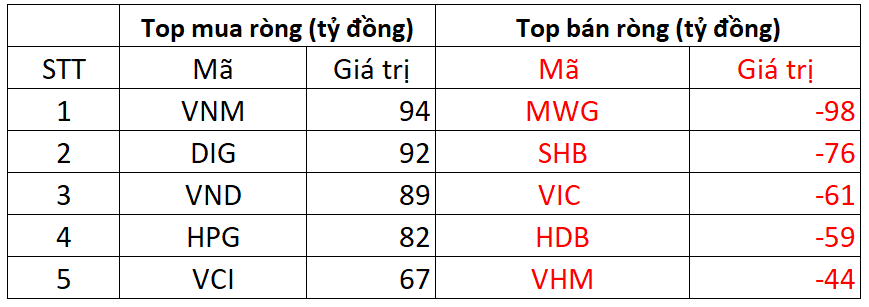

On the buy side, VNM stock was net bought heavily by foreign investors with a value of up to VND 94 billion. Besides, DIG and VND are the next two stocks that were net bought VND 92 billion and VND 89 billion respectively on HOSE.

In contrast, MWG endured the strongest selling pressure from foreign investors with a value of VND 98 billion, followed by SHB, VIC also being sold VND 76 billion and VND 61 billion each.

On HNX, foreign investors net sold VND 42 billion

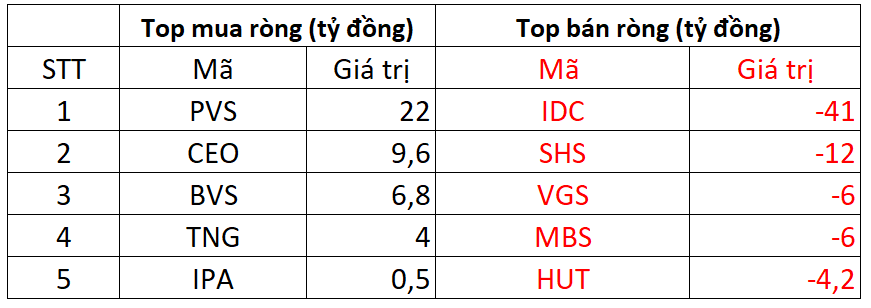

On the buy side, PVS was net bought the most with a value of VND 22 billion. Meanwhile, CEO was ranked next in the large net buy order on HNX with VND 9.6 billion. In addition, foreign investors also spent a few billion VND to net buy BVS, TNG, IPA.

On the other hand, IDC was the stock that suffered the net selling pressure from foreign investors with a value of nearly VND 41 billion; followed by SHS which was sold about VND 12 billion.

On UPCOM, foreign investors net bought VND 15 billion

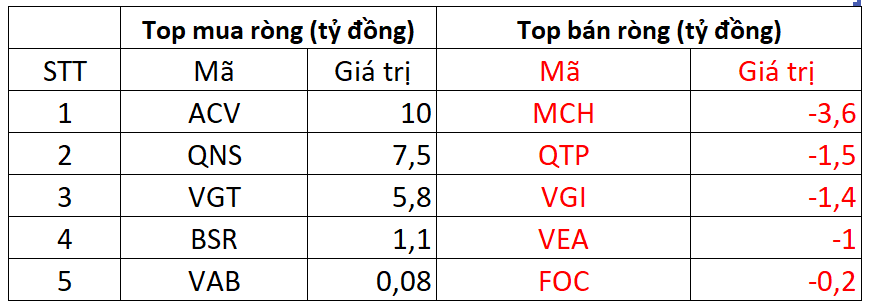

On the buy side, ACV stock was net bought nearly VND 10 billion by foreign investors. Following that, QNS and VGT were also net bought a few billion VND each.

In contrast, MCH was net sold by foreign investors today with approximately VND 3.6 billion; in addition, they also net sold at QTP, VGI, …