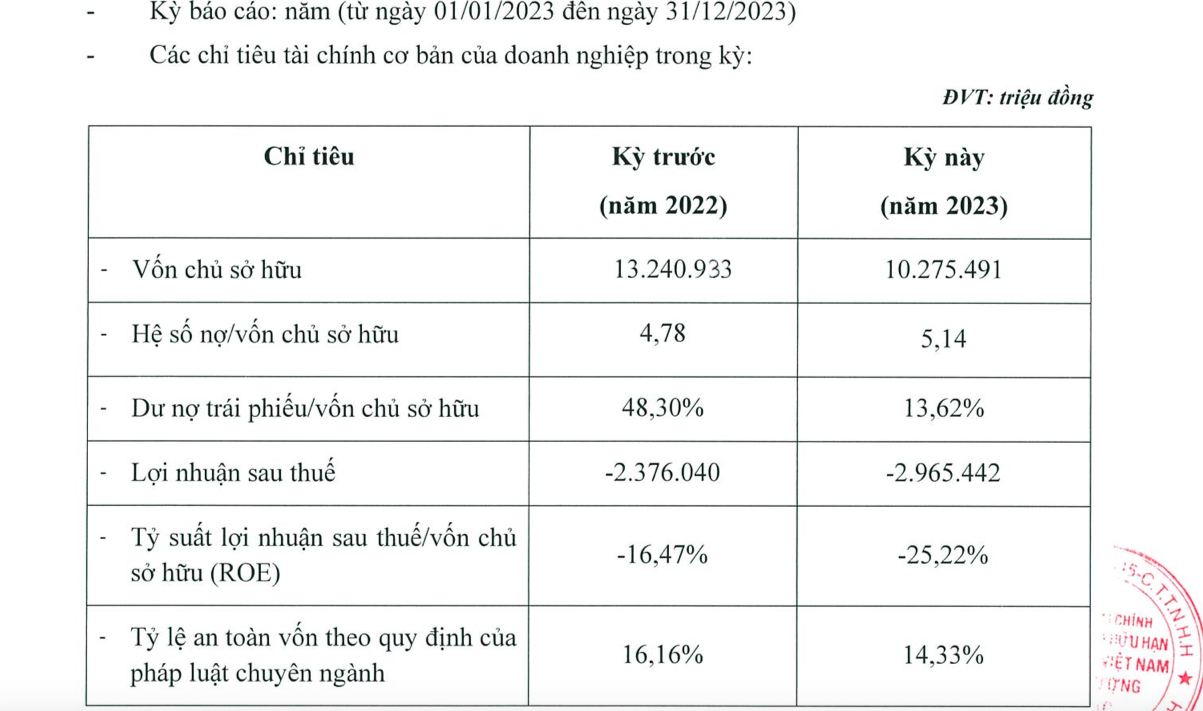

Vietnam Prosperity Bank SMBC Finance Company Ltd. (FE Credit) has just published its periodic financial statements for 2023 on the Hanoi Stock Exchange (HNX).

Accordingly, at the end of 2023, FE Credit recorded a loss after tax of over VND 2,965.4 billion. This is the second consecutive year that FE Credit has recorded a negative profit, with a loss of over VND 2,376 billion in 2022.

Source: HNX.

FE Credit’s equity at the end of 2023 reached over VND 10,275 billion, a 22.4% decrease compared to the same period last year.

Return on equity (ROE) after tax decreased from -16.47% to -25.22%.

In addition, FE Credit’s capital adequacy ratio as prescribed by specialized laws also decreased to 14.33% compared to 16.16% at the end of 2023.

FE Credit’s debt-to-equity ratio increased from 4.78 times to 5.14 times, corresponding to the company’s total debt of around VND 52,816 billion. Of which, the outstanding bond debt is over VND 1,399.52 billion.

According to data on HNX, FE Credit currently has 5 outstanding bond series with a total par value of VND 1,400 billion. These bond series were all issued in 2022, with a term of 2 years and interest rates ranging from 6.8-7.5%/year. Of which, bond series VPFCH2224001 will mature on April 24, 2024; VPFCH2224002 will mature on April 28, 2024; VPFCH2224003 will mature on April 29, 2024; VPFCH2224004 will mature on May 27, 2024; VPFCH2224008 will mature on August 22, 2024.

Thus, in addition to heavy losses in 2 consecutive years, FE Credit is also facing great pressure as hundreds of billions of bonds are about to mature.